A quiet start and in a limited range for the price USD/JPY as it moved between the 106.63 support and the 107.06 level of before settling around the 106.66 level at the beginning of today’s trading. A state of anxiety afflicts the financial markets and negatively affects investor sentiment, and the reason is the renewed dispute between the USA and China amid threats to impose more sanctions at a time when the world economy cannot bear any new shocks. Suffering from the economic shock of the Corona epidemic is still there, and increasing, despite the world’s trend to end closures, but the risks from this procedure still threaten a more violent wave of epidemic infections and deaths.

Italy, the first European country hit by the epidemic and one with the highest loss of lives in the world, has begun to open up cautiously after its closure for two months. In all, 4.4 million Italians were able to return to work. Traffic increased in downtown Rome, construction sites and manufacturing operations resumed, parks were reopened and florists returned to the Campo de 'Fiori market for the first time since March 11. In the same context, many US states have reopened their economic activity because the continued closure will further shrink the economy, which has reached alarming levels for the first quarter of 2020.

With the US economy plunged into severe recession, the Federal Reserve is set to launch a high-risk program in which it will lend money to small and medium-sized companies outside the banking industry for the first time since the Great Depression. Economists say that more than the other eight lending facilities that the Federal Reserve has established in nearly two months since the outbreak of the virus closed the US economy, and the Main Street lending program will be the most complex and challenging to date. It is likely to attract the Fed to more public scrutiny than it has faced since the 2008 financial crisis.

Critics of the bank's program already claim that the Federal Reserve has changed some of the terms of the program to allow heavily indebted oil and gas companies to borrow under the program. For its part, the Federal Reserve says that its changes came in response to requests from many different industries. Many economists fear that the Fed's intention to reduce its losses, partly at the direction of the Treasury, will force it to curb lending.

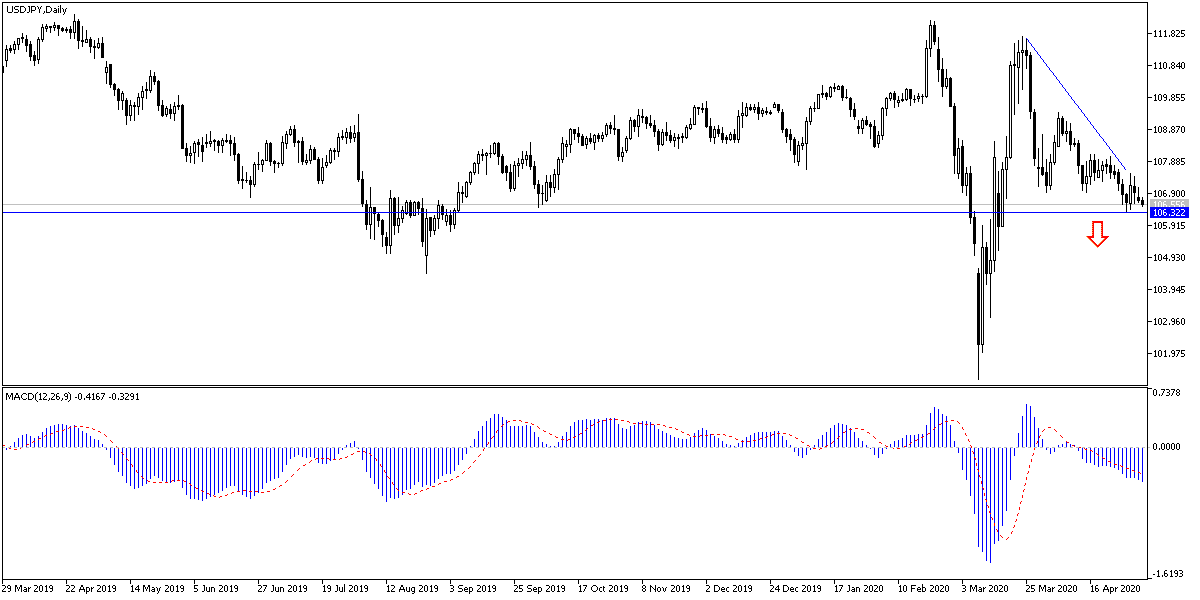

According to the technical analysis of the pair: the general trend of the USD/JPY is still bearish and does not change in my view, stability below the 108.00 support will remain supportive of bear control and a move towards stronger support levels which are at the same time new buying opportunities and the closest of them are currently 106.45 and 105.80. 105.00, respectively. On the other hand, 110.00 psychological resistance is still best suited for breaking the current downside wave.

As for the economic calendar data: There are no significant Japanese economic releases today. From the USA, the Trade Balance and ISM Services PMI will be announced.