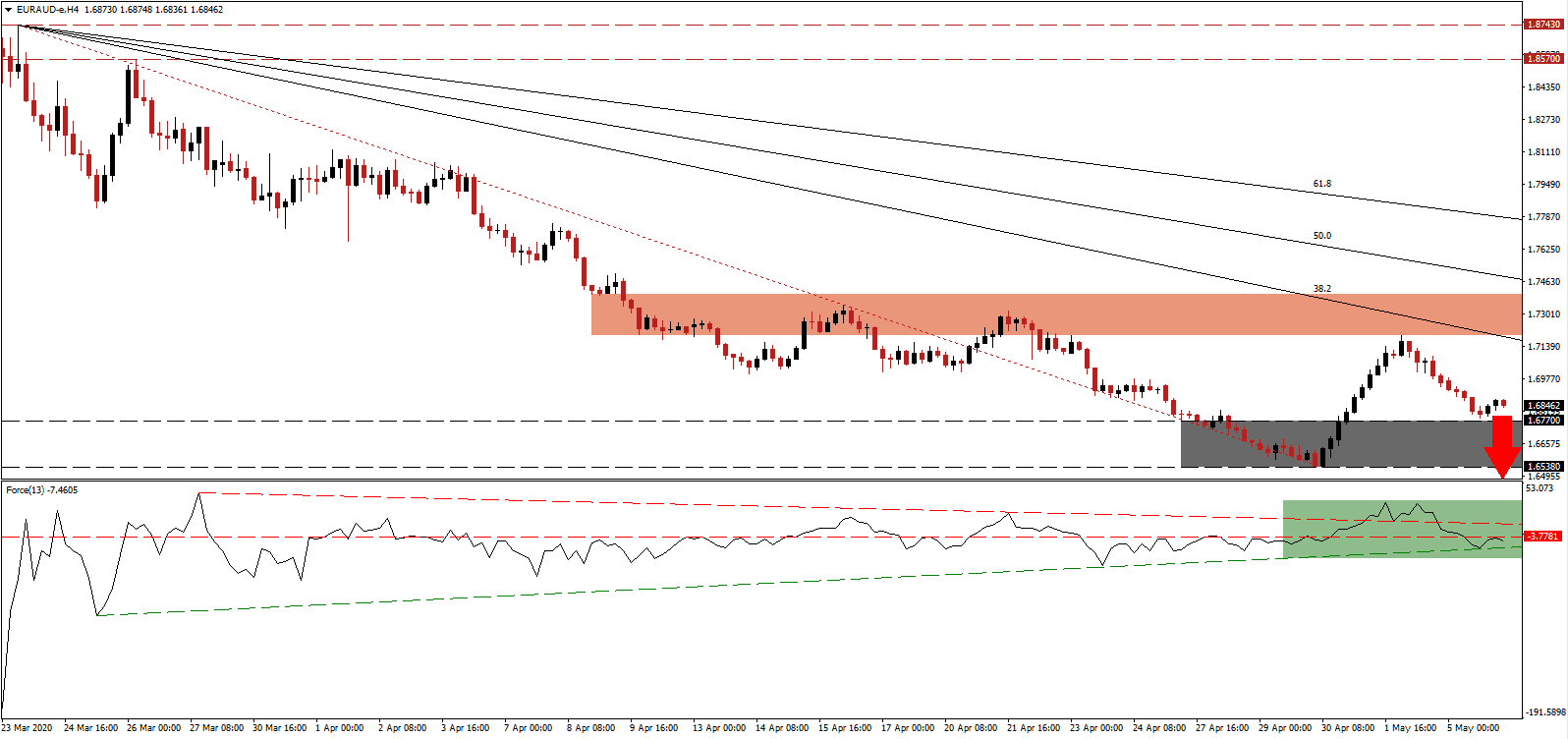

Following preliminary first-quarter Eurozone GDP data, showing a record contraction of 3.8%, European Central Bank President Lagarde cautions second-quarter data may indicate a 15.0% collapse. The 3.8% January-to-March decline was more excessive than during the 2008 global financial crisis, highlighting significant problems yet to materialize. It also threatens hope of a swift economic recovery. Many Eurozone economies are gradually easing lockdown restrictions at a time new infection rates may accelerate. Rising breakdown pressures are anticipated to extend the corrective phase in the EUR/AUD after the short-term resistance zone rejected this currency pair.

The Force Index, a next-generation technical indicator, temporarily halted its decline after reaching its ascending support level. A slight drift to the upside is in the process of being reversed with the Force Index is positioned below its horizontal resistance level, as marked by the green rectangle. Adding to downside momentum is the descending resistance level. This technical indicator remains in negative territory, confirming bears are in control of the EUR/AUD. You can learn more about the Force Index here.

Australian retail sales for March rebounded strongly, but first-quarter data disappointed. Markets are cautiously monitoring relations between Australia and China since the former initiated a diplomatic row, which drew an angered response by the latter. While volatility is likely to increase, the dominant bearish chart pattern is favored to pressure the EUR/AUD into a new breakdown sequence. The most recent advance created a lower high, forming the bottom range of its short-term resistance zone located between 1.7195 and 1.7403, as marked by the red rectangle. This zone is continuously adjusted to the downside to reflect the rising bearish pressures.

Enforcing the downtrend is the descending Fibonacci Retracement Fan sequence, and the 38.2 Fibonacci Retracement Fan Resistance Level already crossed below the short-term resistance zone. The EUR/AUD is expected to challenge its support zone located between 1.6538 and 1.6770, as identified by the grey rectangle. Given evolving fundamental circumstances, a breakdown is anticipated to lead to more selling pressure. The next support zone awaits price action between 1.6295 and 1.6355.

EUR/AUD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.6845

Take Profit @ 1.6295

Stop Loss @ 1.6975

Downside Potential: 550 pips

Upside Risk: 130 pips

Risk/Reward Ratio: 4.23

In case the Force Index pushes above its descending resistance level, the EUR/AUD can attempt a price action reversal. Forex traders are recommended to take advantage of any advance in this currency pair with new net short positions due to an increasingly bearish outlook. Australia is better positioned to restore relations with China than the Eurozone is to enter a sustained economic recovery. The upside potential is reduced to the bottom range of its short-term resistance zone.

EUR/AUD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.7045

Take Profit @ 1.7195

Stop Loss @ 1.6975

Upside Potential: 150 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.14