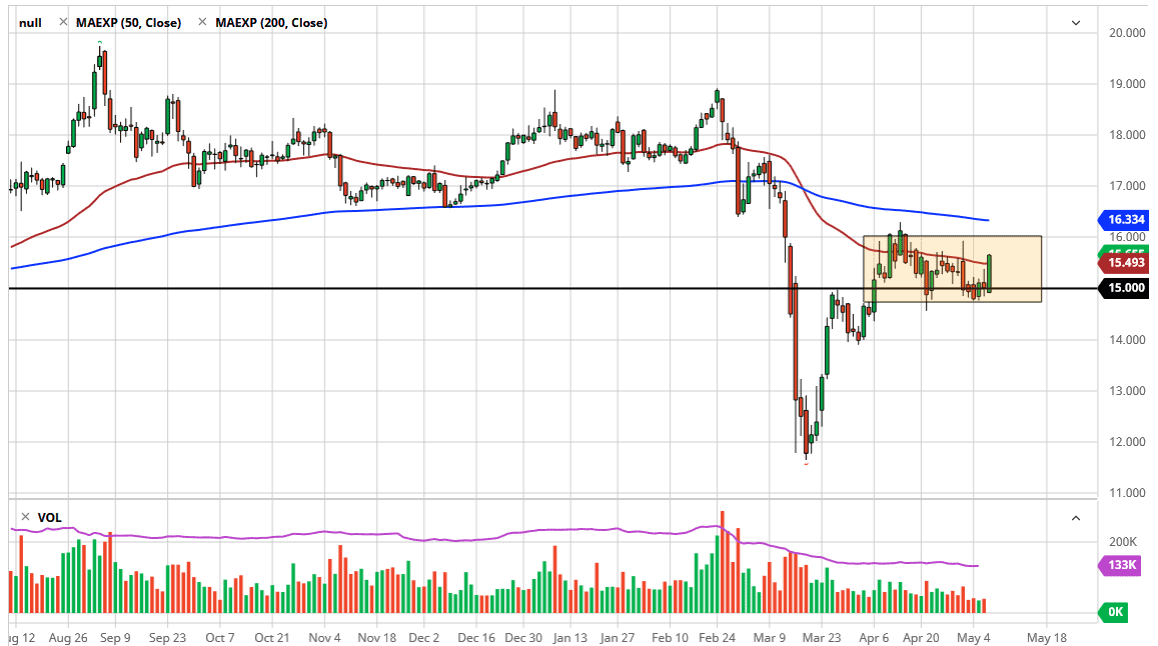

The silver markets have rallied significantly during the trading session on Thursday, as the US dollar got crushed after Fed funds rates for December 2020 went negative. This is extraordinarily toxic for currency, and it does in fact suggest that the market is going to run towards the precious metals part of the equation when it comes to silver. Silver is both a precious metal and an industrial metal, so it asked a little bit different than the gold market does. Ultimately, this is a market that rallied quite stringently, but is still in the same consolidation area that we have been in for several weeks. At this point, the market looks as if it is trying to target the $16 level above which is the top of that range.

To the downside, I still see the $14.80 level as massive support, and therefore it is likely that the market will continue to respect that level, especially now that we have seen such a negative turn of events when it comes to the greenback. However, one would also have to think that there is probably a serious lack of demand for silver from an industrial point of view, so it is obvious that the upside might be somewhat limited here, at least in comparison to the gold market which will shoot straight up in the air if we continue to see a lot of US dollar selling.

Furthermore, the $16 level has offered a significant amount of resistance and it is going to take something special to break above there. If we do, then the $16.33 level comes into play, as it is the 200 day EMA. Once we break above there, then a lot of longer-term traders will come in based upon the overall trend. I do like the idea of buying silver from a longer-term standpoint, but I also recognize that it is more of an investment at this point than anything else. After all, there will be plenty of concerns when it comes to industrial use, so it is difficult to get in and start buying silver hand over fist at this point, and especially when it comes to using leverage. With this, I like the idea of buying short-term pullbacks in little bits and pieces and simply hanging on for the longer-term ride. To the downside, I believe that the $14.50 level will offer support, followed by the $14.00 level.