Silver markets initially dipped during the trading session on Friday but found enough support underneath the $15 level to turn things around. When did up forming a small hammer, but quite frankly precious metals in general did reasonably well after initially selling off during the day. Silver should follow, but silver is probably going to be a major laggard to other metals such as gold, as it is not only a precious metal, but it also has a certain amount of industrial use as well. Industrial use is something that we probably will not see a lot of when it comes to silver or any other base metal for that matter, as the economy has been so heavily damaged.

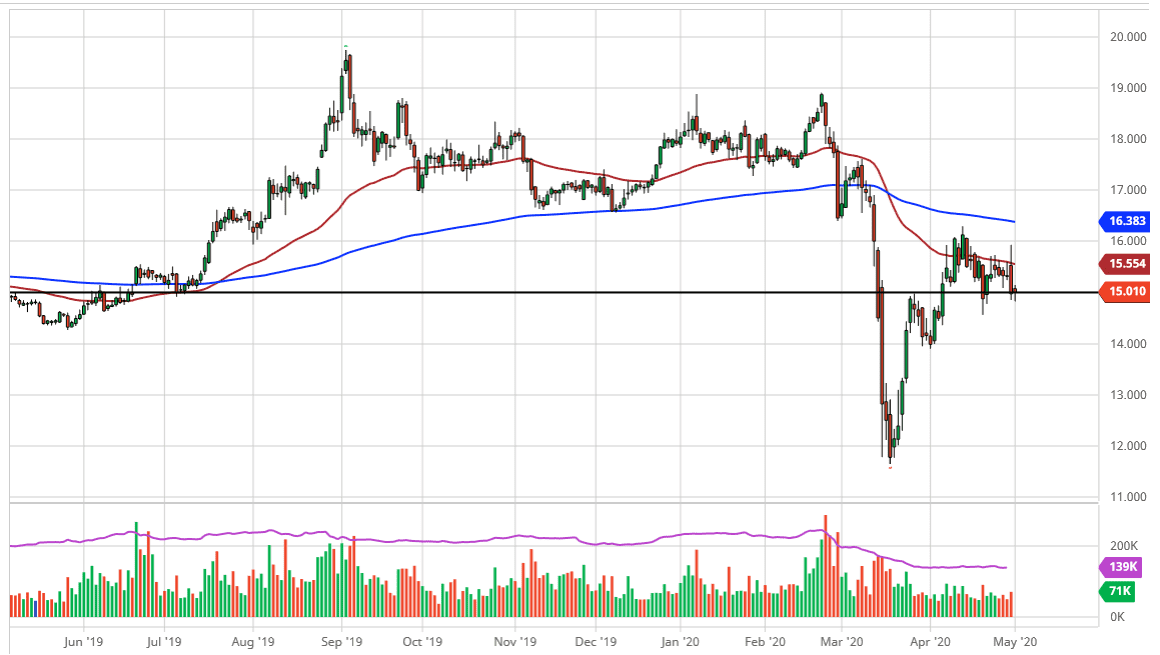

That being said, there is a lot of upward pressure as far as a precious metals trade is concerned as central banks around the world continue to loosen monetary policy. This is especially true with the Federal Reserve as they have basically taken a bazooka and started blowing away anything that looked anything close to economic sluggishness. The market has been trading between the $16 level on the top and the $15 level at the bottom, and a bounce from here makes sense from that standpoint as well, as it simply keeps his market back and forth in the same range. Otherwise, if we break down below here, it is possible that we can find plenty of support underneath, especially near the $14.50 level, and most certainly at the $14.00 level.

If we were to turn around a break down below the $14.00 level, it would open up the “trapdoor” to much lower prices as it could bring in a fresh round of selling. Having said that, the market is much more inclined to rally due to the fact that the US dollar has been losing you, but even if it does not, there is the safety trade. You could look at this as a potential spread trade, buying gold in selling silver simultaneously in order to make up the difference in velocity. Either way, I like the idea of going long, and I do think that eventually we will break above the $16.00 level and it could send this market towards the $17.00 level. I have been buying silver without much in the way of leverage, but I think that if you could buy it on a low levered situation, then you can hold on to the overall uptrend.