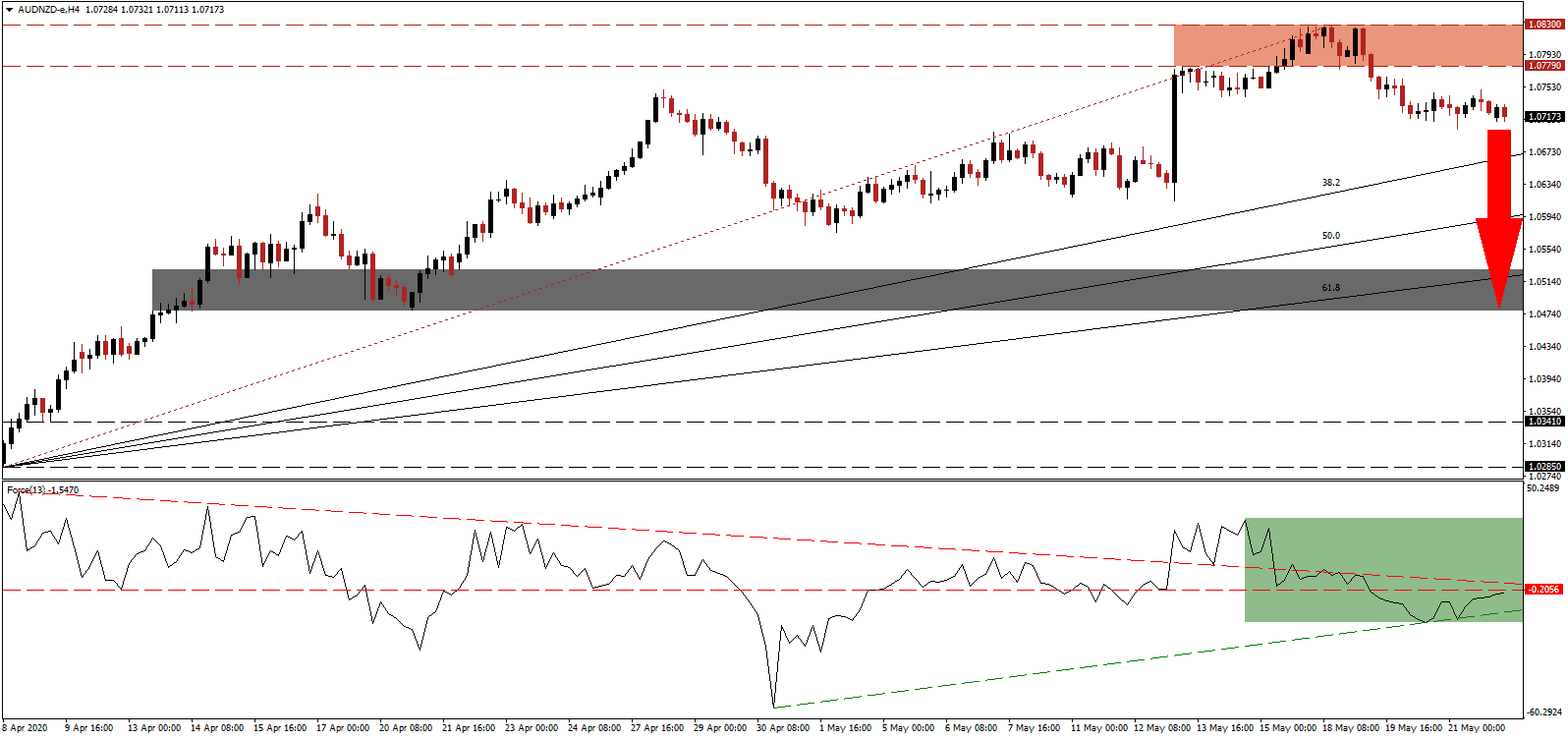

After China applied an 80% tariff on Australian barley imports over the next five years, citing anti-dumping practices, and barring certain beef imports, the General Administration of Customs announced new import rules in Australian iron ore. It threatens to disrupt the A$63 billion annualized export market. Chinese tourists and students voiced to boycott Australia, which decided to spearhead an independent investigation into China, where the Covid-19 virus was initially reported. Australia’s economy cannot afford a trade war with its primary trading partner, especially not with a pending double-digit recession. The AUD/NZD completed a breakdown below its resistance zone, from where more selling is favored.

The Force Index, a next-generation technical indicator, swiftly corrected from its most recent peak and collapsed below its descending resistance level. It was able to drift higher, allowing for an ascending support level to be formed, as visible in the green rectangle, but remains below its horizontal resistance level. This technical indicator is in negative territory, pending a renewed push to the downside, while bears are in complete control of the AUD/NZD.

China is believed to have the Covid-19 pandemic under control after implementing rigorous lockdown measures, shutting down entire regions. Patients who tested positive were quarantined, and 14 hospitals were erected in a matter of weeks. New infections have decreased over the past two months, often into single digits and imported. While the rest of the world entered nationwide lockdowns, the delayed response resulted in a significantly worse outcome. Australia and New Zealand successfully contained the spread, but the former's insistence of conflict may allow the latter to reap the rewards. It creates a distinct bearish catalyst in the AUD/NZD following the breakdown below its resistance zone located between 1.0779 and 1.0830, as marked by the red rectangle.

New Zealand lacks a viable long-term plan for a sustained economic recovery, and with borders anticipated to remain closed, it will rely heavily on food exports. China banned certain beef imports from Australia, with other food sources on a reported hit-list. New Zealand is in a position to increase market share but needs to consider its vital relationship with Australia. Despite the uncertainty, price action is well-positioned to correct below its ascending 38.2 Fibonacci Retracement Fan Support Level. The corrective phase in the AUD/NZD is poised to gather downside momentum until it will challenge its short-tern support zone located between 1.0477 and 1.0528, as identified by the grey rectangle.

AUD/NZD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.0720

Take Profit @ 1.0480

Stop Loss @ 1.0800

Downside Potential: 240 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 3.00

In case the Force Index reverses above its descending resistance level, the AUD/NZD is likely to feel upside pressure. Given the deteriorating relationship between Australia and China, the short-to-medium-term outlook remains bearish. Forex traders are, therefore, advised to consider any breakout attempt as an excellent selling opportunity. The next resistance zone awaits price action between 1.0960 and 1.0993.

AUD/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.0850

Take Profit @ 1.0970

Stop Loss @ 1.0800

Upside Potential: 120 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.40