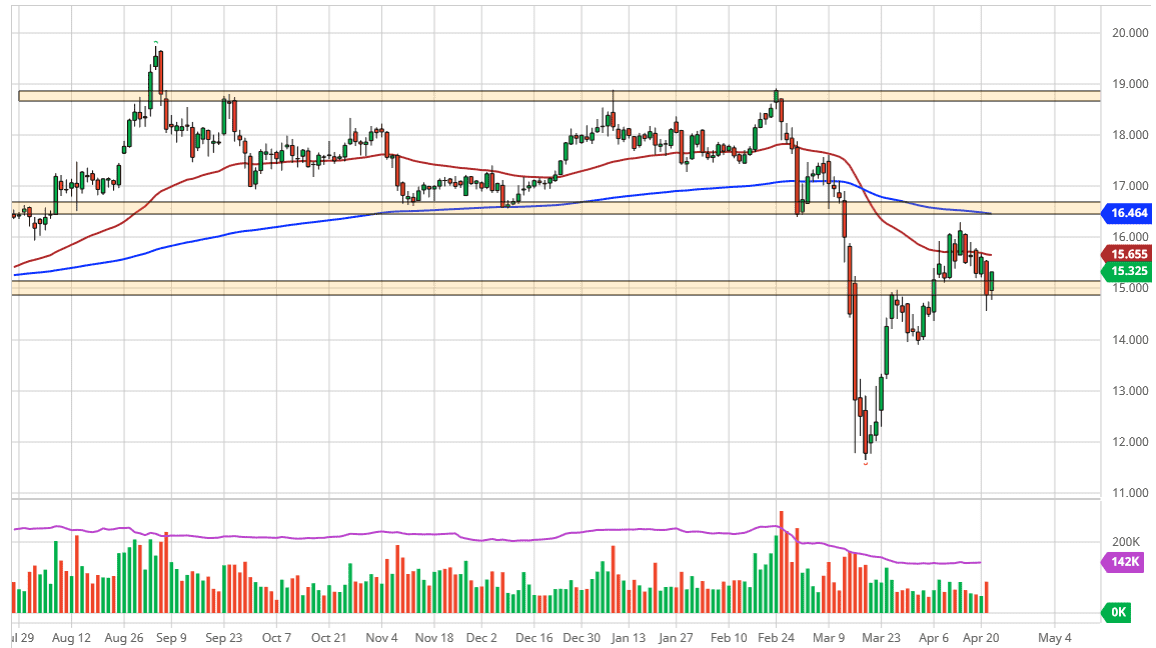

Silver markets have rallied a bit during the trading session on Wednesday, as we have seen the $15 level offer a significant amount of support. At this point, the market is likely to continue to see $15 attract a lot of attention, and as a result it is not a huge surprise to see that we have rally. The Silver market is a bit different than gold though, as it has several other things pushing it along other than the fact that it is considered to be a precious metal.

The candlestick for the trading session on Wednesday was rather strong, although it did not take out the Tuesday candlestick. At this point, the 50 day EMA sits just above so it could cause some issues as well. If we can break above that level, then the silver market is likely to continue to go higher, perhaps reaching towards the $16 level, possibly even the 200 day EMA after that. To the downside, if the market breaks down below the $14.50 level, it is likely that the $14 level will then be the next target and most likely of the bottom of support as it was the bottom of the bullish flag that had rallied from the bottom.

Going back to the drivers of silver, there is the obvious precious metals trade which works in a scenario where central banks around the world continue to throw money left and right, devaluing fiat currencies. It also works as a bit of a safety trade as well due to the precious metal aspect. However, one big problem that the silver markets have is that silver is also an industrial metal, so there is a certain amount of demand or perhaps even lack of demand when it comes to industry. At this point, industry is grinding to a complete halt, and I think it is very unlikely that the demand for silver is going to pick up anytime soon. A breakdown below the lows of the trading session on Tuesday could signify that we are going to test significant support underneath, so it is only a matter of time before we would bounce. On the other hand, the market should continue to see a lot of volatility and although I think that we are going to go higher, it is not necessarily going to be easy. If you want to buy the precious metals, gold will be the way to go.