The US dollar got crushed during the trading session on Wednesday, breaking through the 76 Rupee level as the Federal Reserve has reiterated their desire to stimulate the economy until employment is back to where it once was essentially. In other words, we are talking about quantitative easing and monetary policy actions for the foreseeable future. This put a lot of downward pressure on the US dollar, and it of course showed itself in this market which of course is a little less liquid than some of the other major currency pairs. For example, the volume in this pair is nothing compared to what it is in the EUR/USD pair.

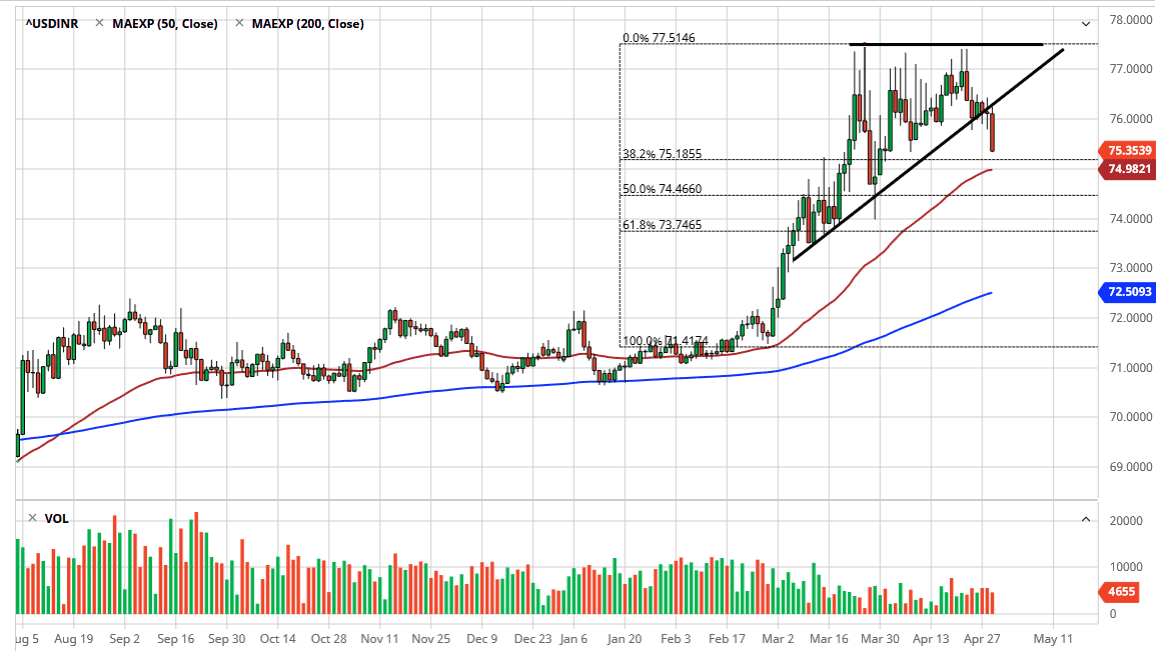

Looking at the chart, we are approaching the 75 Rupee level which will cause a certain amount of psychological support, and it should be noted that we also have the 50 day EMA coming into play just below there. In other words, if the market were to break down below that 50 day EMA, then at that point you would have a serious attempt at changing the overall trend. Do not be wrong, this move during the trading session on Wednesday was very ugly, and we are closing towards the bottom of the candlestick which gives me the idea that we could very well have some follow-through.

On the other hand, if we do see some type of support at the 50 day EMA, then it is likely that the market will go looking towards the 76 Rupee level. I do not like the idea of buying this market blindly at the 50 day EMA though, so I would need to see how the day closes before making my next trade. While I was once very bullish, Jerome Powell made it clear that there was going to be massive amounts of financial accommodation for the foreseeable future. After that kind of talk, it is not a huge surprise that the US dollar got hit. The question now is whether or not emerging markets can capitalize on that scenario. India will be one of the first places to pay attention to, so the next 24 hours will be remarkably interesting to say the least and could lead to a much bigger move given enough time. Ultimately, I believe that this is a market that will continue to see a lot of pressure to say the least.