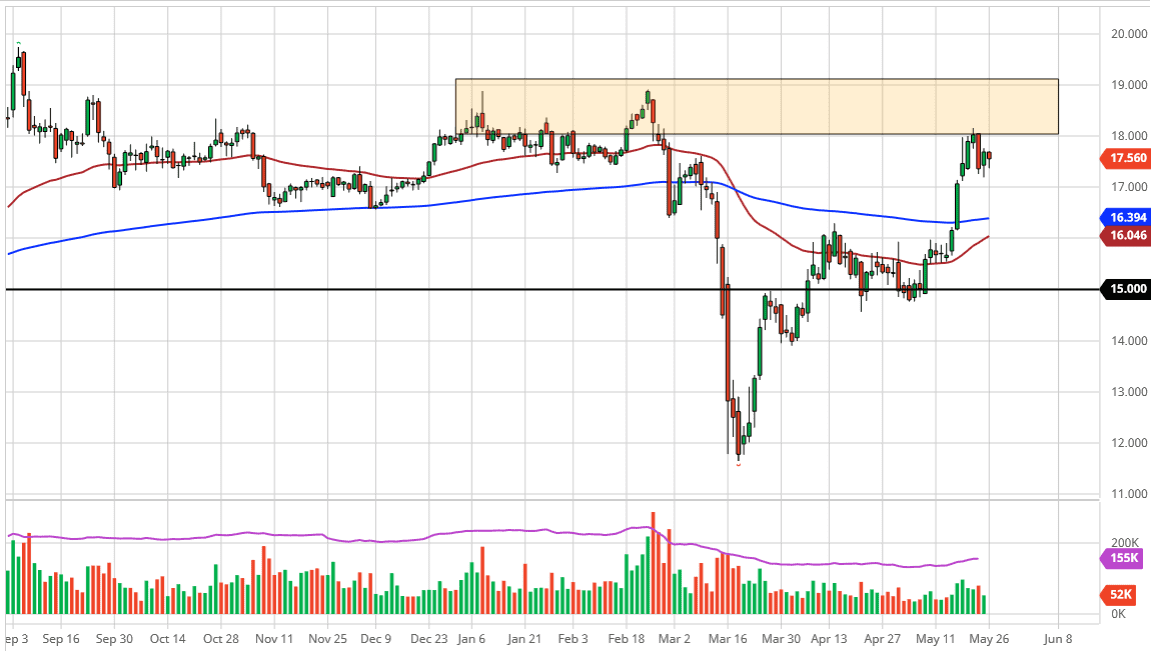

Silver markets have initially fallen during the trading session on Monday, but then bounced a bit as we would have had a very thin trading session. Quite frankly, none of the large trading houses are on board trading, as both the United Kingdom and the United States have a holiday going on. Looking at this chart, the market is likely to see a lot of volatility in this area, and it does not surprise me at all that we are struggling to break out to the upside as we have gotten here rather quickly, and see a significant amount of resistance in the form of the $18 level. After all, there was a gap there that although filled previously, still should cause a bit of a reaction.

To the downside, if we were to break down below the $17 level should continue to allow the market to go down towards the $16.39 level. Furthermore, the 50 day EMA underneath at the $16.04 level makes quite a bit of sense. That would be an area that I would expect to see a lot of buying pressure at as well, because we have seen a major breakout at that point. A pullback to that area would be a simple retest of previous resistance, which is something you see quite a bit in technical analysis. Silver will continue to lag gold regardless, because it has the industrial component which clearly is not going to be a strong as it was before the pandemic occurred. While there is the precious metal aspect, the reality is that if you are going to trade the precious metals market based upon preservation of wealth, you are going to do a lot better in the gold market as it tends to be much more vibrant and bullish when it comes to protecting well. Gold is not necessarily an industrial metal trade; it is simply a precious metal trade pure and true. Because of this, if you are looking for some type of protection trade, gold is where you need to be.