According to a new analysis conducted by the Australian Treasury, the Covid-19 related lockdown is costing the economy A$4 billion per week, with the second-quarter anticipated to eradicate A$50 billion. The Morrison government is under pressure to ease measures implemented to contain the pandemic, as an estimated 700,000 Australians are set to lose their employment. While they were successful in flattening the curve, keeping infections and death rates comparably low, the economic costs are now being questioned. The diplomatic row with China is adding to downside pressure on the Australian Dollar, and clouding the long-term outlook. With bullish momentum absent in the AUD/SGD, more selling is expected to result in an extended breakdown sequence.

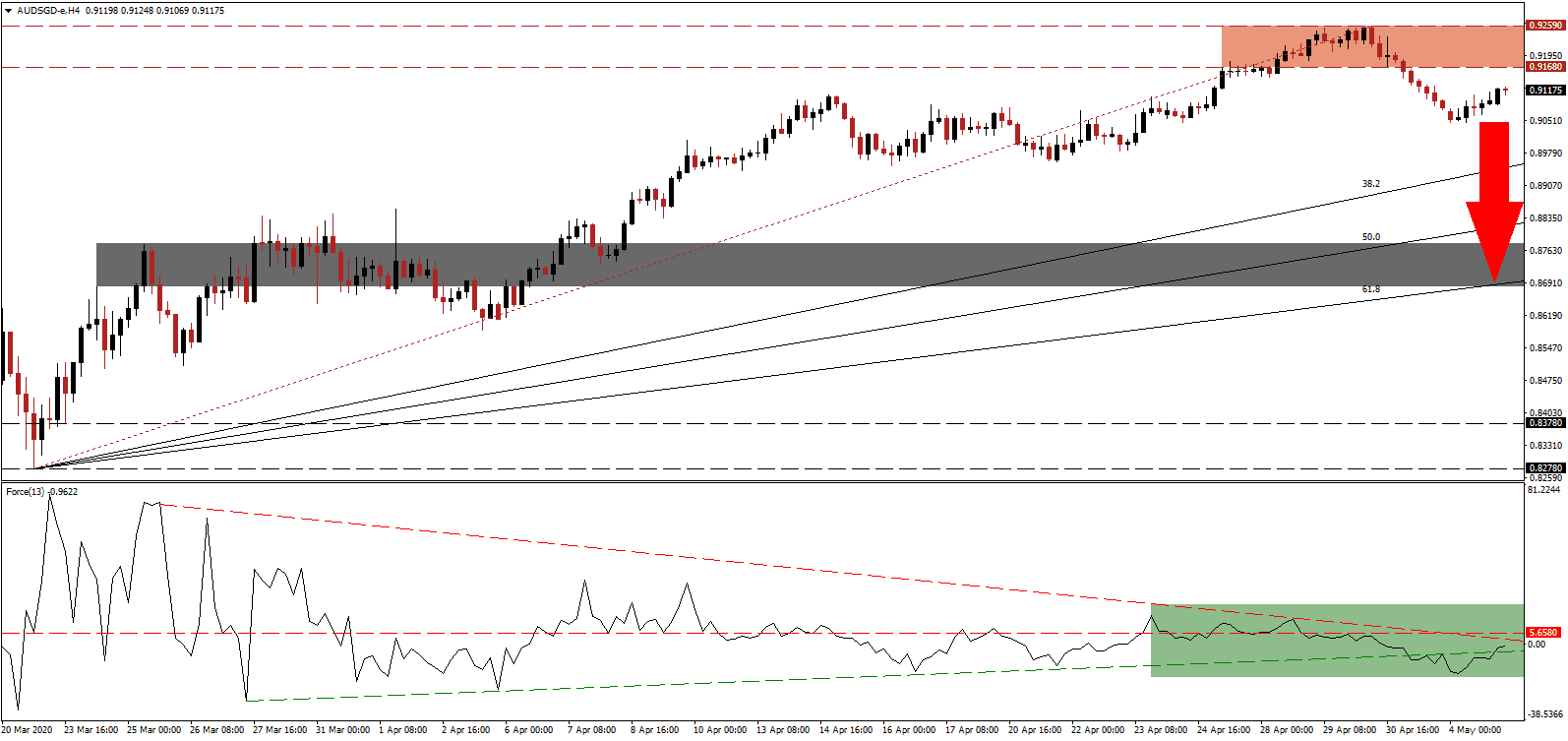

The Force Index, a next-generation technical indicator, reversed the breakdown below its ascending support level as this currency pair recovered from its lows. It remains below its horizontal resistance level, with increased downside pressure provided the descending resistance level, as marked by the green rectangle. This technical indicator is favored to slide deeper into negative territory, as bears are in full control of the AUD/SGD. You can learn more about the Force Index here.

Questions on how to rebuild the Australian economy remain, as permanent adjustments are expected. One social advocacy group seeks an A$$7 billion government plan to build affordable housing for 30,000 families. Infrastructure programs can provide a short-term boost to economic activity, but a long-term approach is equally required. Uncertainty added to the collapse in the AUD/SGD below its resistance zone located between 0.9168 and 0.9259, as marked by the red rectangle.

Singapore is faced with mounting pressures and is looking into a different economic set-up following a deep recession. The island-nation will allow sectors vital to the global supply chain to resume activities first, which include precision manufacturing, biopharmaceuticals, and petrochemicals. Singapore is in a more stable fiscal position that Australia, adding a distinct bearish bias to the AUD/SGD, which is likely to accelerate into its short-term support zone located between 0.8681 and 0.8777, as identified by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level is additionally enforcing this zone.

AUD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.9115

Take Profit @ 0.8685

Stop Loss @ 0.9185

Downside Potential: 430 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 6.14

In case the Force Index completed a double breakout, taking it above its descending resistance level, the AUD/SGD may attempt to push higher. Short-term fundamental developments suggest more downside in this currency pair, coupled with an uncertain long-term outlook. Forex traders are, therefore, recommended to consider any price spike as a second short-selling opportunity. The next resistance zone is located between 0.9342 and 0.9365.

AUD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.9235

Take Profit @ 0.9355

Stop Loss @ 0.9185

Upside Potential: 120 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.40