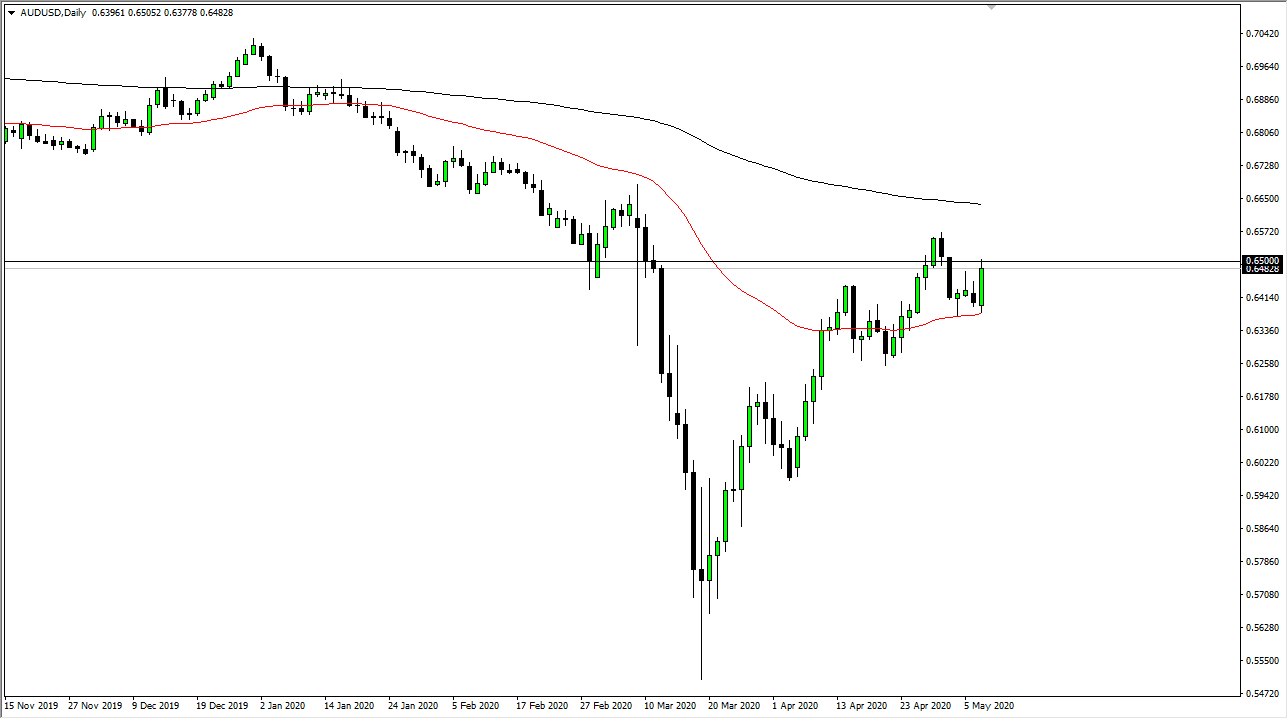

The Australian dollar has rallied rather significantly during the trading session on Thursday after initially dropping down towards the 50 day EMA. By finding support there, it had the ability to turn around and rally, reaching towards the 0.65 handle above. That of course is a large, round, psychologically significant figure, one of the main reasons that we had seen the Aussie gains so much against the greenback is that the Fed Funds Futures rate for December 2020 went negative during the day, which of course is extremely negative for a currency.

Looking at this chart, there is still a bit of a reaction just above so I think at this point what we are probably going to be best served by doing is waiting to form some type of exhaustive candlestick that we can get involved in. The pair is extremely sensitive to risk appetite around the world, but one of the things that has helped propel the Australian dollar higher is that the Australian economy has been less impacted by the coronavirus than many others. This makes sense, because it is much easier to defend a population that is on an island that it is a major continent. Because of this, the Aussie has gotten a bit of a bid over the last couple of months.

That being said, I still think it is only a matter of time before we rollover so between here and the 200 day EMA I should get a candlestick that screams “sell this market.” Once I get that candlestick, perhaps something along the lines of a shooting star, I am more than willing to short this market because the risk to reward ratio is so good. The 200 day EMA above is massive resistance, so if we were to break above there then I think the market could take off to the upside for a much larger move that could run multiple years. At this point, it is more of a “buy-and-hold” type of situation as it could be a major trend forming. Overall, though, this is a market that I think needs to answer several large questions in the near term, and the Friday job summer may very well be yet another catalyst to start trading this pair. I still believe that there is the possibility of falling from here, but clearly the Thursday candlestick was a shot across the bow so to speak.