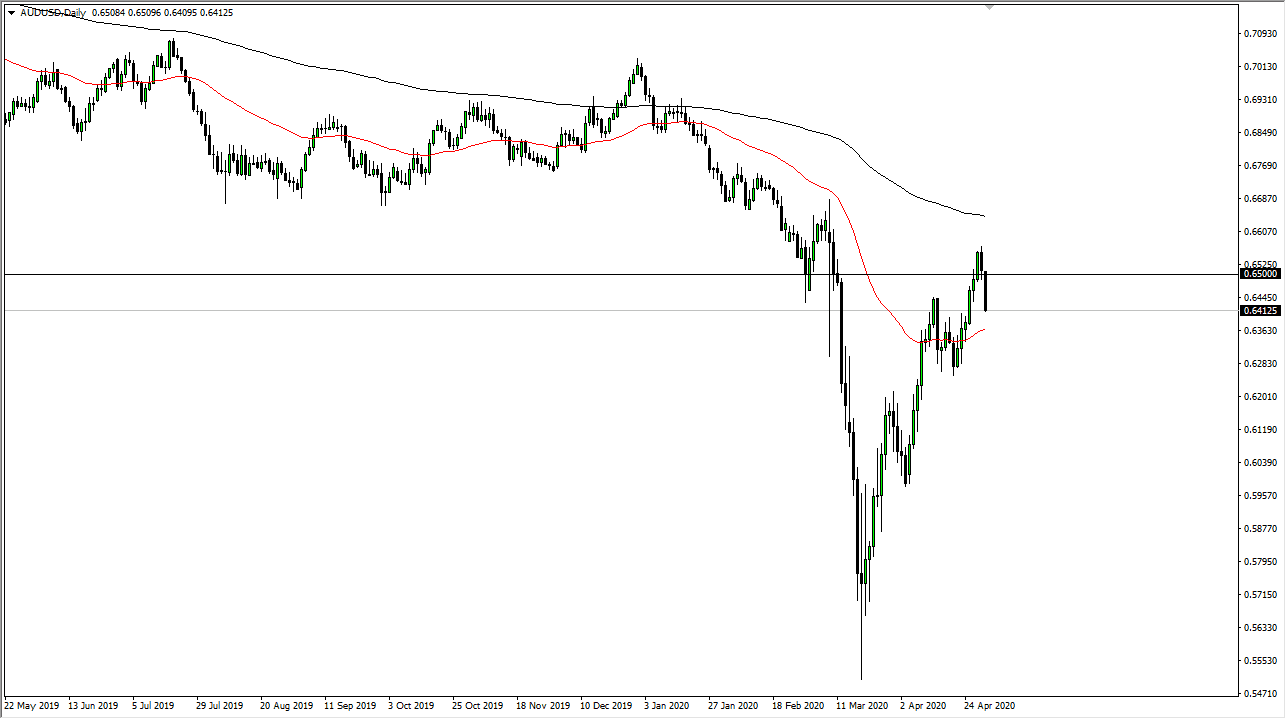

The Australian dollar broke down significantly during the trading session on Friday, as we broke down below the 0.65 handle. At this point in time, it is likely that we will continue to see a reach towards the 50 day EMA. This is of course is a scenario where we see a lot of bullish pressure recently, but sooner or later we need to see this market give up some of the overextension in order to find any sustainable rally. The 0.65 level is of course a large, round, psychologically significant figure so it makes sense that we would pull back from there. Furthermore, we had broken down below that level and it looks like we are going to see this market try to find the next support level which I believe is closer to the 0.63 area.

The Australian dollar of course has been a favorite of currency traders as of late, as Australia has suffered less in the way of coronavirus infections and many other places, and when you look at currency flows it seems that traders are betting on economies that seem to be doing a little bit better in the virus count than other ones.

Ultimately, the Australian dollar is highly levered to the Chinese economy and the global economy as the we continue to see demand drop. The Australian economy is based around supplying the Chinese with raw materials such as iron, aluminum, and copper. If there is no demand for things, then it makes sense that there would be no demand for the things to build those things. This will rip through the Australian economy eventually, and while we have seen a nice rally as of late, the longer-term chart still points decidedly to the lower right, meaning that it is likely that we continue to see more bearish pressure, at least in the short term. If we break down below the 0.63 handle, I think it is highly likely we eventually go looking towards the 0.60 level underneath. The alternate scenario of course is that we turn around and make a fresh, new high, but then we need to worry about the 200 day EMA which of course is a major technical signal. Clearing that level changes the trend completely. That seems to be a bit of a stretch in the current economic conditions, but I am the first to admit that the way the Australian dollar has acted did not seem likely incorrect economic conditions.