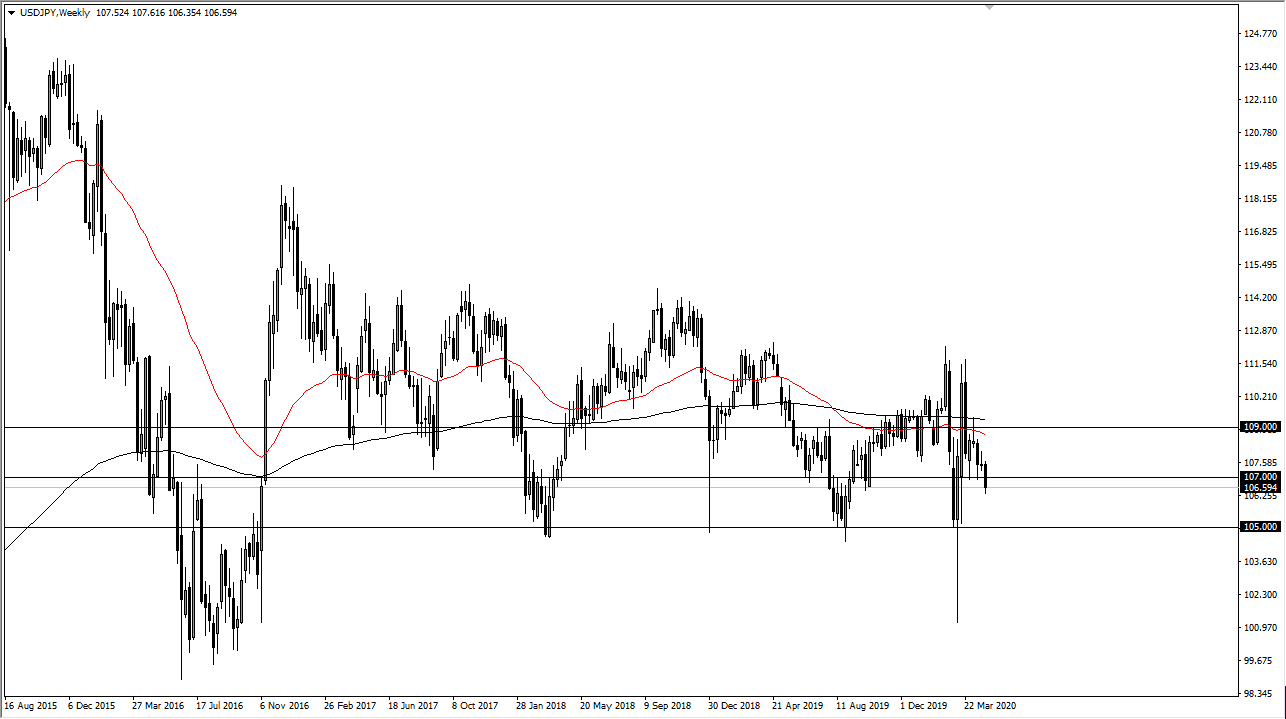

The US dollar has spent most of the month of April grinding lower against the Japanese yen, clearing the crucial ¥107 level, an area that had been massive support previously. Because of this, it looks as if the pair is likely to continue going lower, perhaps reaching down to the ¥105 level, an area that has been rather supportive in the past. With that in mind, I believe that this is a market that continues to offer selling opportunities on short-term rallies, especially as the Federal Reserve is becoming so loose with its monetary policy. Ultimately, this is a market that is trying to figure out what to do with the Federal Reserve liquefying the markets, and of course risk appetite around the world. That is what makes this pair a bit difficult to trade at times, because both of these are considered to be “safety currency.”

I do believe that we are going to continue to rollover, but I think it is going to be a very noisy in difficult month to say the least. If that is going to be the case, then you can expect a lot of volatility based upon headlines and of course anything involving the coronavirus. Economies around the world are locked down at the moment and it is difficult to imagine that either one of these currencies are going to be able to deal with that type of volatility easily. Furthermore, both banks are very loose with monetary policy as we are in a global currency war, a huge “race to the bottom” when it comes to the valuation of currency.

The ¥105 level should be rather supportive, but if we were to break down below there this pair could find itself reaching towards the ¥101 level rather quickly. Once we get closer to the ¥100 level, the Bank of Japan is likely to get involved in one form or another. The Japanese do not like the yen being overly expensive, as it hurts the exports coming out of that country. That is their mantra in normal times, and it most certainly will be on steroids as the world worries about the global economy locking up. A break above the ¥107.50 level could have this market looking towards ¥109 level, but that seems to be a lot less likely now that we are broken through the previous support barrier.