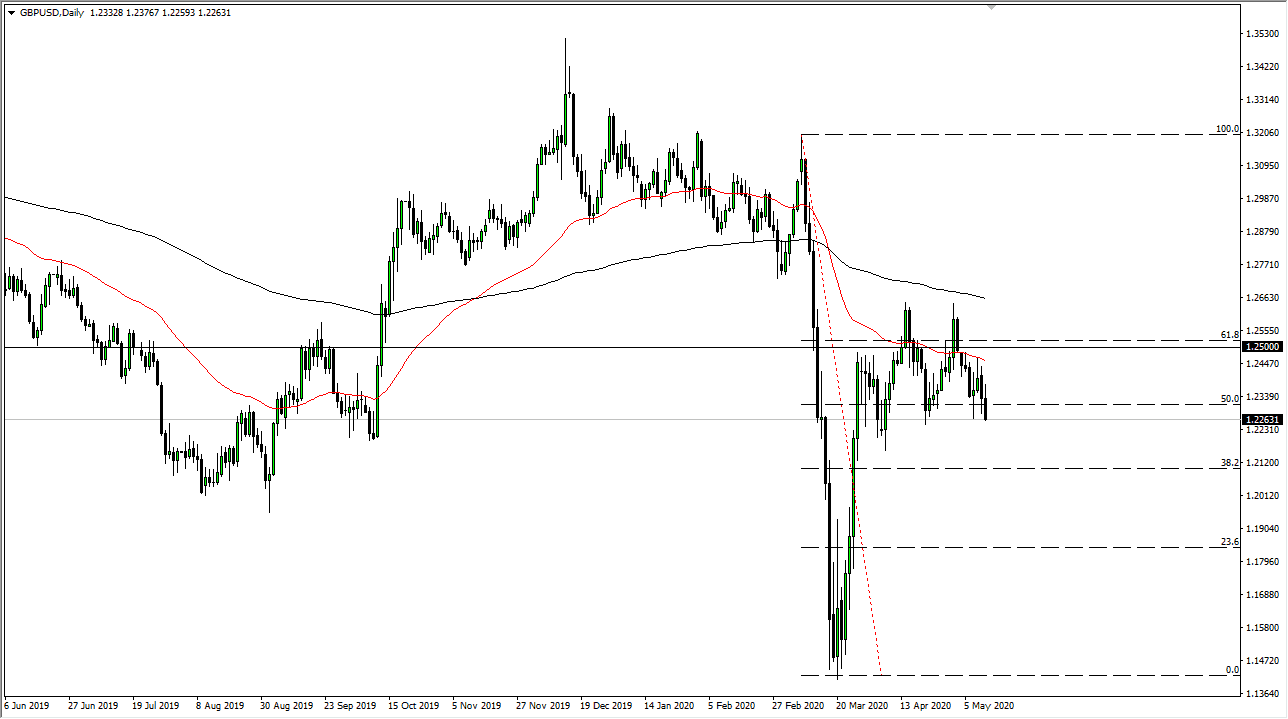

The British pound has shown itself to be rather weak during the trading session on Tuesday, as we had initially rally but then gave back a large amount of the gains to press towards the 1.2250 level, which for me is an area of great importance. If we can break down below that level, then it is likely that the British pound continues to go much lower, with an eye on the 1.20 level, and then possibly even lower than that. Ultimately, this is a market that continues to see a lot of choppy volatility but it is also a market that is starting to show signs of cracks beneath the ice when it comes to risk appetite, which makes quite a bit of sense considering that the UK is still locked down, although it is gradually trying to get back to normal. The US of course is much quicker to open up the economy.

Furthermore, the United States has the benefit of being the world’s reserve currency, so it is considered to be the ultimate safety currency in times of extreme turmoil. Beyond that, we also have the Brexit to deal with and that of course will continue to be a bit of a wait around the neck of the Pound in general.

Ultimately, this is a market that also has a lot of technical factors working in favor the US dollar. The 61.8% Fibonacci retracement level has been extreme resistance, just as the 50 day EMA has. The 1.25 level of course is a psychologically significant number, and therefore will continue to attract a lot of attention if we do reach that region. All things being equal though, I do believe that the momentum is starting to drift much lower and we are simply running out of strength as far as buyers are concerned. That does not mean that it is going to be an easy way going forward, but I do think that it is only a matter of time before the sellers takeover.

Look at rallies as an opportunity to pick up the US dollar at a better price, as it will continue to be the most highly sought after currency in the world. Treasury markets have shown us just how valuable the US dollar is, and we should continue to see that play its part in the FX markets, as the longer-term trend tries to reassert itself.