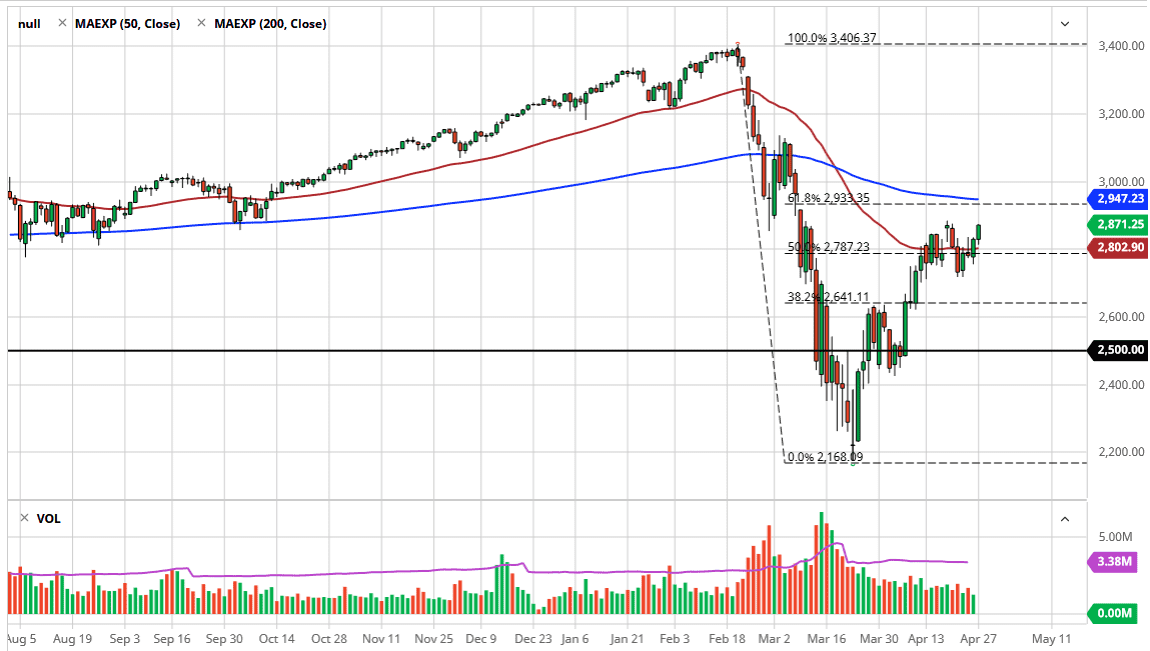

The S&P 500 pulled back slightly during the trading session on Monday and then shooting higher. It looks as if the market is going to try to reach towards the 200 day EMA above, which is relatively important from a longer-term standpoint. Ultimately, it is obvious that the market will continue to see a lot of volatility as we are in the midst of earnings season. The fact that we are closing towards the top of the range is a good sign, but I also see a significant amount of resistance above.

The 200 day EMA will of course attract attention, but there is also the 29th 50 level which looks to be massive resistance, and of course there is the same gap that sent this market much lower. Gaps do tend to get filled, but they also tend to be massive resistance. The 61.8% Fibonacci retracement level is at the same level, so I think that we will see a lot of selling pressure in that area. Quite frankly, stock markets have divorced themselves from reality, because earnings are going to be a disaster, and furthermore earnings next quarter will be even worse.

Losing the 22 million jobs in America that have already been confirmed of course is a significant blow to the economy to say the least. Furthermore, it is very unlikely that people are going to continue living the way they had previously. With that, I believe that eventually the economic reality comes to roost, and the stock market falls. Yes, there is an insane amount of central bank loosening out there, but at the end of the day if you look at various markets around the world, they do not seem to be flashing the same signals that the stock market is. For example, currencies are rather risk off, and most certainly treasury markets are. If that is going to be the case and of course we have crude oil falling through the floor because there is no demand, on what planet would the economy be expected to be strong? It shows a complete disconnect from reality, and sooner or later that will cause major issues. You need to be cautious and wait for the failure of a breakout, so I think we are getting close to that, but I would not just short this market here. That being said, I also have no interest in trying to buy it because we have gotten far ahead of our own skis.