The Euro gave up many of its recent gains amid renewed disagreement between the two largest economies in the world over the cause of the Corona pandemic, which pushed the global economy into the abyss. With the beginning of this week’s trading, the EUR/USD fell towards the 1.0895 support, after gains last week pushed it to the 1.1018 resistance and settled around the 1.0900 level in the beginning of trading today, Tuesday. After Trump's comments accusing and threatening China for being the cause of the epidemic. US Secretary of State Mike Pompeo said before trading opening that there was "a large amount of evidence" confirming the start of the new virus in China. For its part, the Chinese Global Times said in an editorial that Pompeo was "deceiving" and called on the United States to provide evidence.

On the economic side. The results of the final IHS Markit survey showed that the Eurozone manufacturing sector contracted at a record pace in April, as government restrictions to curb the spread of coronavirus put strains on activity. The final PMI fell to 33.4 from 44.5 in March. The result was also below expectations of 33.6.

As for coronavirus, despite the alarming figures of infections and deaths from, the collapsed European economies have begun to reopen to stop further losses. Italy began to open from yesterday with millions of people allowed to return to work as the longest closure of the coronavirus in Europe began to calm, while the United States took steps to stop some restrictions, even with the announcement of tens of thousands of new cases every day.

In Washington, the Senate was meeting for the first time since March, while dozens of people in Florida were waiting before sunrise until seven in the morning for the opening of Clearwater Beach. In South Dakota, the closed swine meat processing plant has taken its first steps toward reopening after over 800 employees were infected with the Coronavirus.

Louisiana lawmakers were also restarting their legislature - even during their dispute over whether they should ever return.

Political battles have become an integral part of the policy to deal with coronavirus in the United States. In Louisiana, Republican lawmakers were angered by Democratic Governor John Bill Edwards's decision to extend the state's closure order until May 15, and they were keen to return to work. But Democrats saw things differently. They said in a statement to them, "It could be a devastating blow to the steps that have been achieved and the safety of our residents, employees and members if we return to work as usual prematurely."

The steps to open US states came even with the death toll in one day reached 1,313 on Sunday, with more than 25,500 new confirmed cases, according to Johns Hopkins University's latest stats. Real numbers are likely to be much higher. With pressure increasing in many countries to take more measures to restart the economy, politicians were also trying to boost funding to search for a COVID-19 vaccine. There are hopes that the vaccine will be available within months, but many scientists warn that it may take longer.

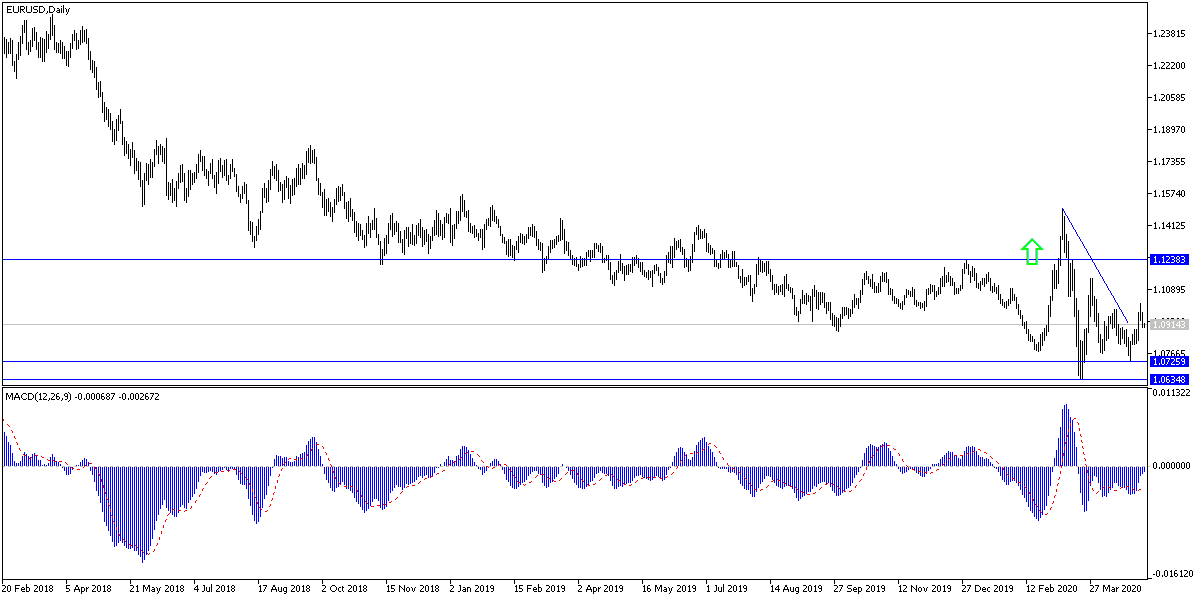

According to technical analysis of the pair: the return of the EUR/USD pair to the 1.0800 psychological support area, as I mentioned in recent technical analyzes, paves the way for the bears to take control of performance again. The pair did not maintain the chance of resistance at 1.10 with the persistence of pressure, which may remain for a longer period, which confirms the selling strategy from each upper level. The next bear’s targets will be 1.0845 and 1.0770 respectively. And there will be no chance of going higher without surpassing the 1.1000 psychological resistance again.

As for the economic calendar data today: From the EU, The change in Spanish unemployment and the producer price index from the Eurozone will be announced. From the U.S, Trade Balance and ISM Services PMI data will be announced.

The German court ruling on the constitutionality of stimulus plans from the European Central Bank will affect the performance of the Euro.