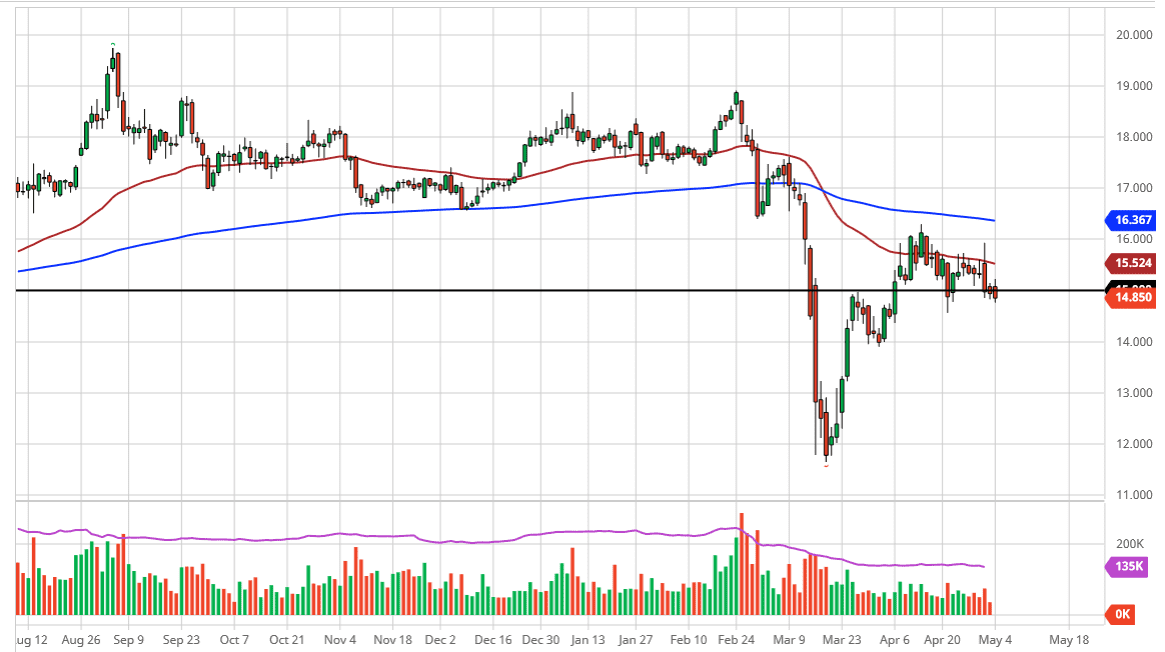

The silver markets have gone back and forth during the trading session on Monday to kick off the week, initially tried to rally but then broke back down below the $15 level. There is a significant amount of support below, extending all the way down to at least the $14 level. That being said, it comes on what your timeframe is as to how you will be trading the silver market. For the short term, it does not look necessarily resilient, and it is highly likely that the market probably will not do much in the next couple of days, because quite frankly we are not necessarily seeing a massive move into precious metals, at least not yet. With that being the case, it is probably going to keep the silver market quiet because it will not have that boost that precious metals trading can give it.

That being said, silver also has the industrial usage portion of the equation as well, and therefore it will probably suffer due to the fact that there simply is not much in the way of industrial demand for anything right now. In that sense, silver is going to essentially be “stuck” until we get some type of decision made as to how the markets are going to behave overall. If you are looking for a potential way to find a secondary market to pay attention to when it comes to trading silver, if gold starts to take off to the upside you could see silver follow, although it will more than likely lag. Furthermore, if the copper market starts to take off to the upside, then you could see silver rally quite nicely considering that both are traded as base metals.

Alternately, if copper falls, then it is likely that the market will then selloff as the base metals are trading poorly. At this point, the market is highly likely to continue to see a lot of back and forth, so therefore I suspect that the silver market is going to be difficult to make a lot of money trading for larger move. However, if you are a short-term back-and-forth trader, then it is likely that you will see opportunities here and there. To the upside, the $16.00 level offers a significant amount of resistance, and therefore the market breaking above there would of course be a huge signal that we are going to go much higher.