The Australian dollar has pulled back a bit during the trading session on Friday, and what would have been a somewhat shortened day as a lot of the American traders would have been focused on Memorial Day than trading, so at this point it does make quite a bit of sense that the Aussie simply stopped moving once the London traders went home. Ultimately, the Aussie had gotten a bit stretched, so it is not a huge surprise to see that we have been rolling over a bit during the last 48 hours.

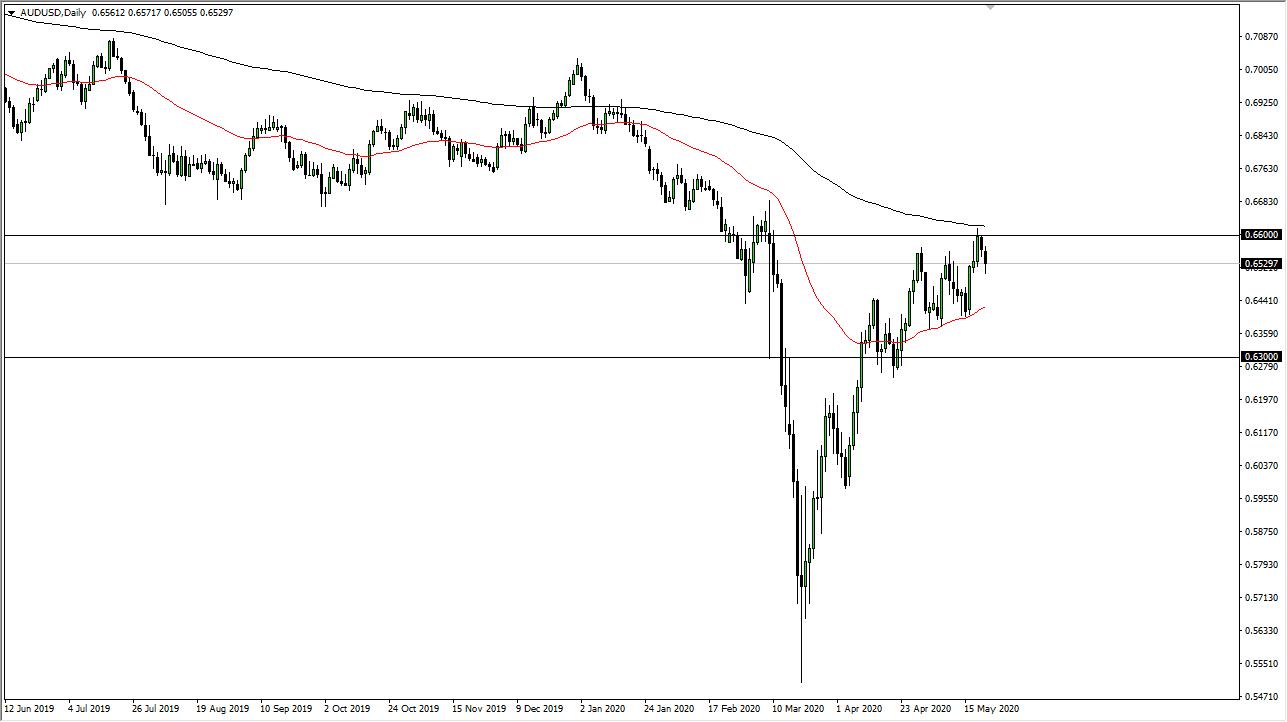

As you can see on the chart, I have a couple of lines drawn. The 0.63 level is an area that I think starts a significant support region, just as the 0.66 level above is significant resistance. The 200 day EMA above that level offers a lot of resistance as well, so having said that it makes quite a bit of sense that we are essentially stuck in this range. As we are closer to the top of the range, if we can break down below the bottom of the candlestick for the Friday session it is likely that we go looking towards the 50 day EMA. In that general vicinity I would expect buyers return but if we break down below there then it is more than likely that we are going to the 0.63 level underneath.

The Australian dollar has a lot of things pushing and pulling on it at the same time, not the least of which is going to be the global economy looking shaky at best. Remember, Australia is highly levered to commodities so if the economy is slowing down that is typically something that works against commodities in general. I believe at this point economic reality is starting to become an issue, and therefore I am on the lookout for a potential “rounded top” forming in this currency pair. On the other hand, if we get a daily close above the 0.67 level it becomes almost certain that we will go looking towards the 0.70 level, possibly even higher than that. As we go into the weekend, one has to be leery of any potential news as the US/China trade situation continues to be deteriorating. If that is going to be the case, that is going to have a direct effect on the Australian dollar.