Business confidence in New Zealand recovered in May but remained deep in depressive conditions. Easing the nationwide lockdown allowed a gradual and modified resumption of activities. The health ministry reported no new Covid-19 cases in five days, while no infected patients are hospitalized. All remaining restrictions could be lifted by the government as soon as the second half of June. Risk-on sentiment allowed the NZD/JPY to ascend into its resistance zone from where downside pressures are expanding with a deterioration in bullish momentum.

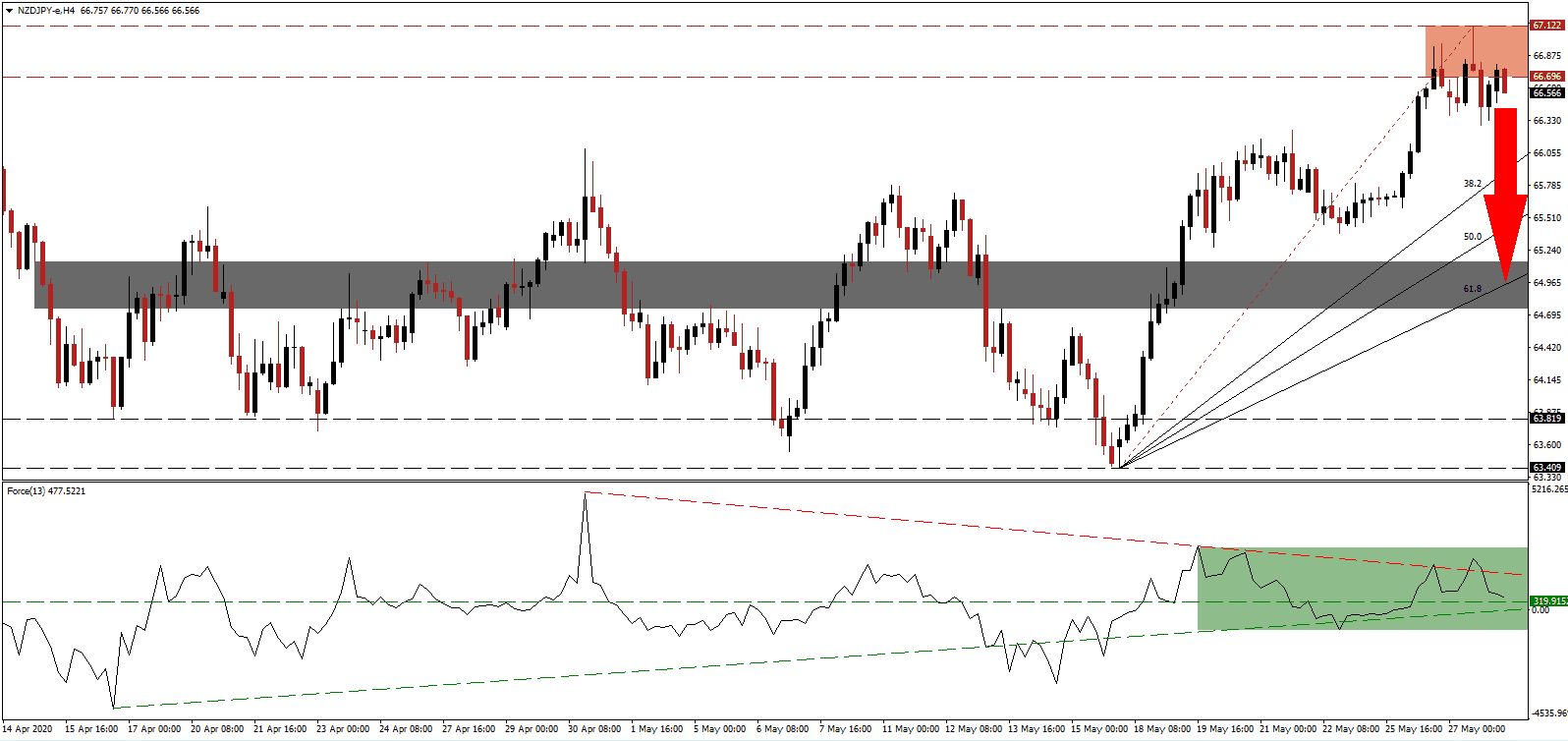

The Force Index, a next-generation technical indicator, points towards the formation of a negative divergence. Price action drifted to the upside, while this technical indicator recorded a lower high. It was then rejected by its descending resistance level and is now being pushed towards its horizontal support level. Expanding bearish pressures are favored to collapse the Force Index below its ascending support level and into negative territory, ceding control of the NZD/JPY to bears.

New Zealand’s borders remain closed with calls growing to allow foreigners who can prove they will have a positive economic impact to be permitted entry. Fears grow that the longer the island nation remains restricted to the outside, the higher the financial loss will be. To date, only 154 were granted access. Prime Minister Ardern’s government lacks a viable plan moving forward, adding downside pressures in the NZD/JPY, which completed a breakdown below its resistance zone located between 66.696 and 67.122, as marked by the red rectangle.

Despite news of closer cooperation between New Zealand and Singapore, a profit-taking sell-off is pending. The Japanese Yen is poised to benefit from the rise in Sino-American tensions due to its safe-haven status. It should allow this currency pair to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. A breakdown extension in the NZD/JPY into its short-term support zone located between 64.741 and 65.139, as identified by the grey rectangle, is anticipated to follow.

NZD/JPY Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 66.550

- Take Profit @ 65.000

- Stop Loss @ 67.050

- Downside Potential: 155 pips

- Upside Risk: 50 pips

- Risk/Reward Ratio: 3.10

In case the ascending support level inspires a reversal in the Force Index, the NZD/JPY is likely to attempt a breakout. With the global economy gearing up for an extended recession, which could stretch into 2021 and full recovery prospects pushed into 2022, Forex traders are recommended to consider any advance as an excellent selling opportunity. The next resistance zone is located between 68.055 and 68.619.

NZD/JPY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 67.550

- Take Profit @ 68.550

- Stop Loss @ 67.050

- Upside Potential: 100 pips

- Downside Risk: 50 pips

- Risk/Reward Ratio: 2.00