As I mentioned before, I now confirm that the USD/JPY pair remains in a fierce struggle between safe havens since the beginning of the Coronavirus crisis, and its threat to the future of the global economy. What confirms this description is the stability of the pair in limited ranges, despite the strong changes in financial markets and global events, amid a downward trend of stability below the 108.00 support. Since the beginning of trading this week, the pair has been moving in the range between 107.94 and the 107.27 support, and is settling around 107.76 at the beginning of Wednesday’s trading. The pair will remain in the observer position of the US economy returning to activity amid health fears of the fiercest wave of a Coronavirus spread, as people begin to take to the streets, factories and companies, even gradually, as the Trump administration wants.

Some American companies are taking the first steps towards getting their employees back to work. It is easier said than done. In negotiations with the Automobile Workers Union in the US states, automakers offer to provide protective equipment, frequently sterilize equipment, and measure workers' temperatures to prevent anyone with fever from entering factories. They say that these steps were taken in medical equipment factories that went back to work.

Amid a near-general tendency for US states to open up economic activity. Health officials fear that such moves, if not carefully planned, could fuel a second wave of COVID-19 infection. Amazon said is developing an internal laboratory that can provide coronavirus tests to all employees, even those without symptoms. Many tech companies have adopted stay home policies at the start of the crisis, with most of their workers able to do their jobs remotely. Facebook allowed the vast majority of its employees to continue working from home until at least the end of May.

On the economic side. Existing US home sales fell 8.5% in March as real estate activity stalled due to coronavirus outbreak. The National Association of Realtors said on Tuesday that 5.27 million homes were sold last month, down from 5.76 million homes in February. The decline was the steepest since November 2015. Experts in this sector believe the situation is likely to get worse. Home purchases were flat in the first half of March due to lower mortgage rates and termination of contracts signed in previous months, and the crash came in response to a possible economic recession from the COVID-19 epidemic. Companies and schools have closed and millions of Americans have lost their jobs.

Sales in March were still 0.8% higher than last year, when mortgage rates were higher than now. The US real estate market was already facing pressure from a lack of sales listings and prices that rose faster than incomes, a group of related problems that intensified last month.

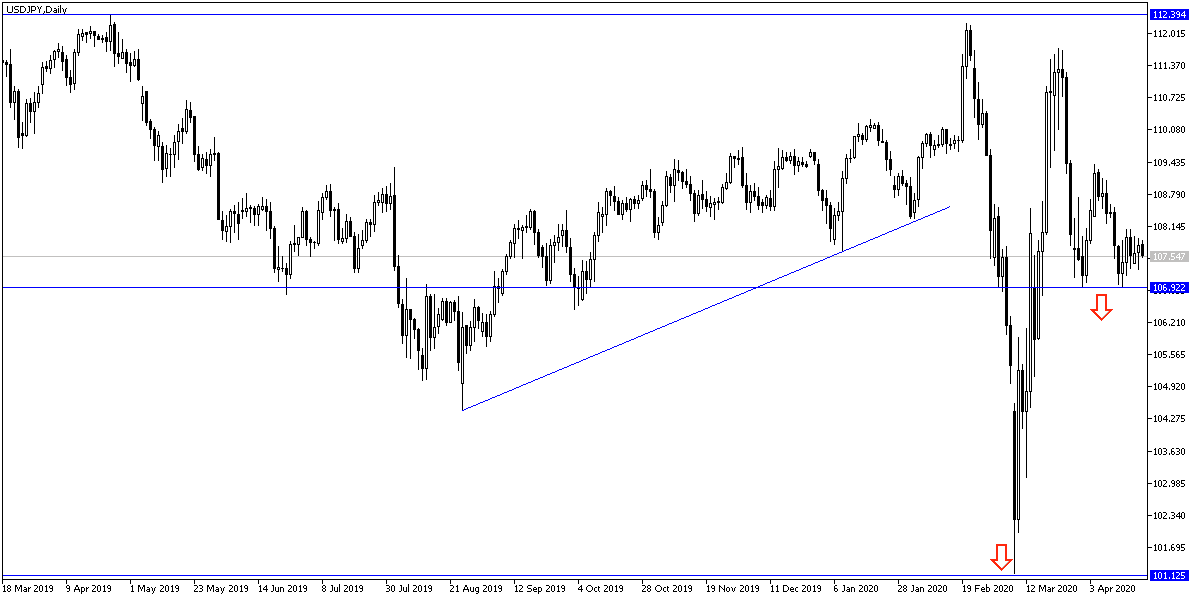

According to technical analysis of the pair: On the daily chart, it appears clear that the USD/JPY is stable in a limited range for several sessions, which implies a strong movement coming in one of the two directions, which is the closest to the continuation of the decline as long as it remains stable below the 108.00 support and the closest support levels for the pair are currently 107.55 and 106.80 and 105.90 respectively. And there will be no chance for an upward correction without moving above the 110.00 psychological resistance. The struggle of safe assets may ultimately be in the interest of the US dollar.

Today, the pair is not expecting any important economic data, whether from Japan or the United States of America.