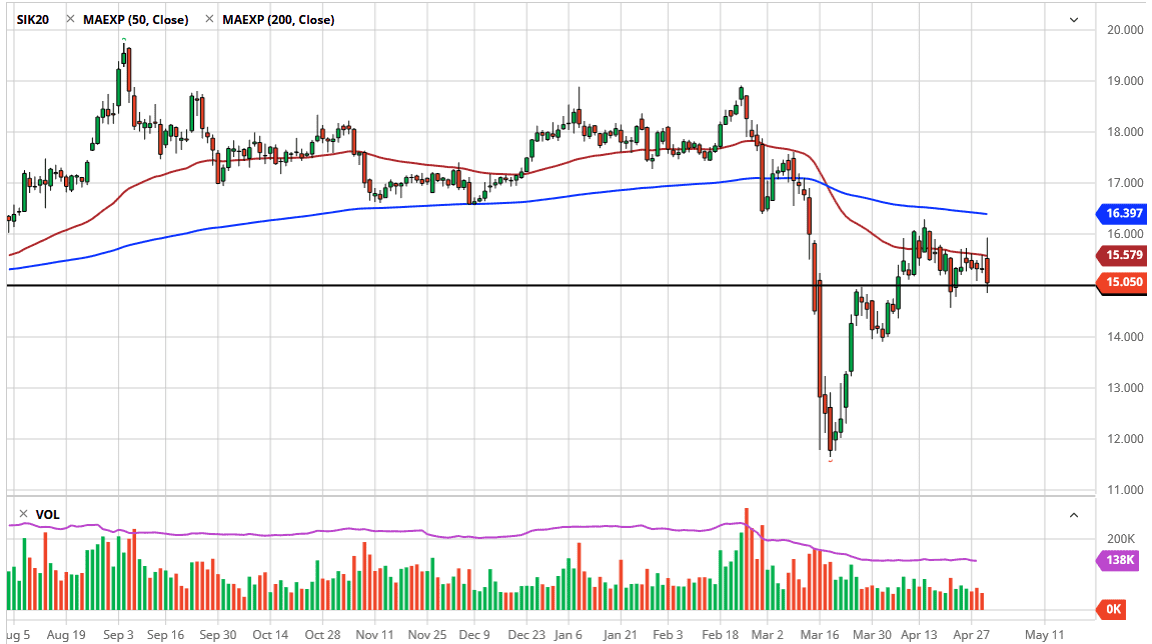

Silver markets have been all over the place during trading on Thursday. Initially, the market rallied rather significantly and reached towards the $16.00 level. However, the market then broke down below the 50 day EMA as the US dollar got hit. At this point, we are simply bouncing around in a larger consolidation area just as we had been previously. With that in mind I think it is only a matter of time before the market has to make a decision, as the area between the $15 handle and the $16 handle is starting to attract a lot of attention.

To the downside I believe that the $14.50 level is an area that should be paid attention to, just as the $14 level will be. To the upside, if we can break above the $16 level it is likely that we will go looking towards the 200 day EMA which is currently sitting at roughly $16.40 above. If we can finally break above that, then it would confirm a longer-term uptrend and we should go looking towards the $17.00 level and then eventually the $18 level.

The biggest problem you are going to have with silver is the fact that there is not going to be much in the way of industrial demand, and that is probably not going to change anytime in the near future. If we were to see some type of increased demand from manufacturers, then we could start to make an extremely bullish case for silver as you also have the precious metals aspect attached to it. That being said, silver does tend to have a mind of its own and it is exceedingly difficult to trade at times. This is a market that will of course continue to pay attention to what is going on with the US dollar as well, but also the overall attitude of markets. With central banks around the world flooding the markets with liquidity, one can make an argument for precious metals to rally but if you are trading for that reason alone it is going to be gold that is going to outperform. In fact, I have been doing a lot of “bread trading”, meaning that I would have been going long gold and shorting silver. Longer-term, I have been more than willing to buy silver on dips, but I do it in physical form, avoiding the dangers of leverage.