Gold price gave up some of its gains in the beginning of this week’s trading, as it fell from the $1733 resistance, reaching the 1721 support before settling around the $1726 level in the beginning of today’s trading. Gold prices have retreated amid an increased risk appetite as more European countries, including Spain, Italy, Germany and Greece, moved to ease closures, and investors are looking for the possibility of taking more stimulus measures to contain economic shocks from the Corona pandemic.

The growing tensions between the United States and China over a new security law in Hong Kong somewhat helped reduce the negative side.

The northern Italian region of Lombardy, which was badly affected by the coronavirus in the country, did not record any deaths for the first time on Sunday. Spain is also easing some closures in Madrid and Barcelona, while Greece, Germany and the Czech Republic are preparing to allow bars and restaurants to start providing service again.

In the same context, primary schools will be reopening in parts of England, starting June 1. Domestic flights across India have resumed, despite an increase in the number of coronavirus cases. Japan lifted the state of emergency in Tokyo and the remaining four regions, as the country managed to control infection with Corona in just a month and a half.

The Nikkei newspaper reported that the government is putting the finishing touches on a new stimulus plan worth about $1 trillion to help companies get rid of the coronavirus. Trade tensions remained in focus as Beijing moved to impose security laws on Hong Kong, adding to concerns about the city's future stability and global trade prospects.

Hong Kong residents defied the rules of social distancing and protested in the streets, while the US Department of Commerce responded by adding 33 Chinese companies and other organizations to a blacklist due to human rights violations and addressing US national security concerns. Taiwan offered to help pro-democracy protesters seeking asylum on the island.

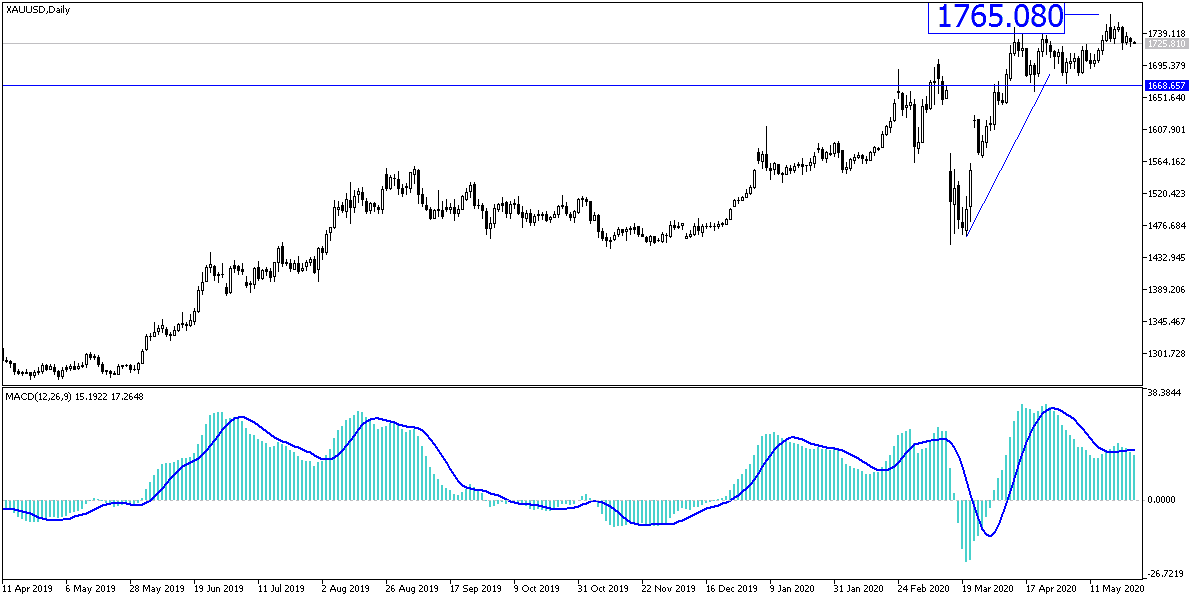

According to gold technical analysis: Despite the recent decline in the gold, the general trend is still bullish as long as it is stable above the $1700 psychological resistance. I still prefer to buy gold from each lower level and the nearest support levels for buying are currently at 1717, 1705 and 1685, respectively. As the bulls continue to dominate, there is still room for returns to come, and the closest targets may be 1735, 1747, and 1770, respectively. The US-China conflict will not end soon, especially as long as the Coronavirus plays its role in the collapse of the global economy, so gold will remain an ideal safe haven for investors.

Gold will interact a lot with the US economic data; consumer confidence index and new home sales.