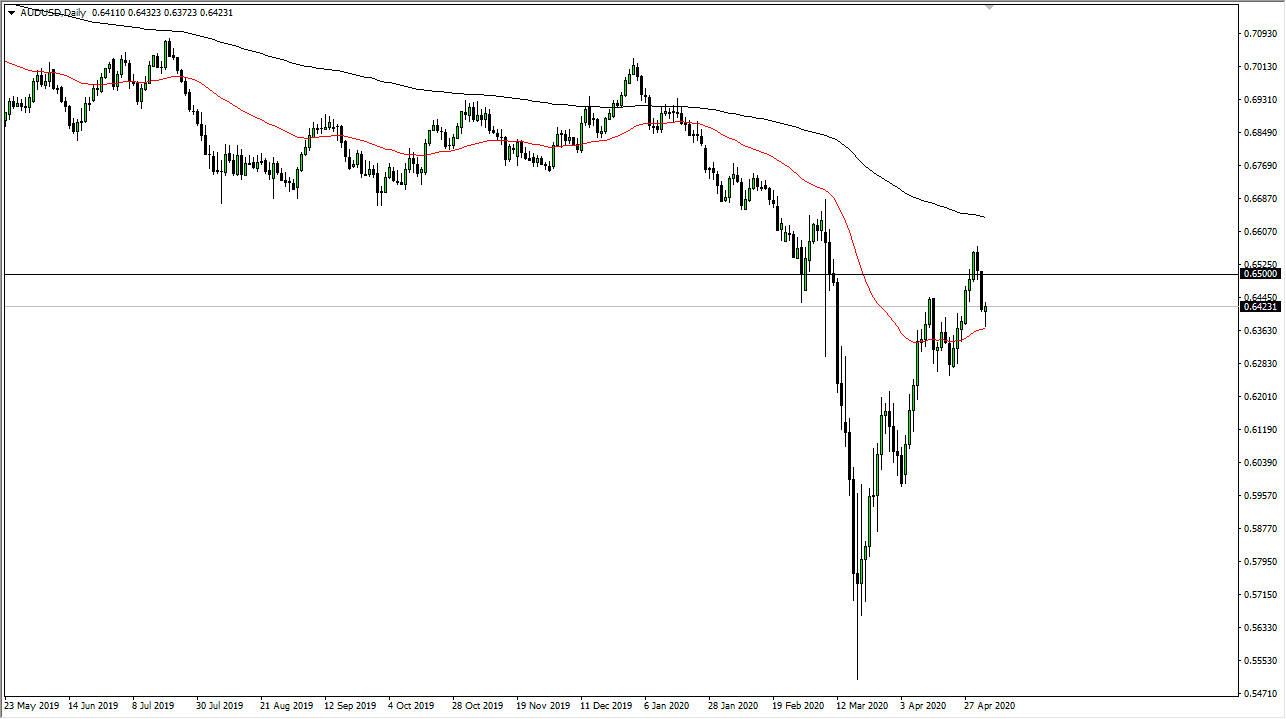

The Australian dollar has initially fallen during the trading session on Monday, breaking towards the 50 day EMA before bouncing a bit. By the end of the day, we ended up forming a bit of a hammer, which of course is a very bullish sign. At this point, if the market breaks above the top of the candlestick it is likely that we go looking towards the large, round, psychologically significant figure in the form of the 0.65 level. At this point, the market is highly likely to see a lot of exhaustion in that area, as we have recently. Furthermore, the Australian dollar suffers at the hands of the risk appetite of traders around the world.

The Chinese economy has been crumbling, as demand around the world for Chinese products or any other products for that matter, has absolute fallen apart. As the economies have been shut down, it makes sense that we will continue to see a lot of negativity in general, as demand will collapse. If nobody’s working, they are buying things. Granted, economies around the world are starting to open up a bit, but we are a long way away from as long as that is going to be the case, it seems very unlikely that the risk attitude of traders around the world is suddenly going to take off. That does not mean we will not get the occasional pop higher, but ultimately, I do think that we are eventually going to see gravity take hold of the market. On the other hand, we could also break down below the hammer, which would open up the market to further selling pressure. Ultimately, breaking down below there also crushes the 50 day EMA and then gets the market looking towards the previous bullish flag. However, there is also an alternate scenario.

If the market was to turn around a break above the 0.65 handle, then it is likely that we could go to the 0.67 handle next, which is the 200 day EMA. If we can break above the 200 day EMA, then the market is ready to go much higher, and we will have completely wiped out the massive selling pressure that sent the market down so low. That of course would be extraordinarily bullish and may change the overall long-term uptrend, but the market has a lot of work to do in order to be able to make that happen. To the downside, it is likely that the market goes to the 0.6250 level.