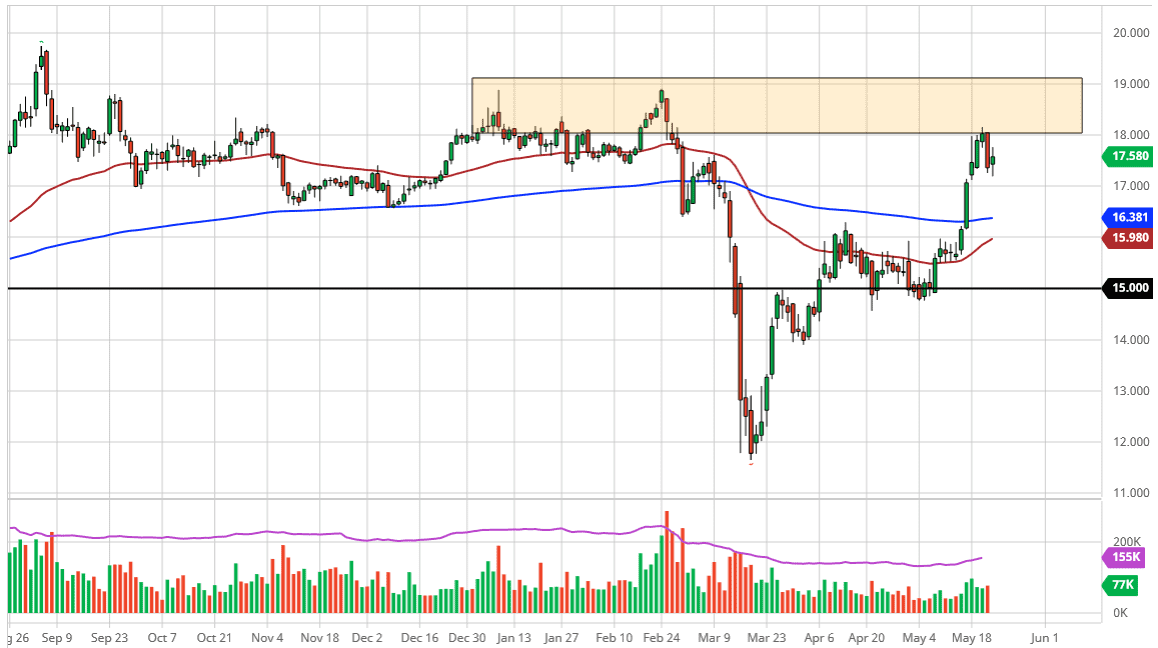

Silver markets went back and forth during the trading session on Friday as we continue to try to figure out whether or not breaking above the $18 level is going to happen in the short term. I suspect not, mainly because of the ferocity of the negative candlestick on Thursday, and then of course the lack of momentum in either direction on Friday. The fact that the Friday session was relatively quiet should not be a huge surprise, due to the fact that the Memorial Day holiday is coming and a lot of the traders in Chicago will have simply been focusing on that instead of futures contracts.

Looking at this chart, the $17 level looks to be crucial and if we break down below there it is likely we could drop a bit. The weekly candlestick is a shooting star so that is worth paying attention to as well. The market has gotten far ahead of itself so it would not surprise me at all to see silver break down from here as it has overextended for the last couple of weeks. That does not necessarily mean that we are going to fall apart but what it does suggest is that we need this pullback in order to build up enough momentum to perhaps try to break out to the upside.

The silver market is of course a precious metal, but at the end of the day it tends to trade more like a base metal than anything else. That makes sense, as silver is used in electronics and automobiles, as well as a mass of other products. If the global economy is slowing down, the demand for silver will as well. Ultimately, this is a market that I think is probably going to underperform the gold market, which is of course tied much more intricately to the risk parameters of traders around the world. Gold also has obvious support underneath, so I think at this point it is likely that the market is going to find buyers over there. You could do a bit of a “spread trade” meaning that you would be a buyer of gold and a seller of silver in order to head yourself a bit, but you need to do the math in order to make sure you are trading the same amount at the same time. At this point, I would not necessarily say I am bearish on silver, I am just not overly excited about it.