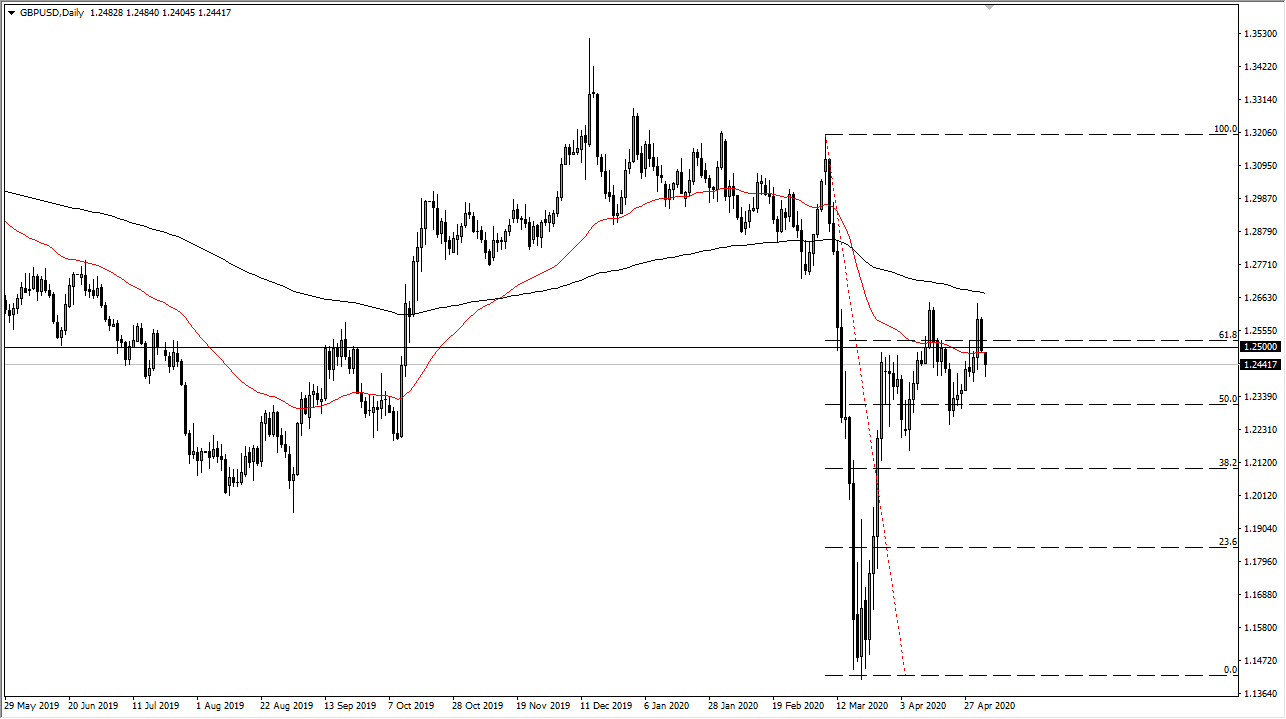

The British pound has broken down a bit during the trading session on Monday, reaching towards the 1.24 level before bouncing slightly. At this point in time, it appears that the 1.25 level is essentially “fair value” for this pair. It will act as a bit of a magnet, but at this point in time it is unlikely that we stay there for too much longer. The 50 day EMA is sitting just below that level, so that could offer a bit of a magnet for price as well. That being said, I think what we are seen as the market trying to figure out whether or not we are going to go higher or lower, and it is worth noting that the most recent high was lower than the one before it.

When you look at the chart, it take out all of the candlestick analysis, you can see that the market has been chopping around back and forth once we get close to the 1.25 level, and it looks as if we are running out of momentum. One of the biggest mistakes traders make in the retail world as they do not pay attention to the rate of change when it comes to the currency pair. While the candlestick for the trading session on Monday was not necessarily a negative candlestick, it does not necessarily look as bullish as it could. As we have made a “lower high”, and now look as if we are trying to make a “higher low”, we could be in the process of trying to come up with some type of symmetrical triangle. At the symmetric triangle gets broken, that quite often will lead to a bigger move.

The 200 day EMA is of course will be paid attention to and it is probably worth noting that the “lower high” was just after we pierced the 61.8% Fibonacci retracement. A breakdown below the bottom of the candlestick for the trading session on Monday opens up the door to a move down to the 1.22 handle, and then possibly a bigger move than that. I do not have any interest in buying the British pound right now, because the UK economy is most certainly in worse shape than the US economy. Having said that, if we were to break above the 200 day EMA I would have to rethink some things.