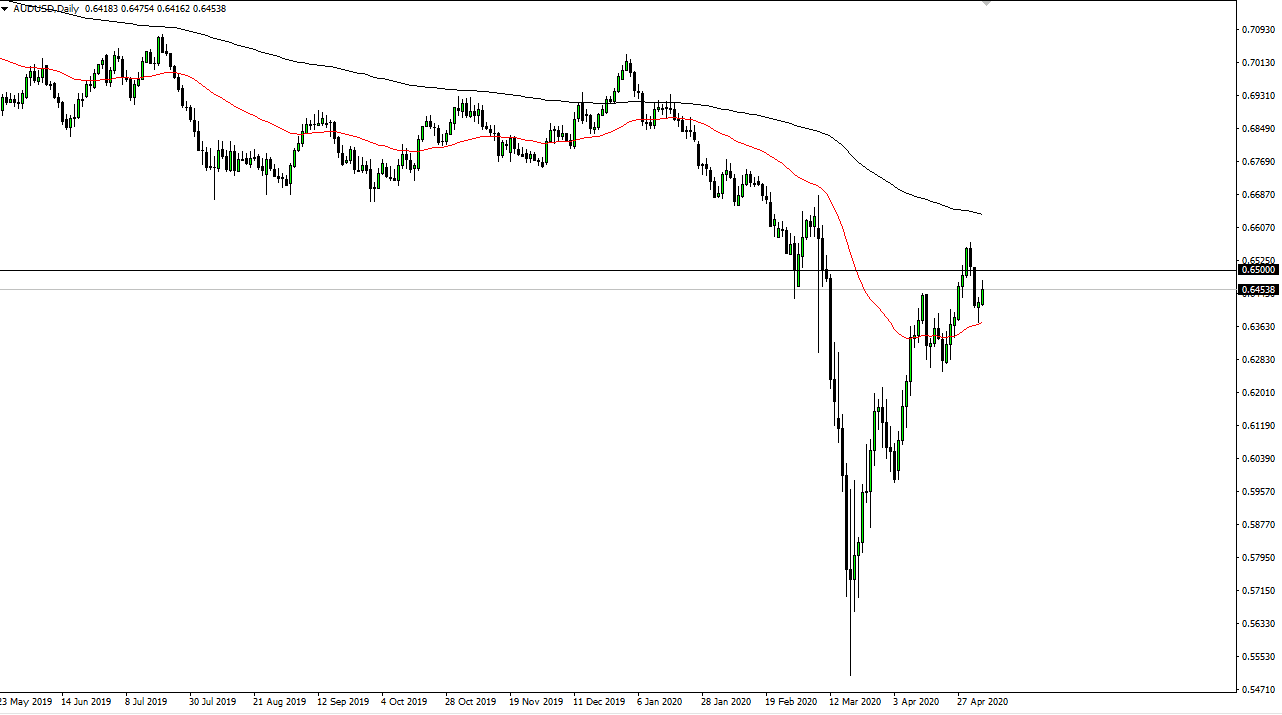

The Australian dollar rallied a bit during the trading session on Tuesday, reaching towards the 0.65 level above. That is a major resistance barrier, so I do think it is only a matter of time before the sellers come in and start pushing this market lower. Ultimately, the market will more than likely continue to pay attention to risk appetite around the world, which seems to be relatively strong moment, but longer-term certainly does not look to be a good bet. After all, the Australian dollar is highly levered to the global growth situation, and as a result it is worth paying attention to the lack of demand that will continue to be a major problem.

After all, if people are not looking to buy things, there will be extraordinarily little in the way of demand for Chinese goods. If that is the case, then the Chinese will be buying Australian commodities, and therefore it will put a significant amount of pressure on the Australian economy. It should be expressed not only in the Australian stock markets, but also the Australian currency. The US dollar of course is a safety currency that people will be flocking to, especially as the bond markets continue to rally and America overall.

If the market breaks down below the hammer from the Monday session, it will not only break a significant amount of support from the short-term standpoint, but it would also break down below the 50 day EMA. If that is going to happen, it will obviously attract a lot of attention. On the other hand, the market was to break above the recent high, then we will challenge the 200 day EMA which is painted in black on the chart. The 0.67 level would be another level that people will have to pay attention to. If we do break above, there then it becomes a longer-term “buy-and-hold” type of scenario.

All that being said, the rate of change seems to be struggling, and that of course shows that we are running out of momentum to the upside. If that is going to be the case, it shows that we are forming a topping pattern, and the sellers should come in and start overwhelming relatively soon. Most of the gains the Australian dollar has enjoyed has been due to an overabundance of enthusiasm for the potential of economies opening up. That being said, the market is a bit ahead of itself as these economies are opening up very slowly.