India resists a massive fiscal stimulus, as favored in developed economies. It attempts to walk a fine line between building a bridge for the most vulnerable sectors, without sacrificing growth. Before the outbreak of Covid-19, the world’s second-most populous country was mired in years of slowing domestic demand. With the financial sector under significant stress, India’s agricultural sector may provide a much-needed economic driver, if the government implements proper procedures. The country’s food reserves are elevated, with a windfall harvest in rabi anticipated. Food security, in combination with the $22.6 billion stimuli to assist millions of daily wage earners, provided a limited window to enact more measures for a sustained recovery. The USD/INR completed its initial correction, which was followed by a bounce off of its short-term support zone.

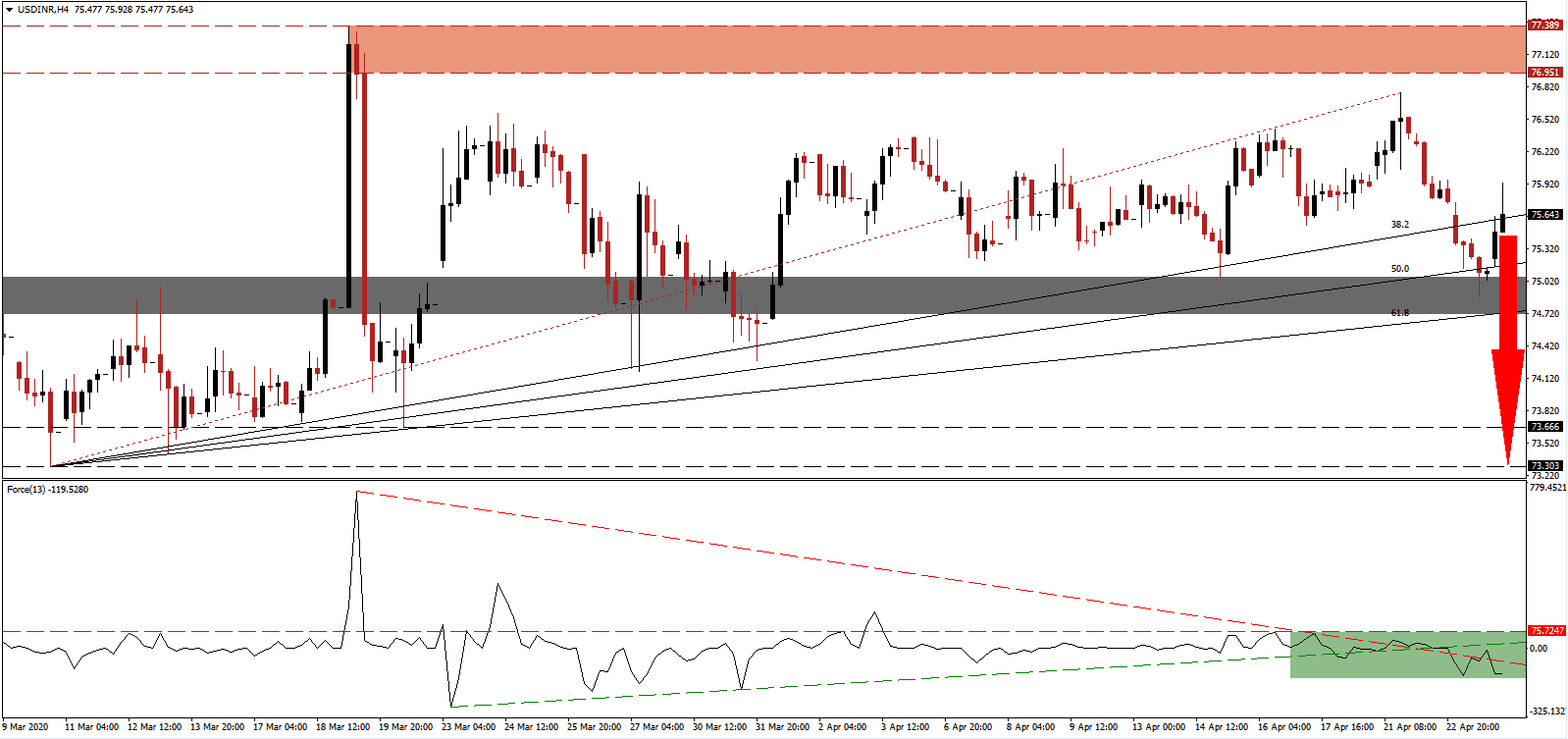

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, as marked by the green rectangle. Adding to bearish developments is the breakdown below its ascending support level. The descending resistance level is expected to push the Force Index farther to the downside. Bears took control of the USD/INR after this technical indicator corrected into negative territory, with more downside likely to follow. You can learn more about the Force Index here.

A team of Indian scientists, members of an autonomous think tank under the department of Science and Technology, are preparing a White Paper outlining a path for a sustained economic recovery. It will concentrate on domestic dominance, and reduce reliance on exports in a post-Covid-19 world. It will represent an adjustment that will conceivably be repeated by a majority of able countries. Following rejection in the USD/INR by its resistance zone located between 76.951 and 77.389, as marked by the red rectangle, the advance in this currency pair ended. Forex traders should expect a extended breakdown sequence.

After this currency pair dipped into its short-term support zone, located between 74.716 and 75.059, as identified by the grey rectangle, it recovered in a necessary step to confirm the presence of dominant bearish forces. The USD/INR briefly pierced its ascending 38.2 Fibonacci Retracement Fan Resistance Level to the upside before changing direction. A breakdown below its 50.0 Fibonacci Retracement Fan Support Level is favored to collapse price action into its long-term support zone located between 73.303 and 73.666.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 75.650

Take Profit @ 73.300

Stop Loss @ 76.050

Downside Potential: 23,500 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 5.88

In the event the Force Index accelerates above its descending resistance level and into positive territory, the USD/INR is likely to recovery into its resistance zone. Given the weaker-than-expected economic state of the US, in conjunction with the mismanagement of capital, the upside remains limited to its present resistance zone. Any retest of it will grant Forex traders a second selling opportunity.

USD/INR Technical Trading Set-Up - Limited Recovery Scenario

Long Entry @ 76.450

Take Profit @ 77.350

Stop Loss @ 76.050

Upside Potential: 9,000 pips

Downside Risk: 4,000 pips

Risk/Reward Ratio: 2.25