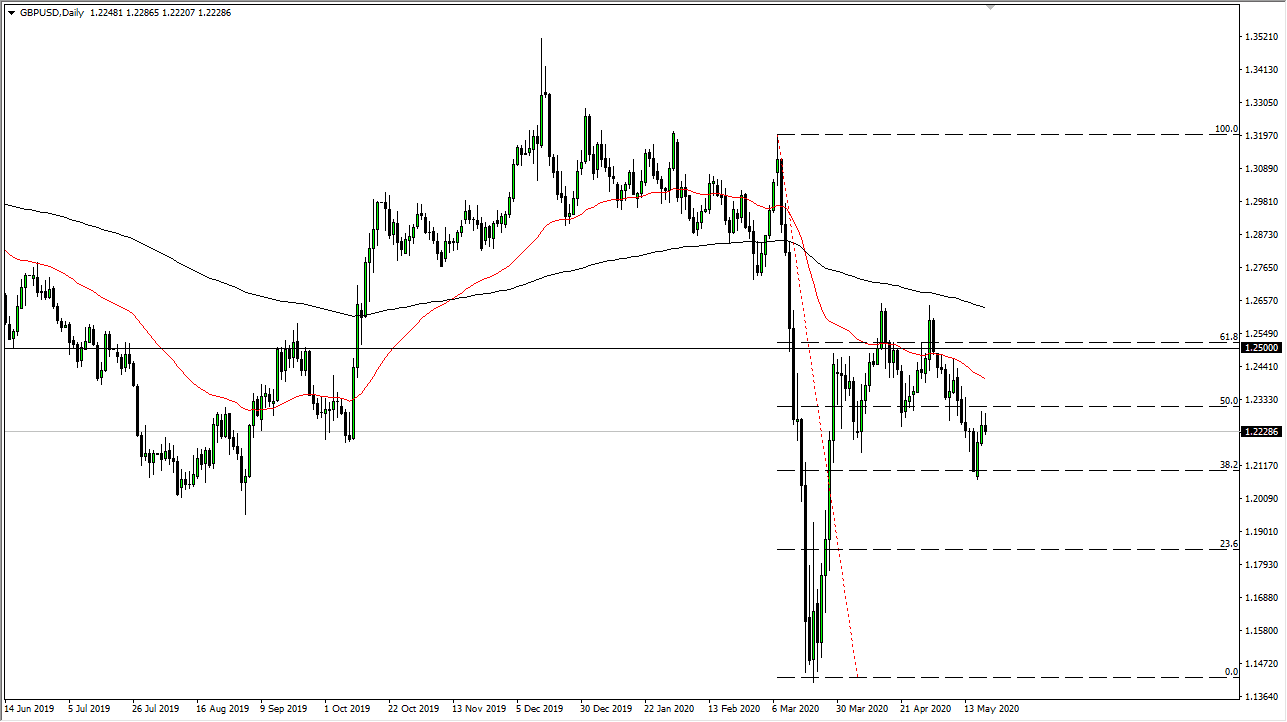

The British pound tried to rally during the trading session on Wednesday but gave back the gains near the 1.23 level yet again. This has shown the British pound to be very resilient, but at the same time has shown the British pound to not be able to get above the 1.23 level. If we can break down below the candlestick during the Wednesday session, it is likely that the British pound will continue to drop from here, perhaps going down to the 1.21 level.

The market continues to see a lot of resistance above, especially near the 50 day EMA which is painted on the chart in red. The market is likely to continue to see a lot of noise, but clearly it looks to me as that the British pound is on its back foot, as it has lost quite a bit against several currencies, not just the US dollar. With this being the case, one should think that more downward pressure comes back into play. I believe that we will eventually go down to the 1.20 level which is my longer-term target. However, what we have seen recently is that anything that is related to hope is likely to have a bit of help here and there.

The candlestick is a shooting star, and that of course will attract a lot of attention in and of itself. Technical traders will jump on this, so it could lead to continued selling that we have seen for so long. However, if we were to break above the top of the session for Wednesday, the market probably will go looking towards the 50 day EMA mentioned previously. Even if that happens, I would not be a buyer, because quite frankly there seems to be only a matter of time before we see exhaustion. Quite frankly, I do not really have a situation where I am looking to buy this pair, but I do recognize that I will have to keep an open mind as we have seen in other currencies. The British pound looks weaker than the US dollar, which is saying something in the environment that we have seen. If you do not sell it against the greenback, you may look to sell it against other currencies such as the Japanese yen or even the Swiss franc. The Australian dollar also has been relatively strong as of late so you could see the GBP/AUD pair breakdown as well.