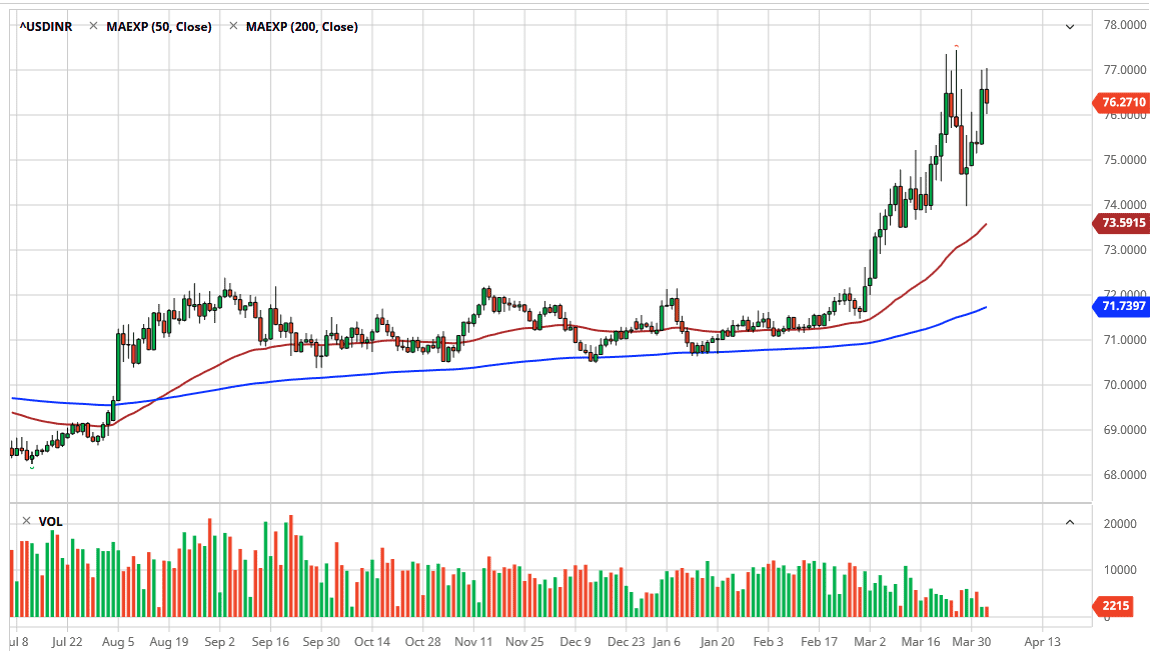

The USD/INR currency pair is one that does tend to trend for very long moves. We have recently seen the US dollar rally significantly towards the ₹77 level, as the market has been much like many other around the world, with emerging markets suffering at the hands of a major dollar shortage. After all, most emerging market debt is issued in US dollars, which were extraordinarily cheap a few years ago. Obviously, the situation has changed quite drastically for the world economy, and therefore it makes sense that the rupee would suffer right along with some of the other exotic currencies.

From a technical analysis standpoint, it does look like the ₹77 level is going to be significant resistance. After all, we have tried to break above it several times recently, but one would have to think that it’s only a matter of time before the pressure gives way and start sending this market to much higher levels. A break above the ₹77 level opens up the door to the ₹80 level, but in the short term we may get a pull back.

Looking at this chart, it’s obvious that the ₹74 level is significant support, and it appears that the 50 day EMA is ready to cross that level. There is also the psychologically important ₹75 level, so one would have to think that somewhere in that general range would be a significant amount of interest in going long. I would be interested in buying this pair on a pullback to that area, but I also recognize that a break above the ₹77 level, especially on a daily close could send this market much higher. With the jobs number coming out on Friday, it’s very likely that we will see a lot of volatility, especially in these emerging market currencies. We already know that the US employment situation is rapidly getting worse, as the economy is essentially locked down. Having said that, the Indian economy is as well and as a general rule people will prefer to have the greenback over the rupee in these types of situations. A pullback at this point simply offers a nice buying opportunity for those looking to find value. That being said, if we were to break down below the 50 day EMA, it’s likely that the US dollar will go looking towards the 200 day EMA against the rupee, but that’s a longer-term possibility. A simple matter of patience should give a nice buying opportunity.