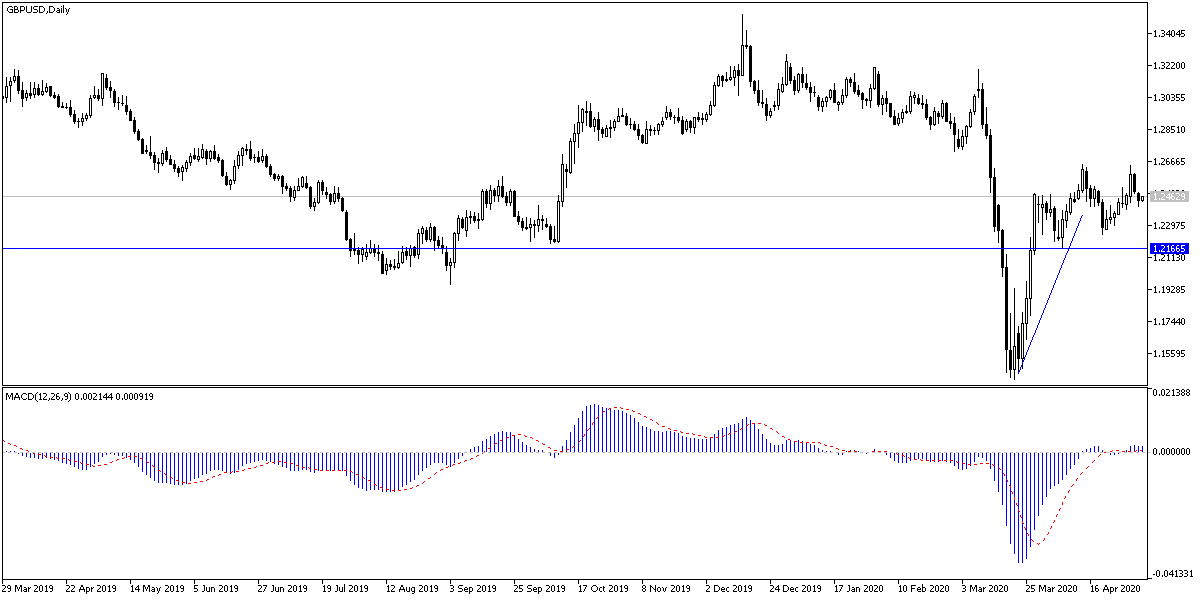

Investors have abandoned risk appetite amid a renewed US-China conflict that will deepen the global crises caused by the Corona epidemic. This caused the GBP/USD to retreat to the 1.2405 support, giving up last week's gains, which reached the 1.2642 resistance, and the pair is stable around the level of 1.2440 at the beginning of Tuesday's trading. The global losses of the epidemic did not stop, which motivates investors to buy into the US dollar as a safe haven.

Johns Hopkins University statistics reported that governments around the world have reported 3.5 million infection and more than 247,000 deaths, including more than 67,000 deaths in the United States. But the unintended spread of disease, the low test rates, and the severe strain the disease places on healthcare systems mean that the true scope of the epidemic is much greater than what is declared.

Economists at investment bank Morgan Stanley see the recession in the economic crisis deeper than they originally anticipated, with only a partial bounce in 2021. A decrease in inflation below 1.0% and a rapid jump in unemployment to 10% in 2020 is likely to be calculated, according to Morgan Stanley, who updated their economic forecasts in the UK a few days before Prime Minister Boris Johnson is expected to announce an exit strategy to end the UK's closure.

Economists expect UK GDP to contract - 9.6% year on year in 2020, followed by a partial recovery - 4.9% year-on-year in 2021. In this regard, Jacob Neal, economist at Morgan Stanley said: “We expect now a bigger blow in light of the closure and a slower recovery as the closure is lifted with cautious consumers and companies”. At the end of 2021, the basic case of Morgan Stanley sees that the GDP level is almost 5% lower than it was in the fourth quarter of 2019, but under the Bears scenario, the economy can be about 10% lower. Britain's unemployment is expected to rise from 4% before the crisis to 9.7% in the second quarter of 2020, before falling again.

On inflation, Morgan Stanley says that the coronavirus shock will be deflationary for prices, given limited demand through social distancing, a higher level of stagnation and a large negative production gap. Given lower oil prices and weak core inflation, Morgan Stanley sees British inflation for 2020 at just + 0.9% on an annual basis, giving the Bank of England ample room to print money and buy government debt under the QE program.

According to technical analysis of the pair: On the daily chart, there is a beginning of a break of the recent bullish correction, and this break will be strengthened if the pair moves to the support levels at 1.2370, 1.2290 and 1.2200, respectively. In addition to escaping the risk, the pound will remain under pressure from fears about a bleak future for the Brexit negotiations, which will support the selling strategy from each bullish level, and the nearest resistance levels for the pair are currently 1.2520, 1.2600 and 1.2730 respectively.

For today's economic calendar data: From the UK, services PMI data will be released. From the U.S, trade balance numbers and ISM services PMI reading will be announced.