UK Covid-19 related deaths are now the highest in Europe, exceeded globally only by the US, home to the most infections and deaths. While several states across the US have resumed limited economic activity, the UK remains in lockdown. Prime Minister Johnson, having survived infection with the virus, resists pressures by the public to lift implemented measures. Numerous virology and epidemiology experts cautioned against reopening economies prematurely, while economists outlined models where an extended lockdown could lead to a more massive and sustained recovery. The GBP/USD is, therefore, well-positioned to enter a new breakout sequence, partially due to patience exercised by the UK leadership.

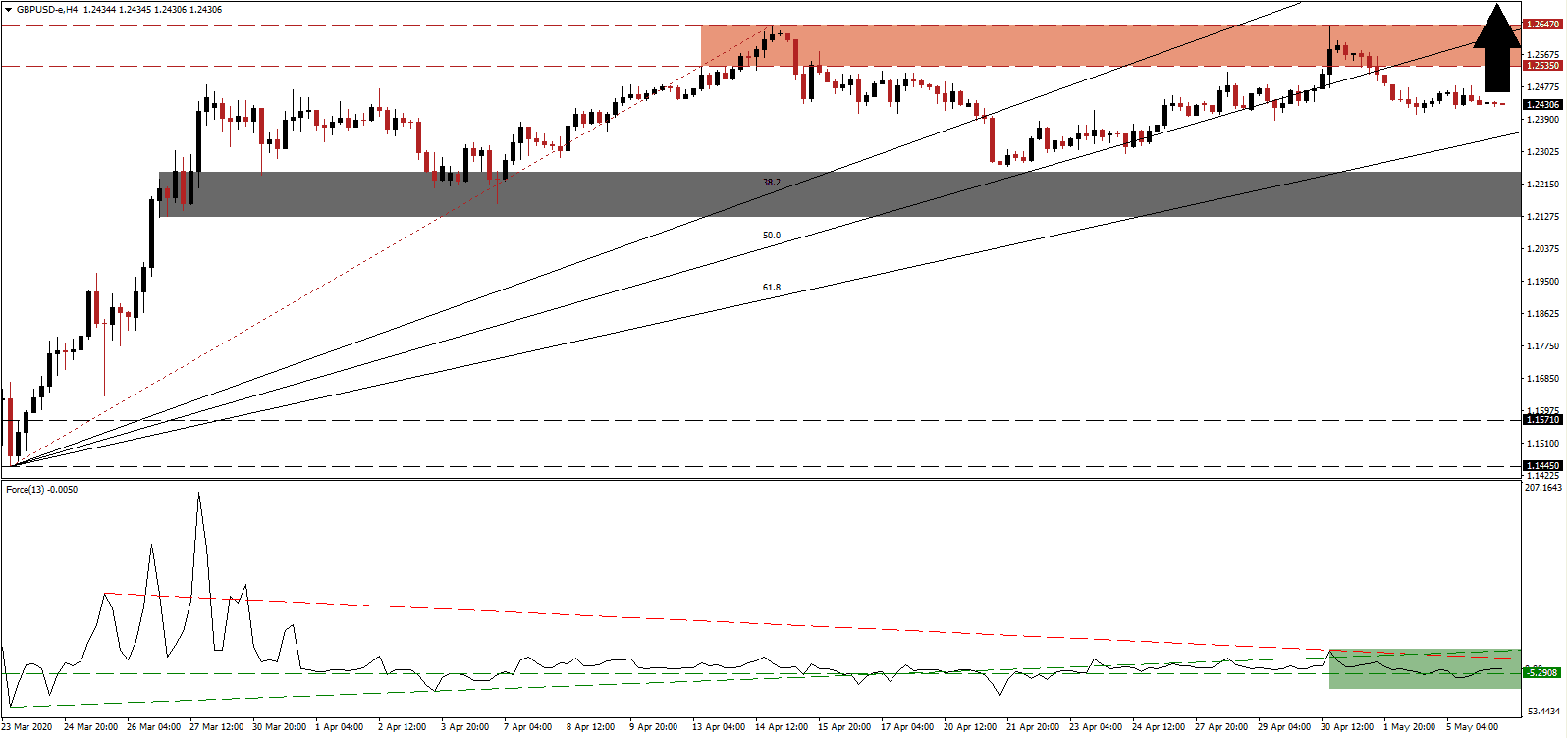

The Force Index, a next-generation technical indicator, converted its horizontal resistance level into support, as marked by the green rectangle. It is now faced with its descending resistance level and remains below its ascending support level. Bullish developments are on the rise, expected to lead the Force Index into a double breakout. This technical indicator is on course to cross above the 0 center-line, at which point bulls will regain full control of the GBP/USD, leading to a spike in breakout pressures.

Adding to breakout pressures is the ascending Fibonacci Retracement Fan sequence. Price action is presently located above its 38.2 Fibonacci Retracement Fan Support Level and below its 50.0 Fibonacci Retracement Fan Resistance Level. Volatility is favored to increase, but the downside potential remains limited due to the ongoing upward adjustment of the short-term support zone. This zone is located between 1.2124 and 1.2247, as identified by the grey rectangle. A higher low during the previous correction increased bullish developments in the GBP/USD from a technical perspective.

This currency pair was rejected twice by its resistance zone located between 1.2535 and 1.2647, as marked by the red rectangle. Long-term fundamental circumstances, in combination with the technical outlook, is anticipated to lead the GBP/USD into a breakout. While the UK could enter its most profound recession on record, recovery prospects are equally compelling. Adding a distinct positive catalyst is the ability of the UK to enter trade deals following the end of the Brexit transition period on December 31st, 2020. Price action will face the next resistance zone between 1.2848 and 1.2982.

GBP/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.2430

Take Profit @ 1.2980

Stop Loss @ 1.2280

Upside Potential: 550 pips

Downside Risk: 150 pips

Risk/Reward Ratio: 3.67

Should the descending resistance level pressure the Force Index deeper into negative territory, the GBP/USD is likely to enter a temporary correction. With the downside potential limited to its short-term support zone, Forex traders are advised to add to their long positions. The outlook for the UK economy and the British Pound are increasingly bullish, where the US Dollar carries a significant bearish bias.

GBP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.2230

Take Profit @ 1.2130

Stop Loss @ 1.2280

Downside Potential: 100 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 4.23