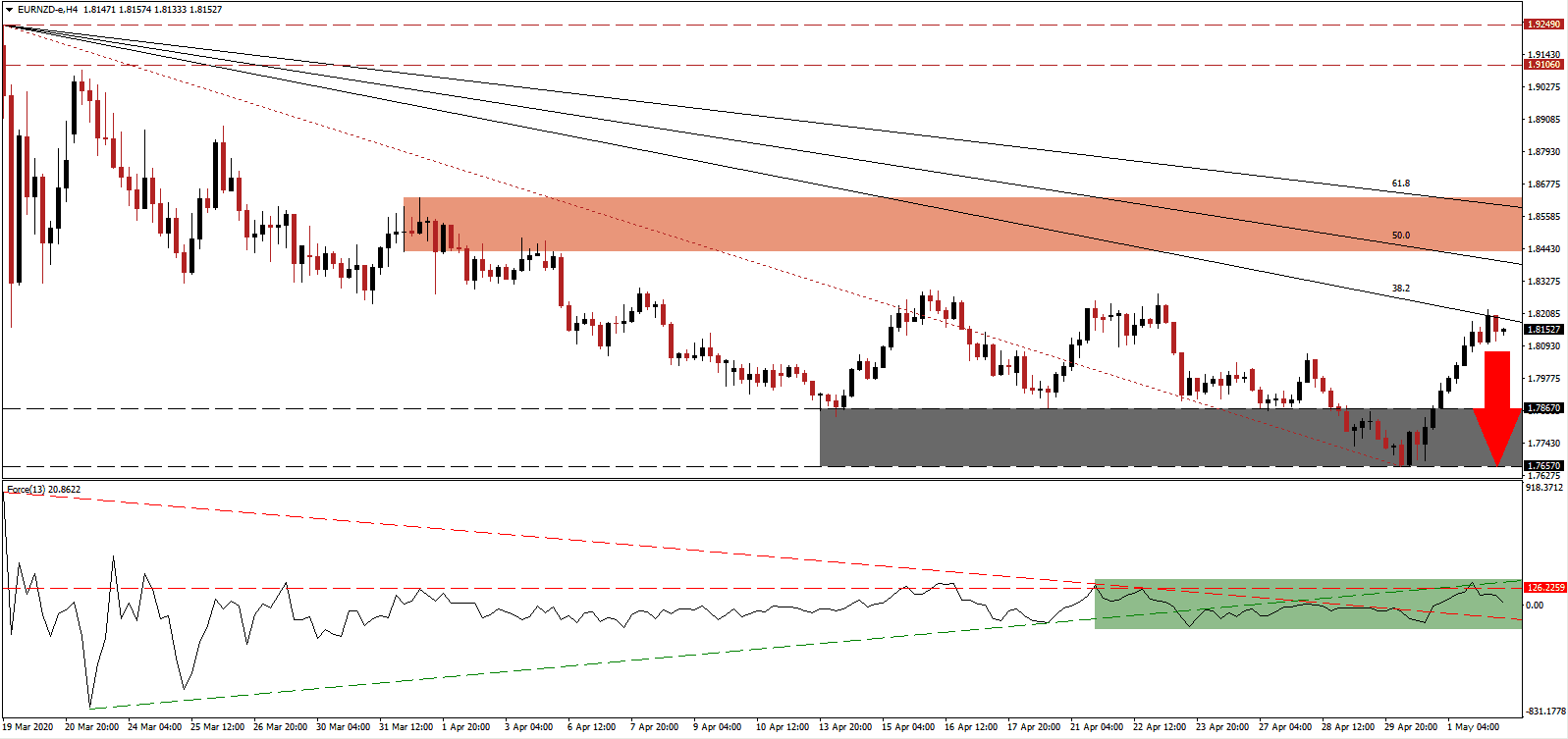

While New Zealand is caught in the vortex of the diplomatic row Australia sparked with China, its currency struggles with rising domestic issues. The latest forecast call for its economy to shrink by 10.4% in 2020 with a slow recovery ahead. It allowed the EUR/NZD to enter a counter-trend reversal, but with Eurozone fundamental and existential threats overshadowing those of New Zealand, a resumption of the dominant downtrend is anticipated. While New Zealand contained the Covid-19 pandemic, the Eurozone is home to four of the five most infected economies. The descending Fibonacci Retracement Fan sequence is expected to pressure price action into its support zone.

The Force Index, a next-generation technical indicator, was rejected by its ascending support level, posing as resistance after the collapse below it. The Force Index remains below its horizontal resistance level, as marked by the green rectangle, and is positioned to correct below the 0 center-line. This technical indicator is favored to push below its descending resistance level, which serves as short-term support, at which point bears will regain complete control of the EUR/NZD.

A series of lower highs and lower lows established a massive bearish chart pattern. The short-term resistance zone located between 1.8431 and 1.8628, as identified by the red rectangle, is continuously adjusted to the downside, reflecting ongoing weakness in the EUR/NZD. New Zealand eased lockdown restrictions, one of the toughest implemented globally, and select Eurozone countries are doing the same. Consumer behavior is likely to face permanent change. While neither country is prepared, New Zealand is better positioned for positive adjustments.

Price action was rejected by its 38.2 Fibonacci Retracement Fan Resistance Level from where a new breakdown sequence may materialize. Today’s manufacturing PMI data across the Eurozone may provide the catalyst to send the EUR/NZD back into its support zone located between 1.7657 and 1.7867, as marked by the grey rectangle. Volatility could increase with bearish factors influencing both currencies, with a more drastic impact on the Euro. You can learn more about a breakdown here.

EUR/NZD Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 1.8150

Take Profit @ 1.7660

Stop Loss @ 1.8300

Downside Potential: 490 pips

Upside Risk: 150 pips

Risk/Reward Ratio: 3.27

Should the Force Index push above its ascending support level, the EUR/NZD is likely to attempt a breakout. Due to fundamental developments, the upside potential remains limited to the top range of its short-term resistance zone, with the 61.8 Fibonacci Retracement Fan Resistance Level favored enforcing the bearish chart pattern. Forex traders are recommended to take advantage of any price spike with new sell orders.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.8375

Take Profit @ 1.8560

Stop Loss @ 1.8300

Upside Potential: 185 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 2.47