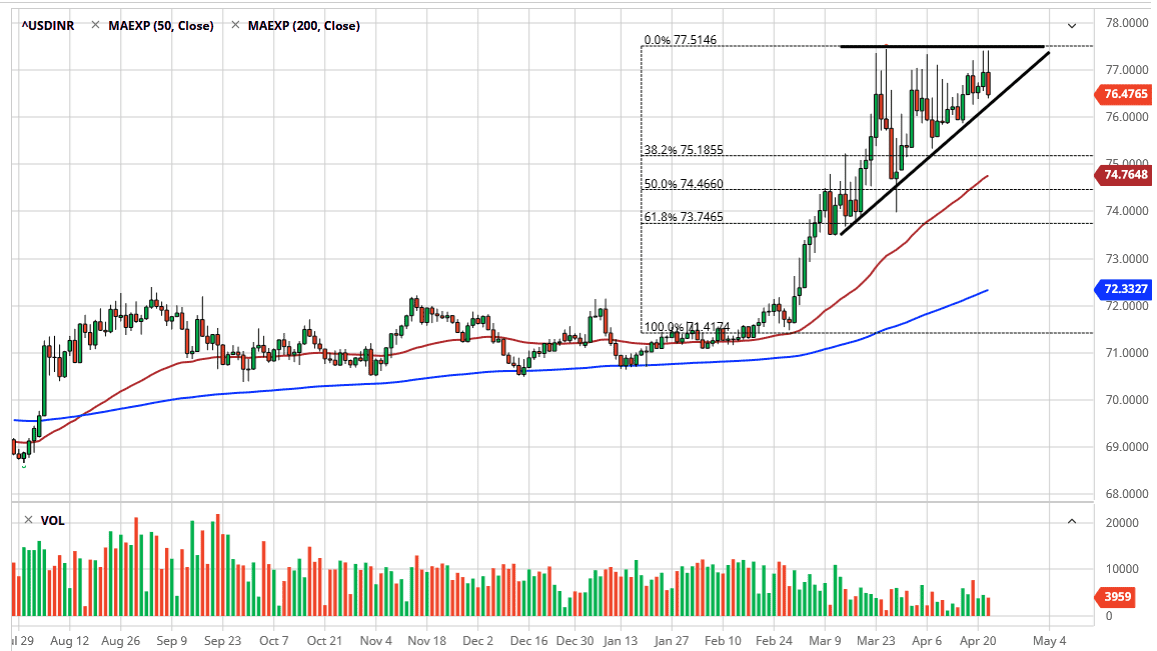

The US dollar initially tried to rally during the trading session on Wednesday but continues to find a bit of resistance near the ₹77.50 level. At this point, the market is highly likely to continue to see sellers in that area, but it is hard not to notice that the uptrend line is very much intact and there should be plenty of buyers underneath. At this point, the market is likely to continue to see finding buyers underneath. This is a bullish ascending triangle, so at this point it’s very likely that the market is going to continue to go higher over the longer term, not only due to the technical analysis, but there is a whole slew of reasons on the fundamental side that should drive this market higher.

While the candlestick of the last couple of days has shown to be negative, the reality is that there are a lot of supportive areas underneath, not the least of which would be the uptrend line, but also the ₹76 level. At this point, the 50 day EMA starts to come into the picture just below at the ₹75 level, and of course we have been in a very bullish trend. The US dollar continues to be one of the strongest currencies in the world and quite frankly emerging market currencies are not the place you want to be.

At this point, there should be a lot of buying pressure if we make it down to that area. That being said though, India is under massive lockdown and will continue to be for quite some time. With the coronavirus ripping through the global economy, this of course will hurt India in and of itself. There are massive concerns when it comes to emerging market debts, which are denominated in US dollars, so at this point there will still be quite a bit of demand for the US dollar. I believe that if we do break down below the uptrend line, then it is possible that we go down to the ₹75 level but at that point I would anticipate that there should be a lot of interest in picking up the greenback. I have no interest in shorting this market, I believe you are either going to be able to buy in this area, or on a slight pullback of a couple of handles. If we break above the ₹77.50 level, then the market is likely to go looking towards the ₹78 level, followed by the ₹80 level.