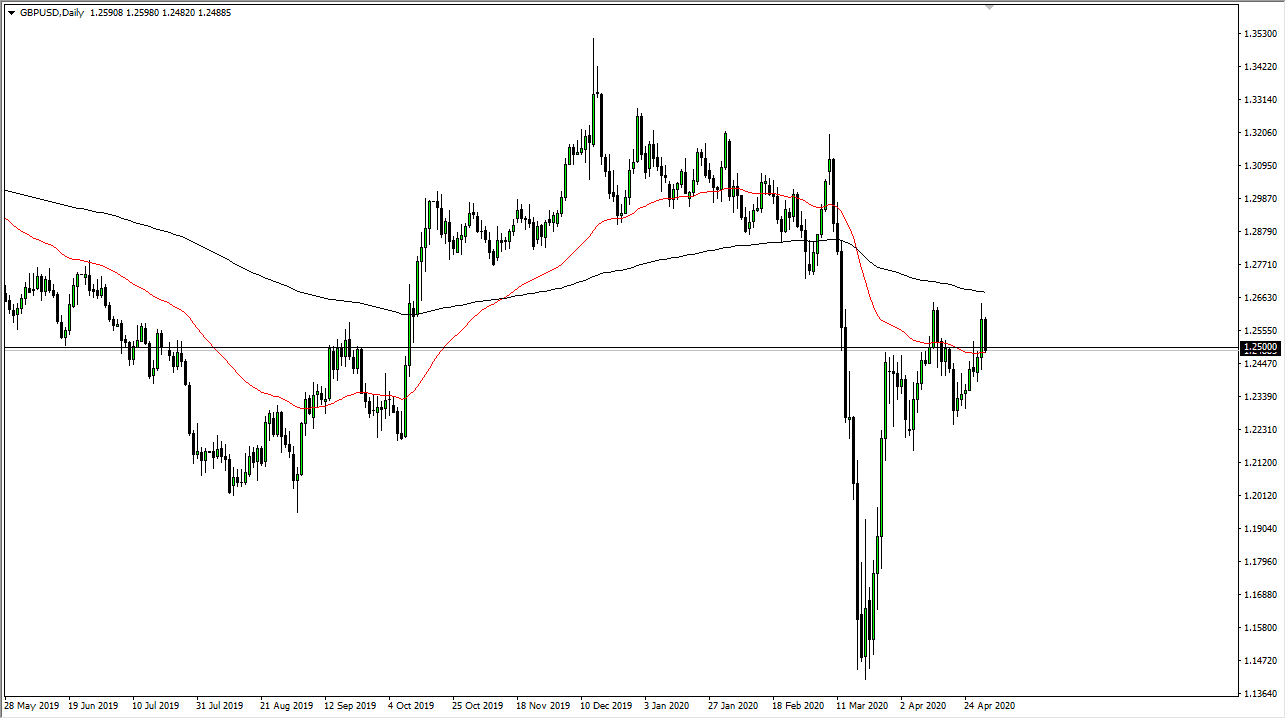

The British pound initially tried to rally during the trading session on Friday but then gave back the gains to dip below the 1.25 handle. This being the case, we have shown that the market does not like staying above the 1.25 handle, so that something worth paying attention to. The 200 day EMA is just above the last couple of candlesticks and has offered resistance the last couple of times we have gotten near it. The fact that we are closing below the 1.25 level shows that there is still a proclivity to pull back from this region.

The 50 day EMA is just below the candlestick for the trading session on Friday, and as a result we need to clear that before we get more negativity. This is a market that has been grinding back and forth over the last couple weeks, but at this point the question now is whether or not we just made a “double top”, so the next couple of sessions will be.

From the longer-term fundamental standpoint, I still believe that the United Kingdom is in much worse shape than the United States, especially considering that the UK will be locked down for much longer. If that is the case, then it makes sense that the British pound will continue to struggle. The only thing pushing this higher from what I can see is that the Federal Reserve has been liquefying the markets and pumping dollars into the system, so it will continue to weigh upon the value of the greenback. Having said that, there is a lot of concern out there and it is driving treasury yields down, meaning that there is still quite a bit of need for US dollars in order to buy those contracts.

To the downside, the 1.22 level underneath will be a target, and if we can break down below the bottom of the candlestick for the trading session of the last couple of days to the upside, if we were to break to the upside and clear the 200 day EMA, then I believe that the British pound will then reach towards the 1.30 level given enough time. At this point in time, I do favor the downside, but I also recognize that this market has continued to hover in the air, much longer than I would have anticipated. All things being equal, it is likely that we will see a lot of back-and-forth range bound trading before we make it absolutely explosive move. Patience will be needed to make a huge trade that looks likely to happen.