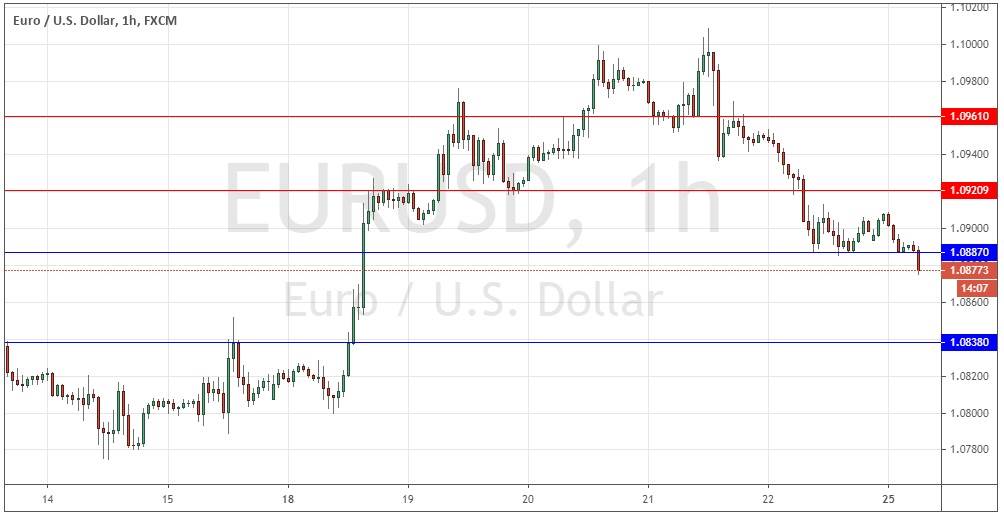

EUR/USD: Key support level breaking down

Last Thursday’s signals were not triggered, as there was no bearish price action when the resistance level identified at 1.0971 was reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered prior to 5pm London time today.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0921 or 1.0961.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Idea

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0838.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that I would take a bullish bias if we had gotten a retracement to 1.0921 or 1.0887 and a bullish bounce at either level. This did not happen, as the price rose initially to hit the big round number at 1.1000 before hitting either level, before reversing.

This currency pair has been consolidating for two months, roughly between 1.1000 at an upper limit and 1.0750 as a lower limit of its range. There will eventually be a breakout, but it does not look likely to happen soon. Therefore, the best approach here is probably going to be looking for longs at bullish reversals at or below 1.0750 and shorts at bearish reversals at or near 1.1000.

We seem to be on the way down from 1.1000 and the price has just broken below the crucial former support level I had identified at 1.0887, so the price is likely to fall as long as it remains below 1.0887. I take a cautiously bearish bias below 1.0887 until 1.0838 today. There is nothing of high importance due today concerning either the EUR or the USD. It is a public holiday in the United States today.

There is nothing of high importance due today concerning either the EUR or the USD. It is a public holiday in the United States today.