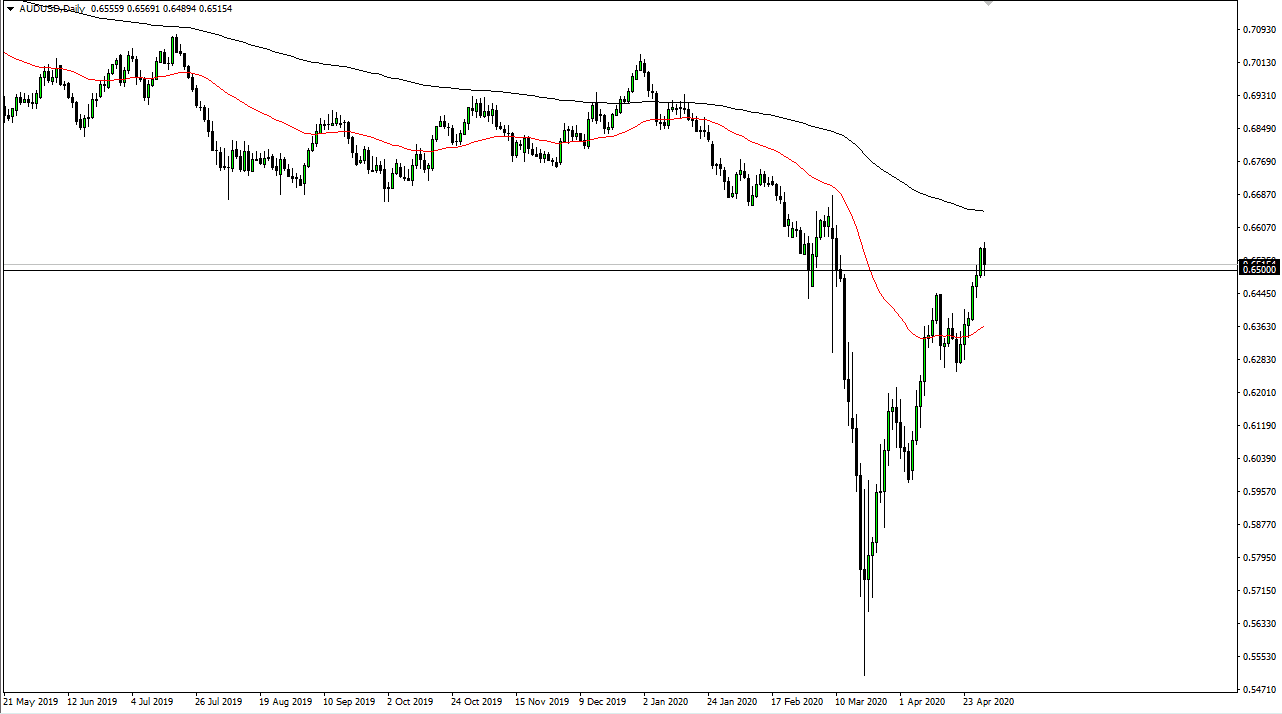

The Australian dollar has pulled back just a bit during the trading session on Thursday, reaching down to test the 0.68 level. That is an area that should continue to attract a lot of attention, but one thing you cannot ignore is the fact that the Australian dollar has skyrocketed to the upside. Ultimately, the market has gotten a bit ahead of itself, and now that we are in the region between 0.65 and 0.67, the Australian dollar has a lot of work to do. This is an area that I think is going to be exceedingly difficult to overcome.

I do believe that a pullback is somewhat imminent, but I will be the first to admit I thought that has been coming for a while. At this point, if we can take out the bottom of the Thursday session, then I believe that this market will go looking towards the 0.6350 area, basically the 50 day EMA. At this point, the market has a lot of work to do to convince traders to continue to simply buy this pair, but at this point every time I have tried it to the downside, I have paid for it.

Remember that the Aussie is highly levered to China, which of course is highly levered to global growth. Global growth is basically dead at the moment, so trade of course is going to continue to cause issues. Looking at this chart, if we were to break down below the 0.6250 level, then we could have a rather significant break down. The alternate scenario of course is that we break above the 0.67 handle, which then could send this market into a longer-term uptrend, but it has defied gravity for some while now. I think that we could see this market pullback is simply to find some type of algorithms are causing all kinds of havoc around the world, stabilization as we had originally broken down too quickly, and now we have rallied far too quickly. One thing that has helped the Aussie dollar is the fact that the coronavirus infections in Australia have been somewhat limited. At this point, that is the one major advantage Australia has over the United States. However, Australia needs the United States and the European Union to buy Chinese goods to push its economy higher. Expect a lot of volatility in this area.