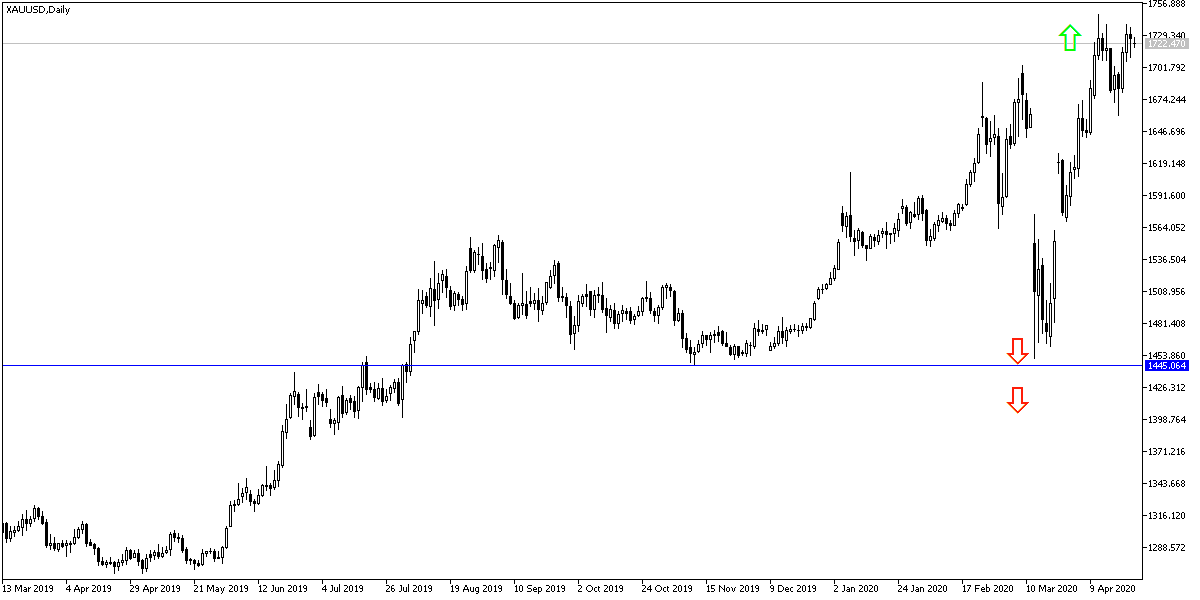

The historic collapse in crude oil futures below zero was a catalyst for the gold price to continue its gains as a preferred safe haven in times of uncertainty. The yellow metal took over the $1738 resistance, its highest level in almost eight years, before closing last week's trading around the $1730 level and settling around the level of 1720 dollars in the beginning of trading this week. On Friday, the gold price failed to extend its weekly gains above the $1740 resistance, as the US dollar continued to show strength amid the Coronavirus pandemic. The gold price has been on the rise since mid-March, as the negative effects of COVID-19 began hitting the United States, resulting in the closure of the world's largest economy.

Gold bulls seem to have benefited greatly from the coronavirus pandemic. This comes after investors rushed to the metal as a safe haven amid fears of a global financial crisis grinding over the epidemic. This trend was supported by the catastrophic results of the global economic sectors. Besides the results of the gloomy profits for international companies due to the virus.

On the economic side. March US existing home sales fell to 5.27 million homes, while forecasts were for 5.30 million homes. On the other hand, the US House Price Index for February exceeded expectations on a monthly basis, with a score of 0.7% and expectations of 0.3%. The Markit PMI for Manufacturing and Services came out lower than expected with readings of 36.9 and 27 vs. 38 and 31.5, respectively. On the other hand, US unemployment claims increased to 4.427 million, with expectations for 4,200 million.

According to gold technical: On the short term, it appears that the price of gold is trading within a high wedge on the 60-minute chart. This indicates a short-term bullish bias in market sentiment. The price of the yellow metal has now risen above the 100 and 200 hours -SMA lines. It appears to be closest to the 14 hour RSI overbought levels. Bulls will look to extend the current gains towards $1736 and $1747. On the other hand, bears will target gains at around $1715 or less at $1,700.

On the long term, and according to the performance on the daily chart, it appears that the price of gold is trading within a sharply high wedge, amid the complete control of the bulls. Accordingly, bulls will target long-term profits at around $1761 or higher at $1,800 psychological resistance. On the other hand, the bears will look to profits at lower levels around $1666 and $1630, respectively.