As an introduction to the details of the US Labor Department figures on Friday, investors and markets’ attention will be paid to the announcement of the ADP survey reading of US jobs in the non-agricultural sector. Tomorrow, attention will be paid to announcing the number of weekly jobless claims, amid expectations that the data will provide historical figures on the negative side due to strict closings in the major US states to contain the rapid spread of the Corona virus, as the United States became the largest in the number of corona virus cases, as it is the largest economy in the world. Therefore, the USD/JPY pair did not find the support necessary to complete its bullish correction, as gains did not exceed the 108.72 level before the decline and stability around the 107.48 level at the beginning of Wednesday's trading.

For economic news. American consumer confidence fell this month to its lowest level in nearly three years as the effect of coronavirus on the economy began to get more pessimistic. The confidence index fell to a reading of 120 in March from 132.6 in February. It was the lowest reading since the index was at 117.3 in June 2017. All the sub-indices that cover consumers' perception of current business and labor market conditions and another sub-index covering the future conditions have decreased. The sharp drop in the index this month reflected growing concerns about coronavirus during the survey period from 1-18 March. And confidence is sure to decrease further because the impact of the virus has a greater impact on the economy.

Analysts believe that the sharp decline in the confidence index reflects increasing concerns about the harm Covid-19 will cause and the sharp declines in stock markets in the recent period.

Commenting on the results, Cathy Postganchek, the chief US financial economist at Oxford Economics, said that the March drop, despite its steep decline, still reduces damage to confidence because the large increase in layoffs began only after the survey was completed in mid-March.

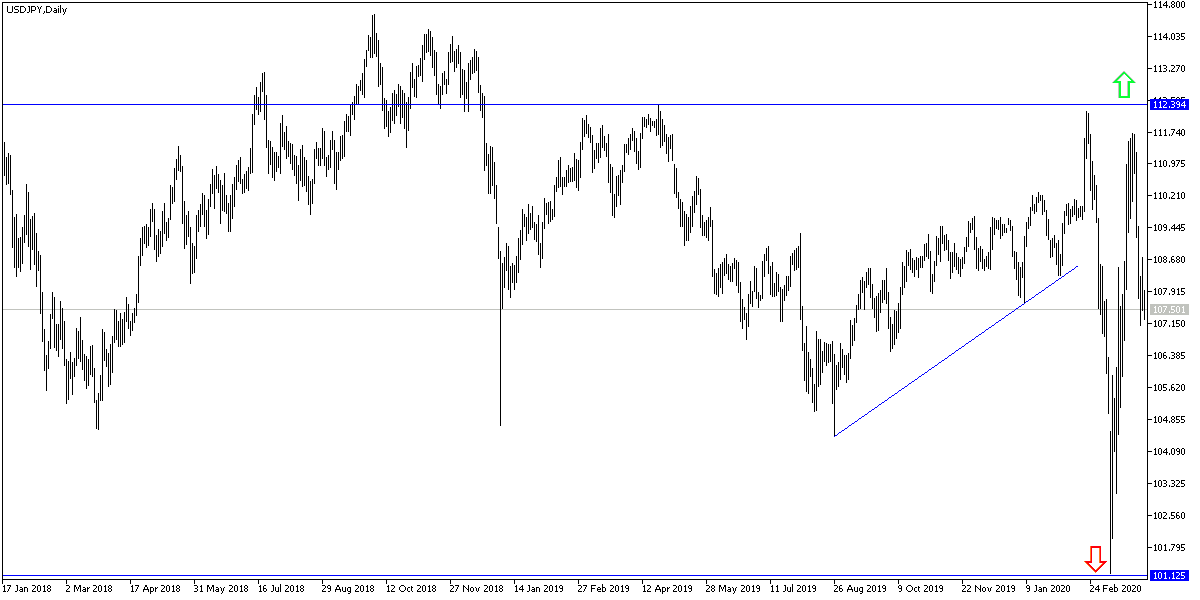

According to the technical analysis of the pair: As I mentioned before, the stability of USD/JPY below the 110.00 level will support more sales and will increase the bear's control over the performance if it moves below the 108.00 psychological support, as is the case now. The financial markets are still witnessing a strong fluctuation in performance with the continued global human and economic losses from the Corona pandemic, which will be a catalyst for the Japanese yen as a safe haven. The nearest support levels for the pair are now at 106.90 and 105.80 respectively, and the last level is good for the return of buying.

For the economic calendar data: From Japan the TANKAN Industrial Survey will be announced. From the United States, ADP change in the numbers of non-agricultural jobs and the ISM Manufacturing PMI data will be released.