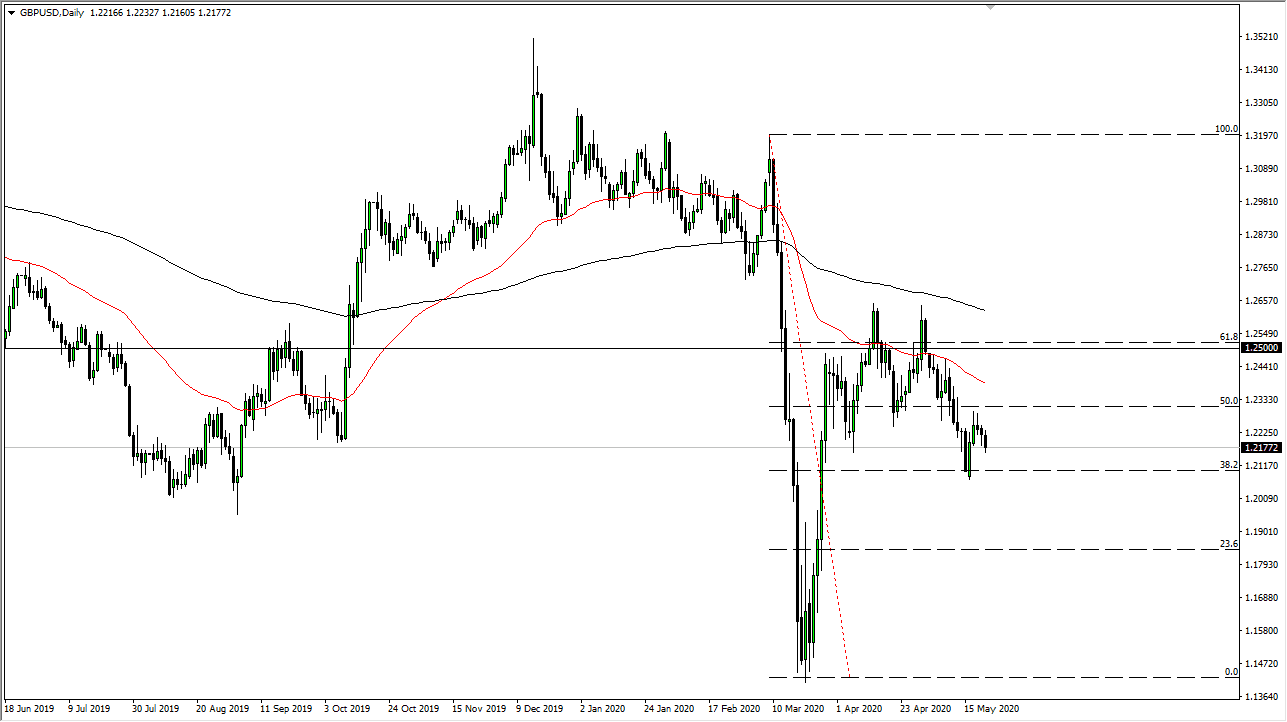

The British pound fell a bit during trading on Friday, breaking down below the bottom of the hammer from the Thursday session. That of course is a negative sign and it suggests that we do see a bit more momentum entering the market to the downside trying to break things down. If that happens, I anticipate that the 1.21 level will be targeted, followed by the 1.20 level. Eventually we will break down below there and then go looking towards 1.1750 level.

On the other side of the equation, if we were to break above the tweezer top that formed from the Wednesday and Thursday candlesticks, it is highly likely that we could see a lot of resistance all the way to the 50 day EMA. The 50 day EMA of course is a technical indicator that a lot of people pay attention to. Recently, it has offered significant dynamic resistance, so it does make sense that we would struggle there. Breaking above that level does open up the possibility of a move to the 1.25 handle, but again unless something was to materially change with the UK economy, it looks as if this is going to be more or less a “sell the rallies” type of currency market.

When I look at this chart, it is not too hard to imagine that the 1.23 level was previous support and as a result the fact that it has offered resistance recently should not be a huge surprise. This would be a continuation of the downtrend overall, and of course show that there is still quite a bit of demand for greenbacks, mainly due to the US Treasury market. The United Kingdom also has to deal with the largest amount of coronavirus cases, and it is part of the world, and of course the fact that the Bank of England has officials recently that have suggested that negative rates were necessarily out of the question. That is not something that Forex traders like to hear, and they will dump your currency in a heartbeat one that becomes an issue. There is a bit of a carry trade in favor of the US right now against many of the other G 10 currencies, so that of course also brings up a certain amount of bullish pressure on the greenback. With this, I think that we do continue to grind lower at this point and I am fading rallies.