The silver markets initially pulled back a bit during the trading session on Wednesday as we continue to see a lot of volatility in this market. It is not a huge surprise, because quite frankly silver is volatile in general. At this point, the market is likely to continue to see a lot of back and forth and therefore I believe we are probably going to have issues when it comes to trying to hang onto a bigger move.

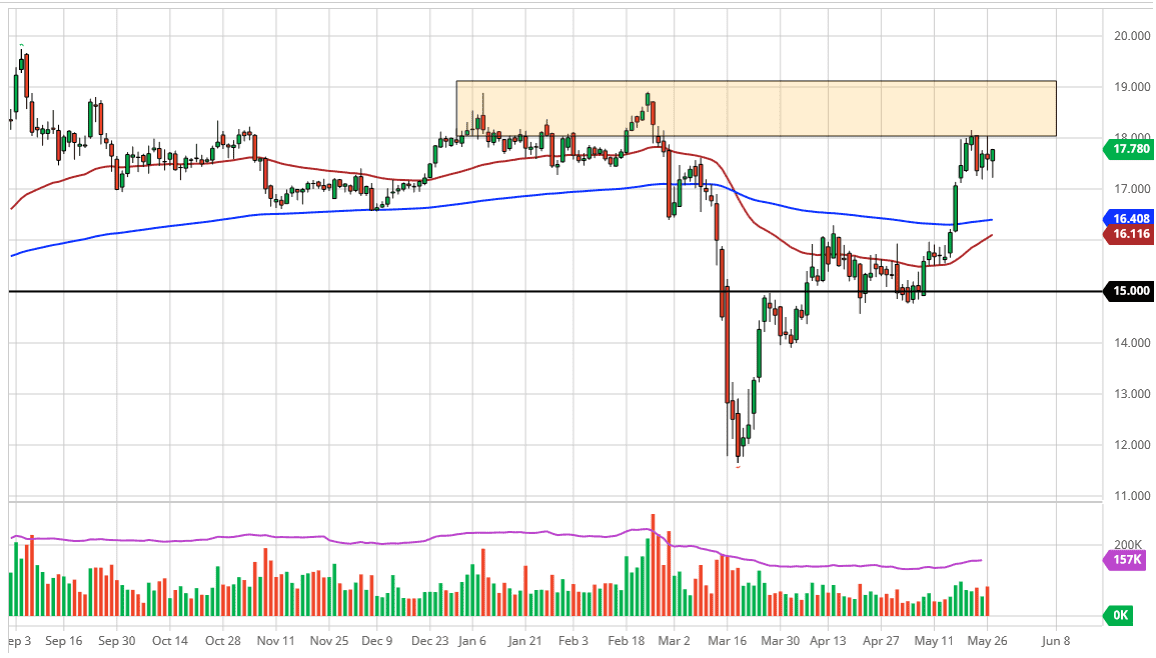

The $17 level underneath offers significant support, as it has been rather resilient over the last couple of days. However, as you can see this is a market that will often see massive moves suddenly. The $17 level underneath being broken opens up a potential move down to the 200 day EMA which is closer to the $16.40 level. The 50 day EMA is starting to turn towards the 200 day EMA, perhaps getting ready to have the “golden cross” come into play. That being the case, it is difficult to imagine a scenario where the market simply breaks down it continues going lower. With that in mind, I like the idea of buying silver on dips, because it does offer a bit of value in a scenario where we had seen a lot of buyers come in.

Looking at the upside, the $18 level is obvious resistance, and I believe that the gap from before just above there is a potential resistance barrier as well, and I think that will continue to cause a bit of trouble. However, if we can break above the $18.20 level, then I think it opens up a move towards the $19 level. Looking at this chart, it is highly likely that we are trying to squeeze higher but ultimately this is a market that will lag gold because quite frankly it is not as great of a hedge against inflation. Keep in mind that silver has a built-in industrial component, and as a result the lack of demand for silver is going to be a major issue. In other words, just the precious metal trade is probably going to lift this thing, but it does help. After we have seen such a huge rise to the upside, it makes quite a bit of sense that we continue to consolidate in the short term as the market comes to grips with the big move.