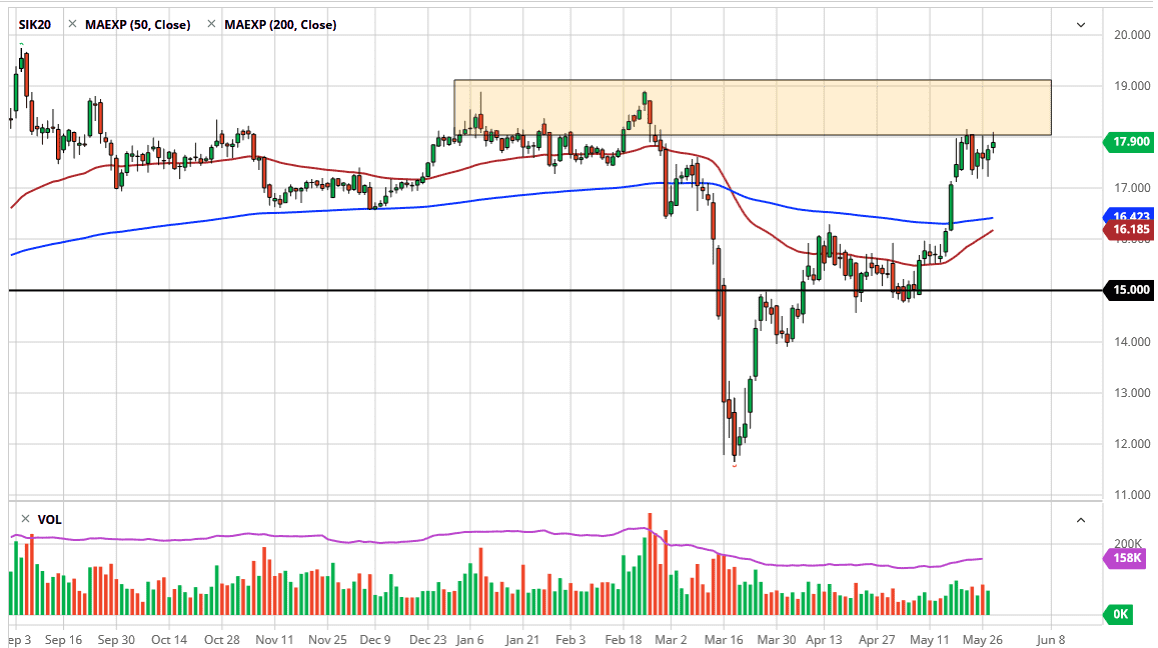

Silver markets initially tried to rally during the trading session on Thursday but found resistance again at the $18 level. By doing so, it looks as if we are not ready to go anywhere significant, and therefore I think we stay within the same one dollar range that I have been talking about for a while. The $18 level above continues offer resistance, while the $17 level underneath continues to offer support. If we were to break down below the $17 level, then it is likely to go looking towards the $16 level. This is not to say that I think we are in a scenario where we should be shorting, just that I think it is likely we pull back a bit in order to find that value.

Keep in mind that silver moves on a couple of different premises, including industrial demand and the precious metal trade as a way to shy away from risk. After all, markets do tend use precious metals as a bit of a safety currency, and the silver market certainly can function as such. However, it is that industrial portion of the market that simply weighs upon the silver market for the longer-term move. If industrial demand picks up, then of course silver is going to do quite well. I do not think it is going to, so I think it is going to need some type of shock to the system in order to break out significantly to the upside. At the very least, it needs to build up enough momentum to make that move. This is a market that had gotten far ahead of itself and as a result will need to digest some gains.

To the downside I believe that the 50 day EMA and the 200 day EMA both offer support of areas, just as the $16 level does. I do not have any interest in shorting silver I think that we will have an opportunity to pick it up “on the cheap” later down the road. However, if we break above the $18.20 level then we will have cleared a gap that had previously been filled, which is yet another victory for the market to celebrate and go higher from. All things being equal I believe that this market probably underperforms gold in the near term, which did see a little bit of resistance just above it during the day as well.