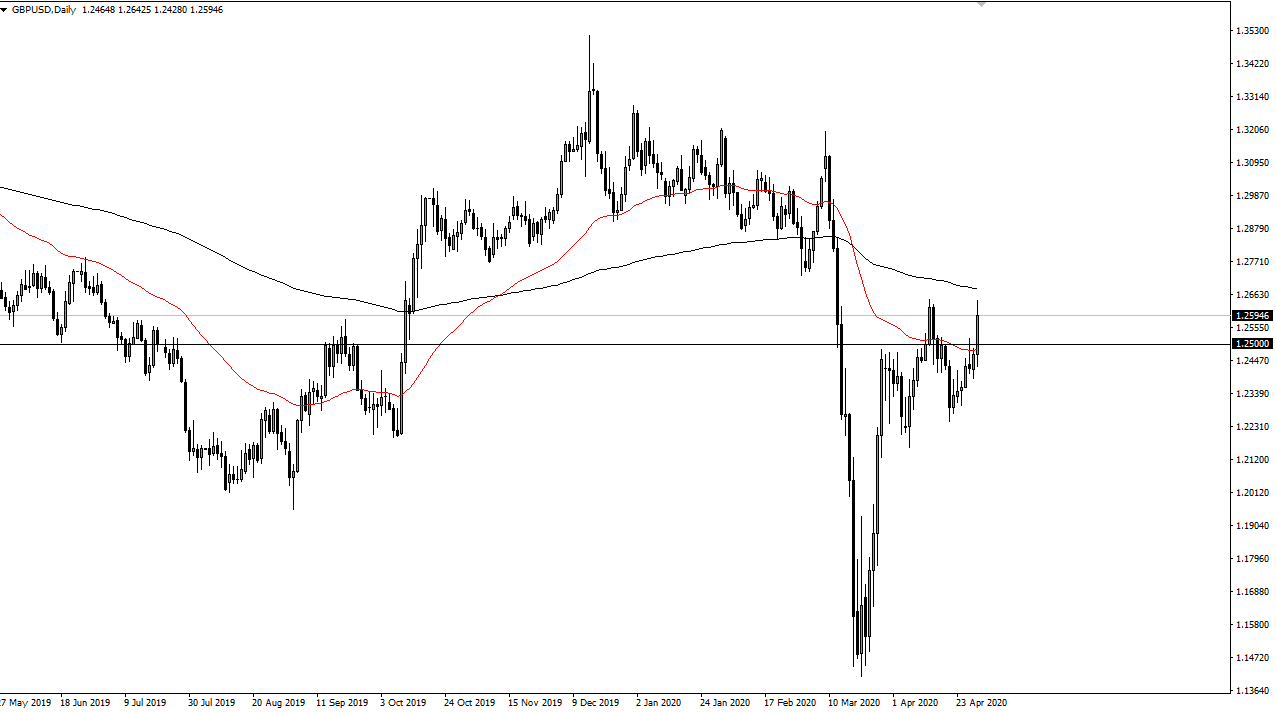

The British pound has rallied rather significantly during the trading session on Thursday, reaching towards the 1.26 level. We did pull back a little bit towards the end of the day, but at this point it looks as if the Federal Reserve is willing to do whatever they can to bring down the value of the US dollar. If they can do that, that should send the British pound higher, but at the moment we are looking at the 200 day EMA just above, so do not be surprised at all if the market pulls back.

One thing that is worth paying attention to is the fact that the market shot straight through the 1.25 level, so it certainly looks as if the buyers are trying to press the issue. This is a market that could go all the way to the 1.30 level before finding more pressure if we do clear the 200 day EMA, so at this point in time I think what you need to do is wait to see if we can close on a daily chart above the 200 day EMA before you start buying, and even then it would be a short-term move more than anything else.

If we turn around and breakdown below the 1.25 level, it is likely that the market goes down to the 1.23 level underneath which should be somewhat supportive. If we break down below there, then the market is likely to continue to go much lower, down to the 1.20 level, and then eventually the 1.175 level. Overall, this is a market that does seem a bit disconnected from reality, as the United Kingdom has a whole slew of issues in the United States does in, but at the end of the day it is all about the Federal Reserve more than anything else in most markets, so this one should not be any different.

If we turn around a break down below the 1.25 level, pay attention to how price reacts to the 50 day EMA, because it could give us a bit of a heads up as the where we go next. Breaking down below that level is likely to see pressure increase to the downside and therefore it will be interesting to watch. Keep in mind that May Day is on Friday, so liquidity is going to be an issue during certain parts of the day, so we could have a bit of a strange market.