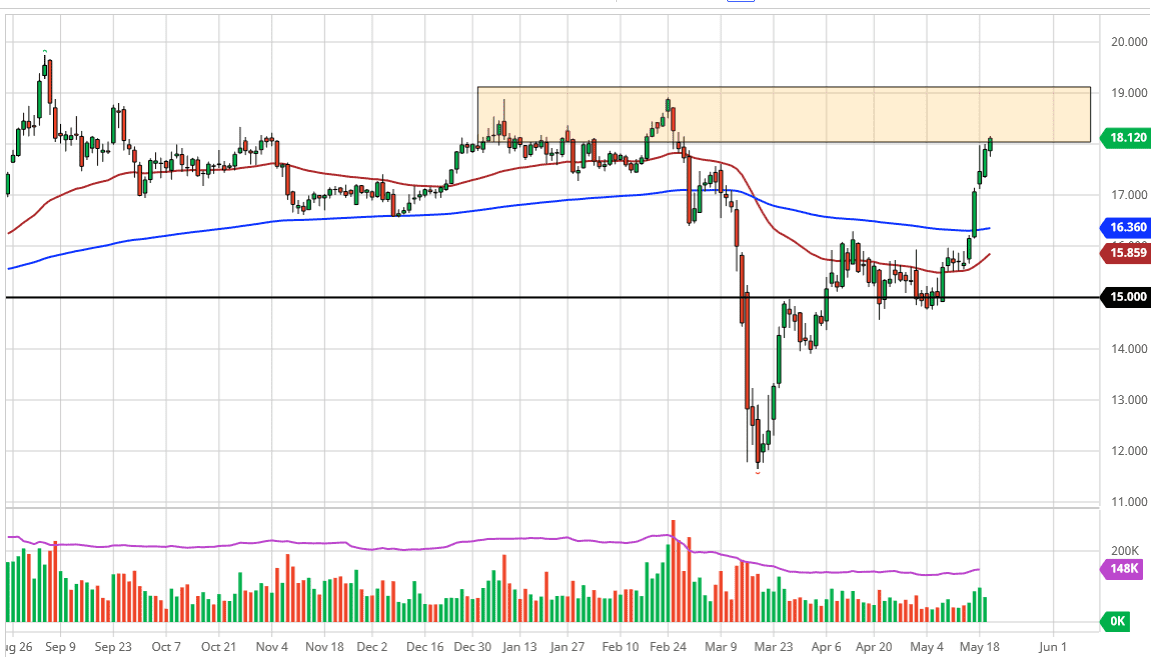

Silver markets have rallied a bit initially during the trading session on Wednesday, breaking above the $18.00 level. This is a large round number that of course will attract a certain amount of attention, as it has a lot of psychological interest attached to it. This is the beginning of major noise going all the way to the $19 level, so it does not surprise me at all that the market has pulled back just a touch.

Silver is a bit of an anomaly though, because retail traders tend to look at it as a precious metal that moves with gold. The reality is that it does not anymore, due to the fact that it also has an industrial component. When you look at volatility regiments, it is quite often that silver has more in common with copper or iron that it does gold, although when it is all about the precious metals aspect, perhaps trying to recover wealth when it comes to the central banks destroying fiat currencies. If that is going to be the case, it is likely that the silver market will rally, but over the longer term it does tend to favor the industrial metal trade.

When you look at the last five candles, you can see that we have gone straight up in the air and quite frankly this is a bit too much in the short term. I suspect that we pull back towards the $17 level, there could be buyers there. Furthermore, we could go down to the 200 day EMA as well, near the $16.35 level. The $16 level will also be massive support as we had formed a consolidation area between there and $15, so having said that it is highly likely to find value hunters down in that region. Ultimately, silver is bullish but has gotten ahead of itself, so a pullback is going to be necessary at the very least.

You can short this market if you choose to, but it has to be a short-term trade at this point. After all, we have seen an explosive move for a reason, and if the US dollar continues to see selling pressure, that could push this market higher as w You can short this market if you choose to, but it has to be a short-term trade at this point. After all, we have seen an explosive move for a reason, and if the US dollar continues to see selling pressure, that could push this market higher at all. One thing that is worth paying attention to though is the fact that we have filled the gap from previous trading, which is just above the $18 level. That gap has already been filled before but quite often there is a lot of “market memory” in that general vicinity.