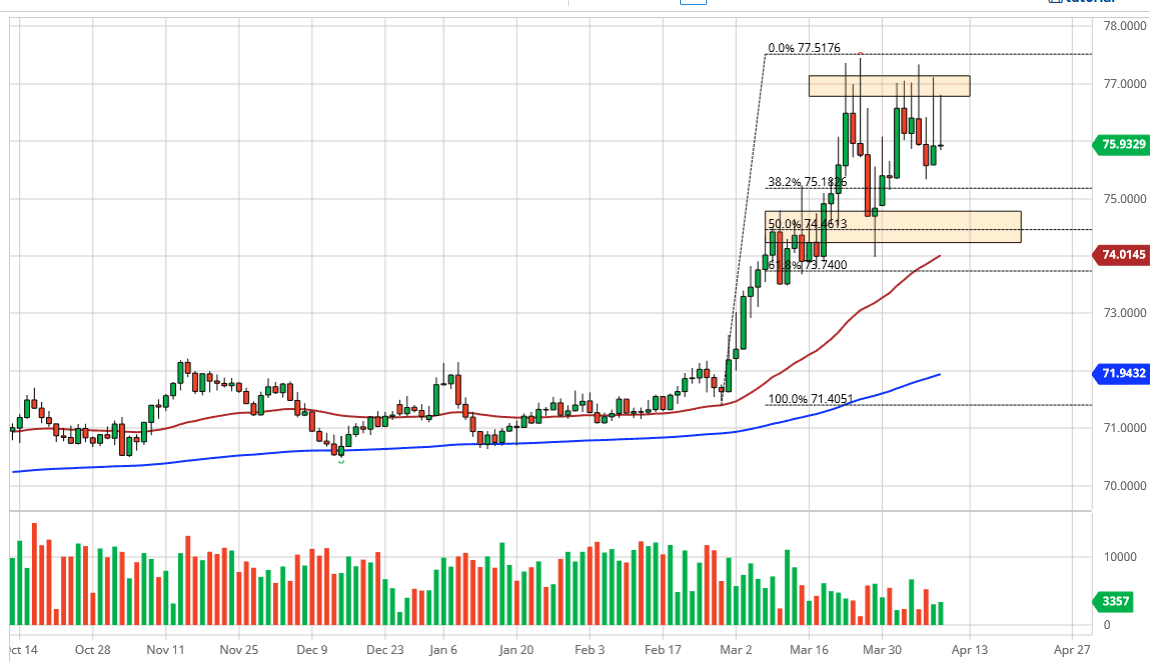

The US dollar initially tried to rally during the trading session on Thursday, reaching all the way towards the ₹77 level again, before pulling back yet again during the day. This shows signs of extreme weakness near the ₹77 level, and it makes sense considering that the level has been so resilient over the last couple of weeks. This is the top of a major consolidation area, but we have formed a shooting star for the second day in a row, and this of course is people thinking that perhaps the momentum may be starting to rollover. That being said, the Federal Reserve helped quite a bit during the day as they have announced a massive stimulus package that is well over $2 trillion.

Because of this, the US dollar got hit a bit, but India is probably not the place this is going to run to. That being said, even though the candlestick is relatively negative for the Thursday session, I suspect that we are simply going to bounce around in the same consolidation that we have been for some time, meaning that the ₹74.50 level is more than likely going to offer quite a bit of support. Furthermore, the 50 day EMA is starting to approach that level and therefore I think a lot of people will be paying attention to it. Because of this, a pullback from here may offer a nice buying opportunity to take advantage of value in the US dollar when it comes to not only the Indian rupee, but the possible other emerging market currencies as well. After all, the emerging markets around the world will certainly be hit by the global slowdown and India won’t be any different. In fact, India is essentially in a complete lockdown at this point.

All things being equal, I do believe that there is still longer-term demand for the US dollar, due to the massive amount of debts in emerging markets that are dollar based. Furthermore, although the US dollar may be slightly weaker against some of the other major currencies, it’s very difficult to imagine that players move into emerging markets as a result. At this point, you should be looking for value in the greenback, not necessarily against every currency, but clearly the Indian rupee is also going to suffer right along with other currency such as the South African Rand, Hungarian foreign, etc.