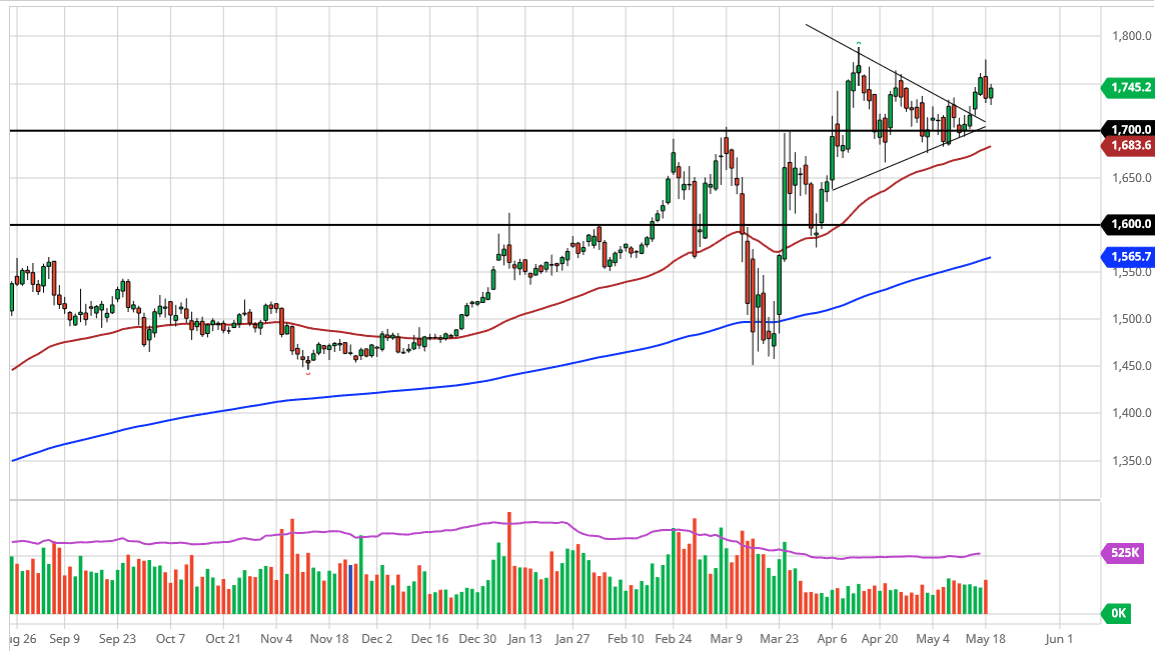

Silver markets have exploded to the upside over the last couple of days, and the Tuesday session was not any different. We ended up reaching towards the $18 level but as you can see, we have stopped just below there. Ultimately, this is a market that I think will continue to see a lot of noise extending all the way to the $19 level, and at this point it is very unlikely that we just simply slice through there. Having said that, we have seen the market reached towards the top of the shooting star from the previous session, and of course just below that $18 region. There is also a small gap just above $18, so it is worth paying attention to.

Furthermore, I think there is a significant amount of resistance that extends to the $19 level, so I am looking for an opportunity to short silver between here and there. However, I would also point out that if we do pull back, it is highly likely that there are plenty of supportive levels underneath to think about. The $17 level course will attract a certain amount of attention as it was a crucial level previously, and then of course the 200 day EMA after that, followed by the $16 level. In other words, there are plenty of reasons to think that the buyers will return given enough time.

Keep in mind that the silver markets have a couple of different main reasons for moving, and therefore it is not a huge surprise to consider that it is diverging a bit from what we have seen and gold over the last couple of days. The silver markets not only are a precious metal, but they are also an industrial metal. In that sense, it comes down to whether or not the market is looking for safety in the form of currency, like they would with gold, or if the market is trying to bet on an industrial recovery. An industrial recovery should in theory demand much more in the way of silver, and that could drive silver higher. The last couple of days has been a lot of “risk on” so because of this it makes sense that silver has rallied a bit. I think we have gotten ahead of ourselves though, so I think at the very least we are going to see a pullback. Longer-term, I do like silver, but I tend to use non-levered avenues.