Silver markets bounced a bit during the trading session on Tuesday, as the $14.90 level has offered significant support, which extends all the way to at least the $15.00 level. That being said, silver has been a bit of a laggard when it comes to metals, especially precious metals. After all, the gold market is much closer to its highest than silver is, because the gold market is used more as a currency while the silver market is used more as a way to play base metals.

Take a look at the copper markets, they will quite often give you a feel for what the silver markets are going to do as well, as both of these metals are used in a similar manner. With the shipment of electronics in South Korea and China dropping drastically, it does suggest that there is going to be a lot less need for silver in the foreseeable future. The silver markets will continue to be a little lackluster when compared to gold. That being said, there are days when we get more of a “risk on” type of situation and traders start to think about the idea of the economy reopening. If the economy is going to reopen, then the theory would be that there will be a lot more demand for silver to produce these items. The reality is that the demand of course will not necessarily keep up with this. If that is going to be the case, then the demand for silver overall is going to be a bit of a laggard.

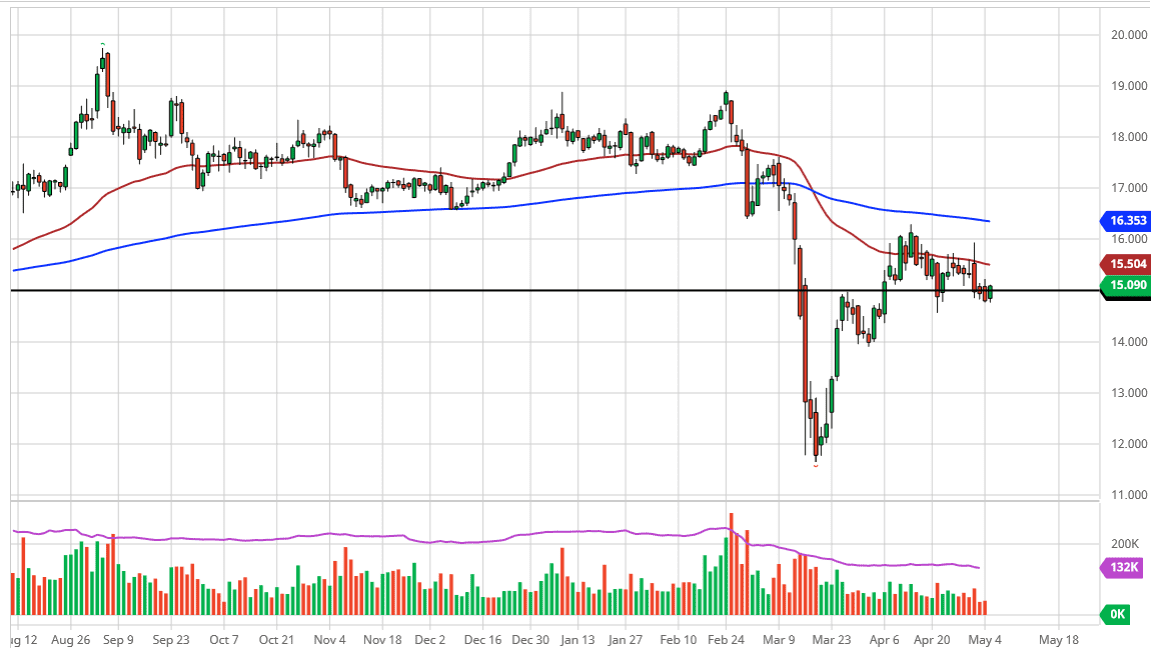

To the downside, the as it should be support, just as the $14.00 level which is an area where we had bounced from rather significantly in the past as well. To the upside, the $15.50 level features the 50 day EMA, and a break above that opens up the door to the $16.00 level. The 200 day EMA is above at the $16.35 level, and if we did break above there I would anticipate that the market probably moves towards the $17.00 level I think it is going to take a significant amount of effort to get there, but that is one possibility that we need to be prepared for. All things being equal, I think it's best we probably grind sideways in the silver market until we get a little bit more clarity when it comes to overall demand.