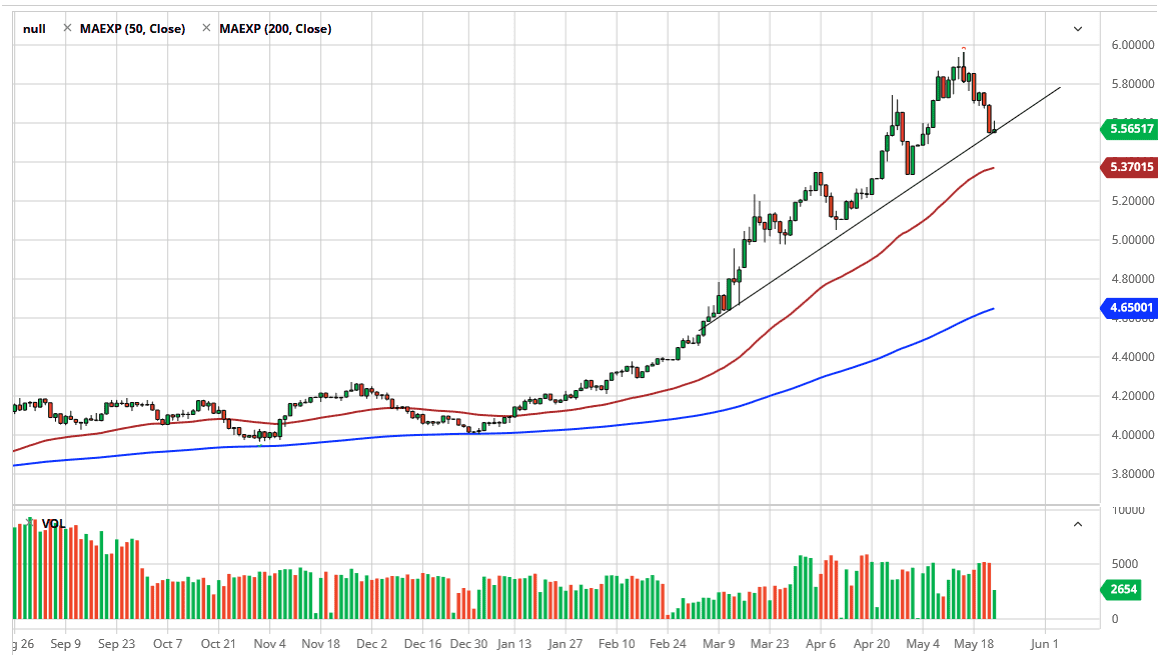

The Brazilian Real has fallen over the last couple of days to reach down towards a significant trend line. The market looks highly likely to continue seeing a lot of questions of this area, as we are right at the 5.56 level, but you should also take a look at the 50 day EMA underneath at the 5.37 level. Even if we break down through this uptrend line, it is likely that it does not change the overall trend. Quite frankly, there are far too many things working against Brazil right now to think that the greenback is suddenly going to implode against it.

This is not to say that we cannot see this market pullback, most certainly we can. I think there are multiple areas that will be worth paying attention to, the first of course will be the 50 day EMA. Below there, the 5.20 level underneath should offer quite a bit of support as well, and then most certainly the 5.00 level will cause a lot of support also. Ultimately, this is a market that is worth paying attention to even if you do not trade it, because it gives you a clear picture of how the US dollar is going against Latin America, and then by extension emerging markets overall. Because of this, and the massive amounts of dollar-denominated debt world, it is worth paying attention to how emerging market currencies are behaving. If they get blown up, then it typically means that the greenback is going to continue to strengthen against most currencies.

The alternate scenario of course is that we break above the top of the inverted hammer being formed for Friday, and that opens up a possible move to the upside, perhaps towards the 5.75 level, possibly even the 6.00 level over the longer term. That would be a very bullish sign, not only due to the fact that it is breaking the top of an inverted hammer, but it is also reaffirming the overall idea of an uptrend line. Ultimately, this is a market that I think is about to make some type of decision as to whether or not things are going to get a lot worse from a risk appetite matter, or if we are going to pull back a little bit further and let the dollar collect some of its gains over the last several months. It should also be noted that Brazil has had a massive amount of coronavirus infections and of course that has influenced the pair.