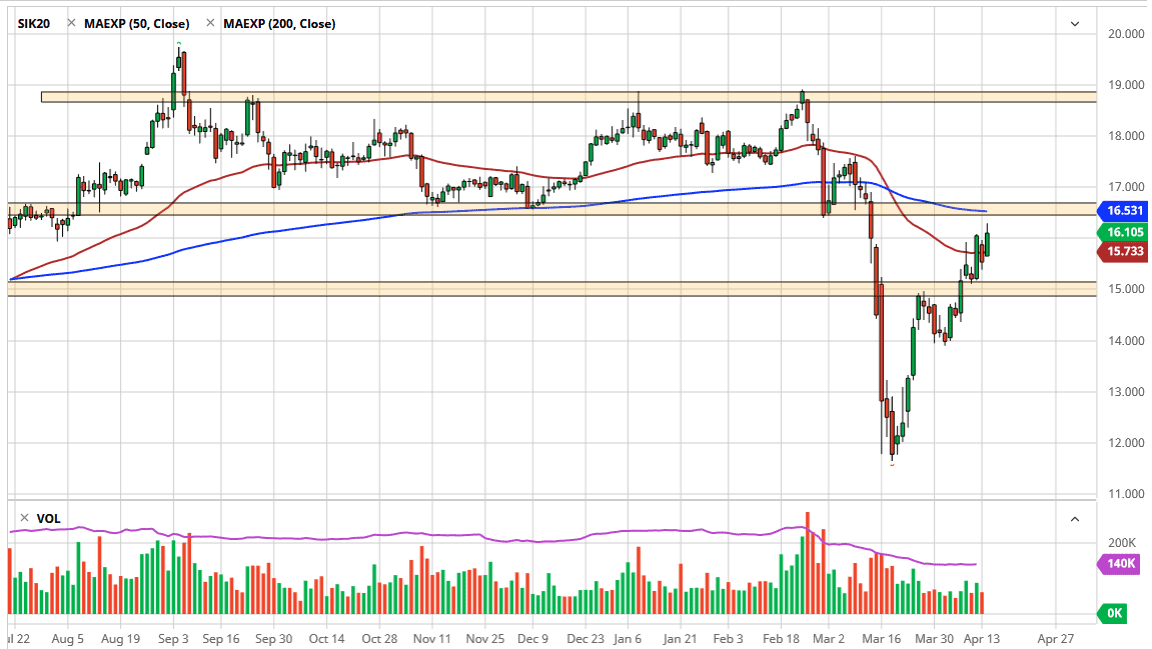

The silver market rally quite a bit during the trading session on Tuesday, but it still sees a lot of resistance above. It was completely different than the gold market, which Saul quite a bit of selling in the middle of the day. Ultimately, the 200 day EMA is just above at the $16.50 level, and now it looks like the market is going to at least try to get there, but at this point I would anticipate a lot of resistance there based not only upon the EMA, but also the previous support there being resistant.

Keep in mind that although silver had a very good day during the trading session on Tuesday, the reality is that the silver markets also have to worry about industrial demand in electronics and the like. Quite frankly, with the global markets slowing down, despite what the stock market would tell you, the reality is that silver demand is going to fall. It’s very likely at this point that the market will eventually pull back a bit, and it’s very likely that the gold and silver market will divert a bit, or perhaps offer the “pairs trades” that has become so popular, shorting silver while buying gold. You make the difference in momentum, which is clearly favoring gold in general.

The industrial use part of the equation will continue to cause massive problems for this market, and I do think that a pullback is coming. The $16.50 level looks to be far too difficult, so I’m looking to fade rallies in that general vicinity, although I do believe in the longer-term efficacy of an uptrend and silver. After all, we have formed a massive bullish flag underneath, but we have also reached the point where we are getting close to a complete pullback of the meltdown previously. It seems as if the only thing we need is some type of bad news to send this market right back down as it will crash much quicker than gold would. Remember, gold crashed previously due to liquidation in order to cover margin calls, not necessarily because there wasn’t an argument for shorting gold all of a sudden. Dollar liquidity problems have relaxed a bit and that has helped precious metals, but in the end that still a major problem. I would be looking for some type of support near $15 to buy, and certainly $14. If we break down below there, then things get very gloomy.