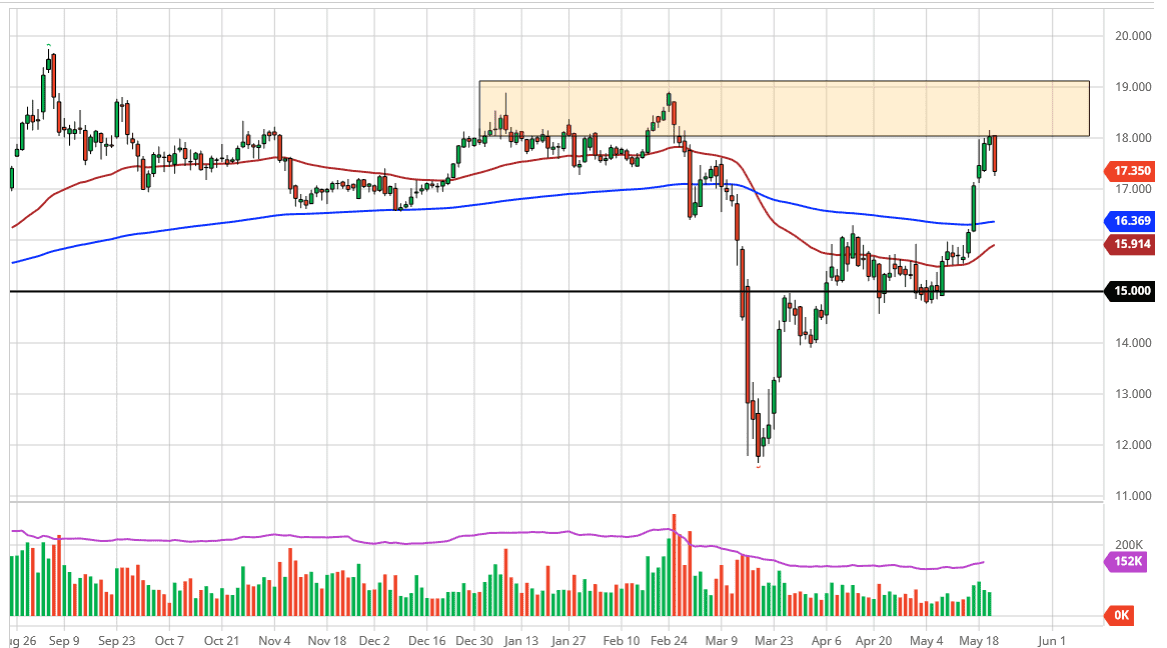

The silver markets fell rather hard during the trading session on Thursday after testing the $18 level. This is a large, round, psychologically significant figure that of course will attract a lot of attention. At this point, the market also is testing a gap from back in February that sits just above the $18 level. After reaching towards that area, you can see that we have pulled back quite a bit. The open pit session closed at roughly $17.40, and it looks like we have further to go to the downside. There is a gap underneath that still has not been filled yet, which is closer to the $17 level. Because of this, I fully anticipate that we will probably continue to go a little bit lower. This does not necessarily mean that we are going to collapse completely, but clearly a pullback is definitely needed.

Looking at the $17 level, if we can break down below there it is likely that we go looking towards the 200 day EMA. That is near the $16.36 level, and that of course is something that people will pay quite a bit of attention to. Furthermore, the 50 day EMA is reaching towards the $16 level, an area that catches a lot of attention due to the fact that the market has made this move after breaking out above that level.

Silver of course has the industrial component to it that gold does not, so it will of course continue to lag. The negative candlestick that formed during the trading session on Thursday suggests that the market is starting to recognize that it is overdone, especially when it comes to silver of all things, which will need strong industrial demand in order to continue. Do not be wrong, I think that we could see buyers again, but pulling back to build up the necessary momentum makes quite a bit of sense. That being said, if you are playing the silver market due to the “precious metals aspect”, you need to be buying gold instead. Furthermore, silver is much more volatile than gold, which is saying something considering just how volatile gold can be. There is an alternate scenario, which means that if we were to break above the $18.25 level, the market goes higher, perhaps reaching towards the $19 level. That is very unlikely though, so I am not looking for that to happen.