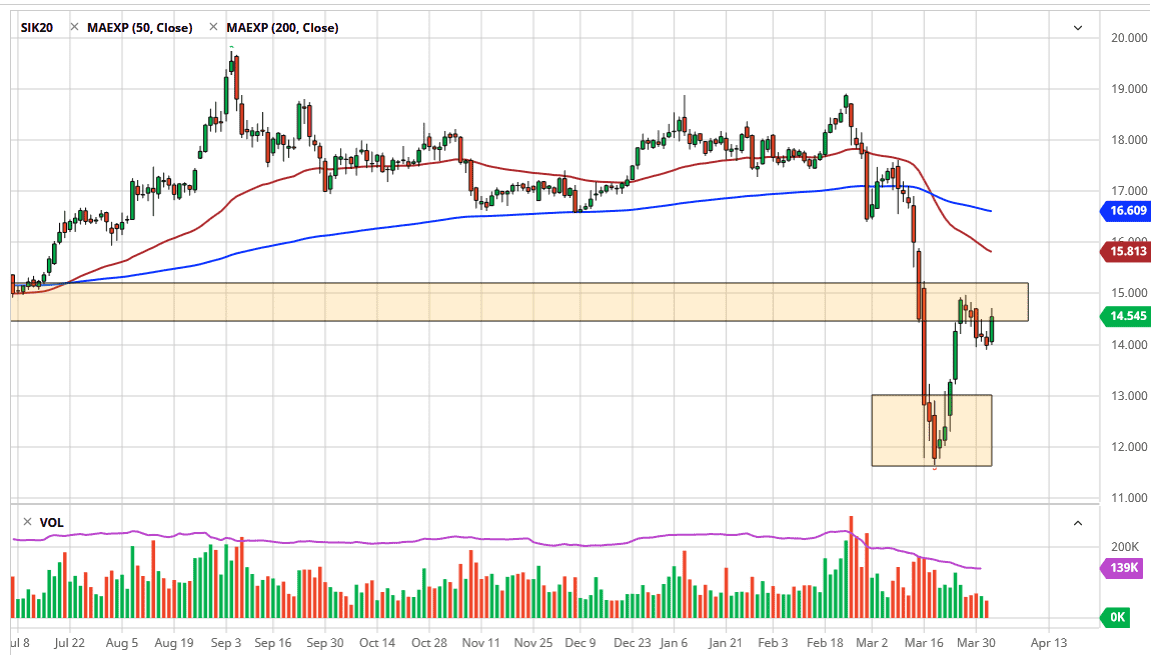

Silver markets rallied a bit during the trading session on Thursday as initial jobless claims in the United States came out extraordinarily negative. By gaining 6 million+ jobless claims, this is of course a very negative change of tone when it comes to the US economy and therefore it’s likely that more stimulus is coming. That of course should continue to help with the precious metals aspect of silver, but the industrial demand will fall off of a cliff. That being said, I believe at this point what we are more than likely going to see is a significant amount of noise, and of course resistance at the $15 level which has been so stingy so far.

If we can break above that $15 level though, that could send this market towards the 50 day EMA, and then the $16 level. Furthermore, the bullish flag that seems to be trying to form at this area measures for a move all the way to the $17.50 level, which lines up with exactly where the market fell apart. It is because of this that I believe a daily close above the $15 level in this market since silver all the way to that area and makes it a huge buy. This does make sense but pay attention to gold and make sure that it is rallying as well.

To the downside, the $14 level should continue to offer plenty of support based upon it being the bottom of the flag and the recent bounce. If we do break down below that level, it will destroy the bullish flag and could possibly send this market looking towards the $13 level where there should be plenty of support based upon the fact that it was previous resistance when we were consolidating down there. I do believe that the market is going to make a significant move rather quickly, but anticipating the move is relatively dangerous. This is especially true considering that the jobs number comes out on Friday, and therefore you need to be very cautious about trying to jump into this market with both feet. Simply reacting to what is instead of what you thinks going to happen is by far the most important thing you can do. Pay attention to the US dollar, that could also have a massive influence on this market, if the US dollar strengthens, it could provide trouble for silver.