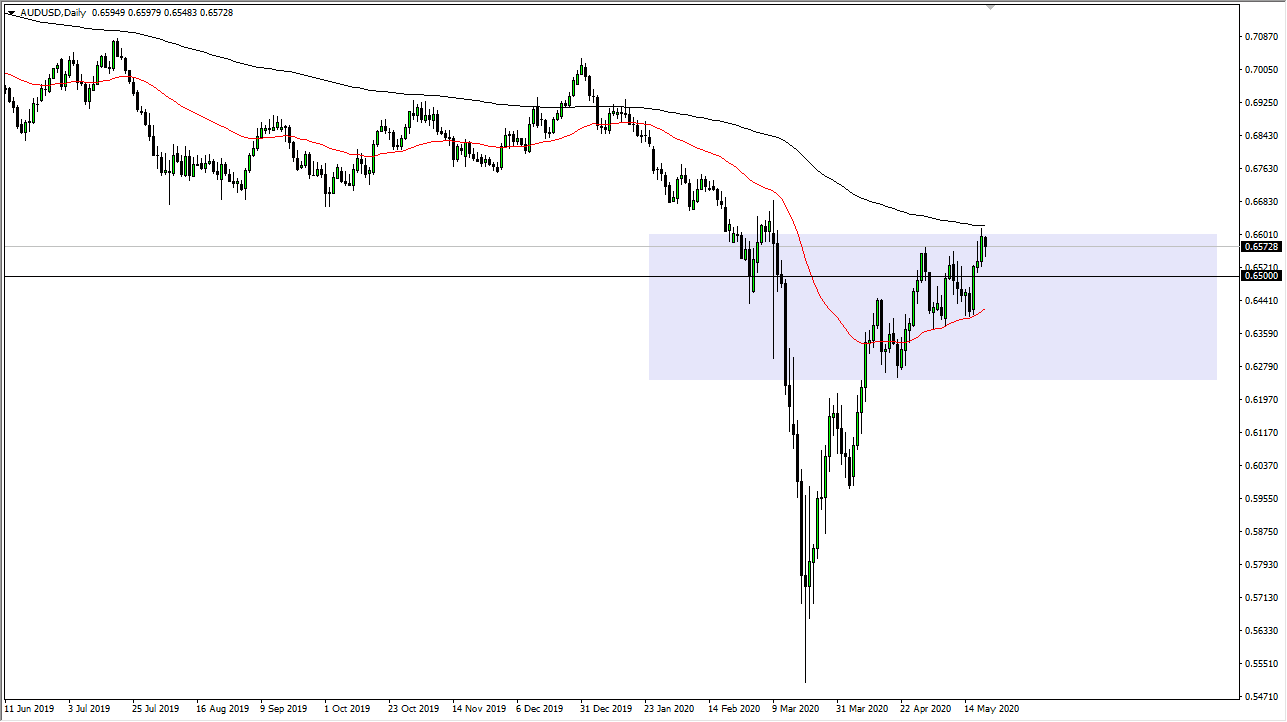

The Australian dollar has shown itself to be strong over the last couple of days, but it pulled back from the 0.66 level rather stringently. In fact, one point look like we were going to break out to the upside, but we started seen massive selling pressure and then a bit of a capitulation from the highs. At this point in time it is likely that we will continue to look at the area above as massive resistance and I think it is only a matter of time before we rollover again. Ultimately, the 0.65 level underneath could be a target, and if we can break down below there it is likely that we go much further to the downside.

To the upside, if we were to break above the 200 day EMA then it is likely that we could continue to go higher, perhaps reaching towards the 0.67 handle. That is an area that if broken above that would probably break the back of sellers. Ultimately, the market has gotten a bit of her stretched in at this point we are going to see one of two things: we are either looking at the apex of a rounded top, or we could eventually break out to the upside. That being said, we should pay attention to the fact that the Australian dollar is overly sensitive to economic movement, and it should not be lost on anyone that the Chinese just locked down 110 million people. Furthermore, there are also flaring tensions between the Aussies and the Chinese when it comes to trade, so that of course will not do any favors for the Australian economy.

If we were to break down below the 0.65 level, I think that we would see an acceleration of selling, and that could be the beginning of using this as an apex for the rounded top. If we were to break down below the 50 day EMA, it is likely that the market then goes looking towards the 0.6250 level. Ultimately, it is at the top of a “V”, so it comes down to whether or not we are truly seeing some type of major reversal in the economic conditions. At this point, this market looks over done by not only a momentum point of view, but also a simple logical point of view. At this point, I would anticipate there is much more risk to the downside than up.